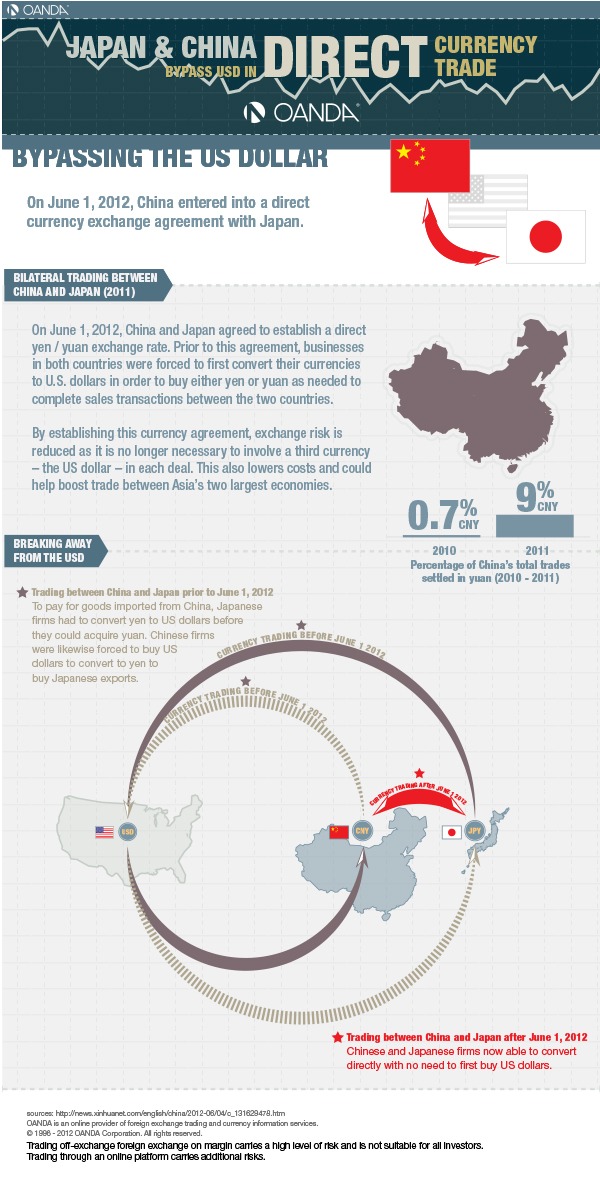

The world’s No. 2 and No. 3 economies, China and Japan, began trading directly with their respective currencies.

This move has long term implications on the status of the USD as a reserve currency.

OANDA prepared a nice infographic visualizing this move, and explanations from Mingze Wu, OANDA’s Market Specialist.

“Japan’s currency agreement to China means that banks will be able to exchange Yuan directly into Yen and vice versa without the need for USD. From the point of view of end users e.g. commercial companies, this should theoretically translate to lower costs when exchanging between Yuan and Yen. This agreement also came at an apt time, when Japan made record highs in imports and exports to and from China.

Imports from China have grown to USD183.4 billion, a 20% increase while exports rose 8% to USD161.5billion. A cost savings of even 1% will equate to more than USD2billion in savings for both Japanese and Chinese companies.

It is rare for every agreement to benefit both parties equally, and certainly this is no exception. You would have noticed that imports from China to Japan have increased in greater magnitude as compared to the opposite flow. This does not bode well for Japan, whose local industry is already suffering from declining domestic consumption. Also, looking at recent China trade balance data – exports rose 11.3% YoY vs 10.6% expected; Imports rose 6.3% vs 11.0% expected. A trend began to emerge – China is also aggressively exporting to fuel its economy growth as domestic demands begin to wane.

With all things considered, Japan may be encouraging even more imports from China with the agreement while getting less than what they bargained for in terms of exports. Will this break Japan’s economy? Of course not, but it is definitely not helping either.”

Further reading: Gold for Oil: India and Iran Ditch Dollar – Report