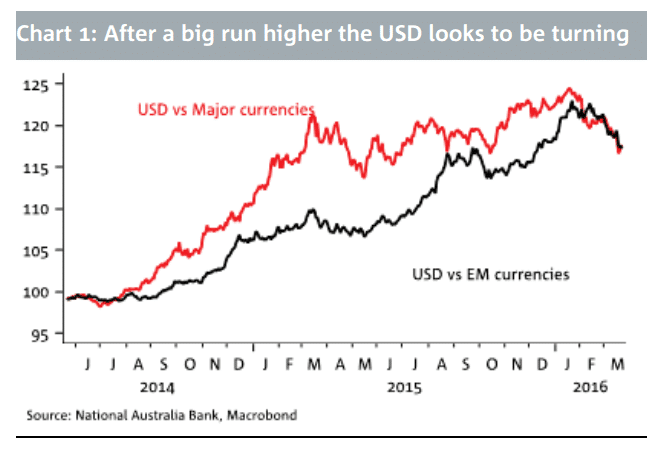

The US dollar is not looking as strong as it used to be. The team at NAB analyzes:

Here is their view, courtesy of eFXnews:

Policy announcements from the ECB and the Fed in the last few weeks go some way to support the theory that G20 Central Bank governors came to a tacit agreement at their February Shanghai gathering that policy pronouncements in recent months had not been conducive to financial stability and instead exacerbated the ‘global economic and financial developments’ the FOMC talked of in its March Statement.

To this end and to the extent that Central Banks are able, the theory is that going forward they will attempt to be more coordinated in future policy initiatives and will consider the global economic and financial impact of policy shifts rather than just their own domestic backdrop.

Is this view credible? If it is it could signal a USD top is in, allowing for a period of renewed risk-seeking behaviour that sees the USD fall a little further, only for it to recover some ground ahead of a potential June Fed hike.

Were that to be the case, however, we’d suspect any USD recovery into June and maybe out the other side would be reasonably modest and not sufficient to recapture its highs of January where it peaked after a 25% broad gain, marking multi-year highs against major and EM currencies. The thinking here is if the Fed and others in G20 are genuine about co-operation then there’s an argument for the Fed at least to keep any Fed policy-driven USD gains limited by emphasising the downside risks to the economy. This plays to a gradualist approach to any further tightening to limit risks of a ‘wash, rinse, repeat’ of last August’s and this January’s ructions.

Accordingly we make minor adjustments to our G3 USD forecasts to take account of this view. If our language however seems slightly evasive it is because central banks are making a frustrating habit of wrongfooting observers and investors. Whether this is by design or the result of having little clear idea themselves and thus being at the mercy of markets is not clear – we have our suspicions.

Take the Fed: Having raised rates in December against the advice of many, including the IMF and even some insiders, it communicated that the financial market ructions of early 2016 were not borne out by the macroeconomic data. At least that’s what chair Yellen told Congress in February. There’s a strong argument that markets simply dis-regarded Fed hike projections as a non-starter and that this aided sentiment, though Yellen and Fischer were vindicated by the broad market rebound and recovery in oil/commodity prices.

…Notwithstanding ad-hoc comments from Fed members such as Lockhart and Williams, which we are minded to take as unreliable, the risk we see is for stronger US wage rises, forcing the Fed to be more aggressive that it currently envisages; a scenario which could boost the USD further than we currently price. Before that, we prepare for a further stepped decline in the USD of something in the order of 2% to 3% in the broad index, split between potentially larger moves for some currencies in favour and smaller for others.

NAB targets EUR/USD at 1.12, 1.11, 1.09 and GBP/USD at 1.43, 1.44, and 1.43 by the end of Q2, Q3, and Q4 respectively.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.