The third and last attempt to elect a president failed in the Greek parliament, and Greece goes to the polls. This already sent EUR/USD to new lows – the lowest since 2012.

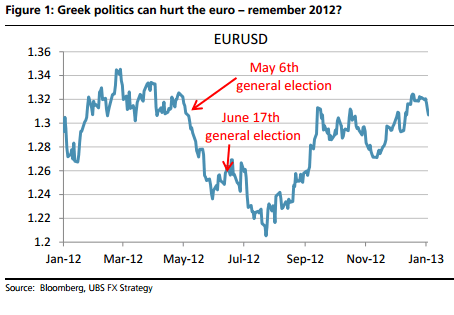

Can the very round level of 1.20 be attacked? Both UBS and ANZ weigh in with a chart looking back to the past Greek episode:

Here is their view, courtesy of eFXnews:

Following the failure to elect the New Democracy-led coalition’s Presidential candidate at the third attempt, Greece will hold a snap general election, probably on January 25th. The following are UBS and ANZ’s takes on that and what does it mean for EUR/USD in the near-term.

UBS: A second euro-negative:

“Our bearish view on EURUSD rests on the assumption that monetary policy settings on both sides of the Atlantic are likely to diverge markedly next year. That remains the case, but nowwe believe the return of political uncertainty to Greece could trigger an acceleration of the euro’s downtrend over the next two months,” UBS argues.

“We’ve been here before, sort of Seasoned euro-watchers need only cast their minds back to 2012, when the inconclusive outcome to Greece’s first general election that year quickly drove EURUSD 6 big figures lower,” UBS adds.

“If this tail risk were to re-assert itself during the upcoming election campaign, then we think a dip below 1.20 in EURUSD could be a distinct possibility,” UBS projects.

ANZ: Sell any EUR/USD squeeze s/t:

“Needless to say though a “Grexit”, or growing concerns about one, would raise risk premia across the euro area and force a significant re-pricing of assets. That is something that the ECB and the new EU Commission will truly want to avoid, as will Athens,” ANZ argues.

“In all likelihood, therefore, uncertainty in Greece will only add to pessimism towards the single currency in the short term and squeezes in EUR/USD remain selling opportunities for now,” ANZ advises.

“Whilst Greek uncertainty may also (at the margin) dampen expectations over QE at the Jan 22 meeting, the reality that regional political developments could impinge on ECB policy settings would be negative for the EUR in our view,” ANZ adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.