The services sector is enjoying strong growth, at least according to ISM’s survey. A score of 57.2 is better than expected and the highest since 2015. The new orders component jumped to 61.6, prices paid is up to 57 but the employment component misses. It is actually falling from 58.2 to 53.8 points, and this is worrying from official Non-Farm Payrolls report.

The dollar was hit earlier by ADP and beforehand by the FOMC minutes and seems to be in no rush to recover.

Here is a quote from the ISM report:

Nine industries reported increased employment, and four industries reported decreased employment. Comments from respondents include: “We reduced our workforce in December due to missed sales forecast and revenue misses” and “Less labor hours to align with reduced business needs.”

The ISM Non-Manufacturing purchasing managers’ index was expected to slide from 57.2 in November to 56.6 points in December. The services sector is the vast majority of the US economy. The employment component serves as a hint towards the Non-Farm Payrolls report tomorrow.

See how to trade the NFP with EUR/USD

The US dollar was on the back foot following the FOMC Meeting Minutes. These showed that some FED members were pricing in fiscal stimulus in their optimistic views. They may have gotten ahead of themselves.

Earlier, ADP NFP missed with 153K. ISM’s manufacturing sector figure, released earlier in the week, beat expectations and contributed to the strong start for the greenback in 2017.

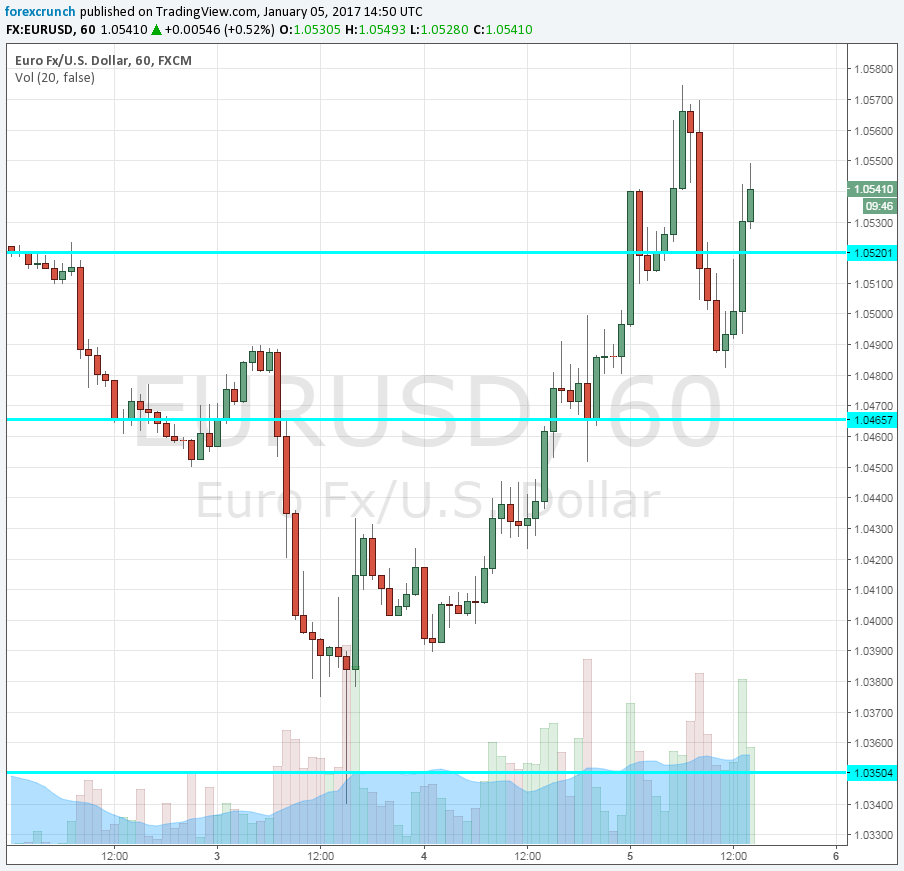

Markit’s services sector gauge was upgraded from 53.4 to 53.9 points in the final read for December. Here is how EUR/USD looks on the chart: