No real surprises in the US services sector report: the PMI slips to 56.9 against 57 expected, basically as expected. Factory orders drop 0.2%, exactly as predicted and with an upwards revision for the previous month, from 0.5% to 1%.

Currencies are stable in the aftermath.

The employment component is at 57.8, much better than 51.4 seen in the previous month. Had this figure been released before the NFP, it would raise expectations. The correlation between ISM’s services employment component and the NFP is falling apart.

New orders fell sharply from 63.2 to 57.7 points. The “prices paid” component, which reflects inflation, fell to 49.2 points, below the 50 point threshold that separates expansion and contraction. The rest of the components are more stable.

The US ISM Non-Manufacturing PMI was expected to tick down from 57.5 to 57 points in May. The services sector is the vast majority of the US economy. The publication usually serves as an indicator towards the Non-Farm Payrolls, but this time the jobs report is already behind us.

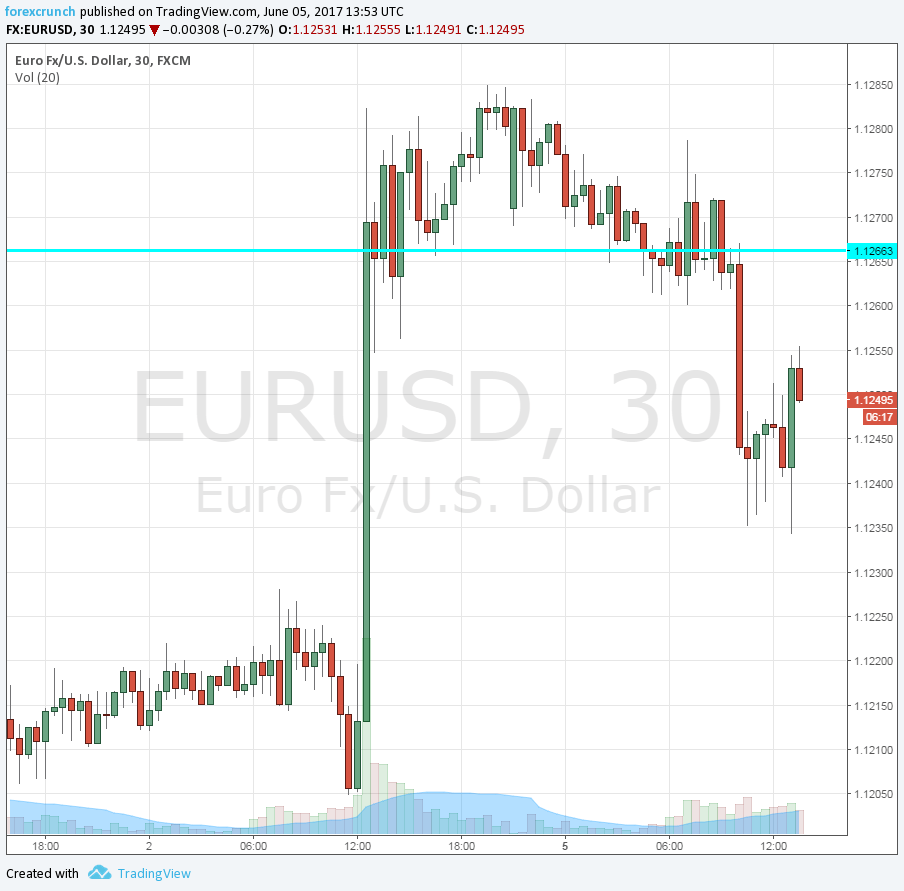

The US dollar was gaining some ground against the euro and the yen while slipping against the pound. The UK has been the center of attention after yet another terror attack and as the elections approach.

On Friday we learned that the US economy gained only 138K jobs, worse than expected. Moreover, wages rose by 2.5% y/y once again and did not accelerate.

While the Fed is expected to raise rates at the June 14th meeting, this may turn into a dovish hike.

Here is the EUR/USD chart: