The Fed took the extreme dovish path, hitting the dollar hard. Is this is an even more significant change? The team at SocGen weighs in:

Here is their view, courtesy of eFXnews:

The term ‘Currency Wars’ was used by Brazil’s erstwhile Finance Minister, Guido Mantega, in September 2010 in response to moves by some (Asian) countries to resist upward pressure on their currencies from the weak US dollar. Abenomics spread the fight into new territory as the yen fell, and the ECB opened a new front last year.

But since September 2010, the Brazilian real, South African rand and Russian rouble have all lost half their value against the US dollar. The euro and yen have fallen by 18% and 26%, respectively.

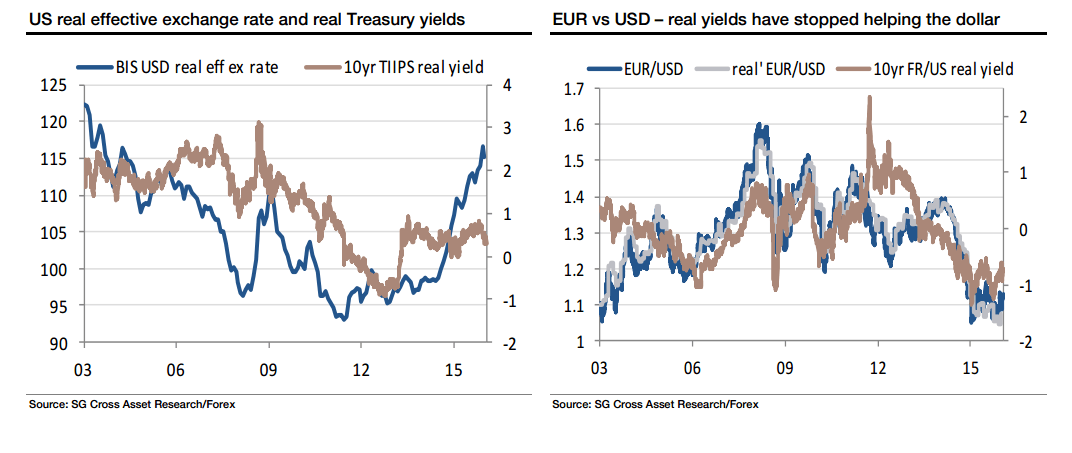

And now, just as the ECB and BoJ find that cutting rates even further does not achieve much, the US is effectively declaring a unilateral truce. The Fed is worried about low inflation expectations and is planning to raise rates more slowly.

That does not (yet) mean that the dollar’s 4.5y rally is over for good, but it does mean it is over for now.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.