The US services sector is doing better than expected: the ISM PMI shows a score of 54.5 points. Among the components, the employment sector returns to expansionary territory with 50.3 points, new orders are up to 56.7 and prices paid are up to 49.1 points. So, prices are still falling, but at a slower pace. The US JOLTS job openings missed with 5.445 but the previous figure was revised to the upside with 5.604. More importantly, the quits rate has edged up to 2.1% and the number is 3 million – another sign of gradual improvement in confidence.

The US dollar extends its gains as most data pieces are above expectations and show that employment and inflation are on the right course. More quits mean more confidence and moving to higher paying jobs. A stronger services sector is of course welcome news.

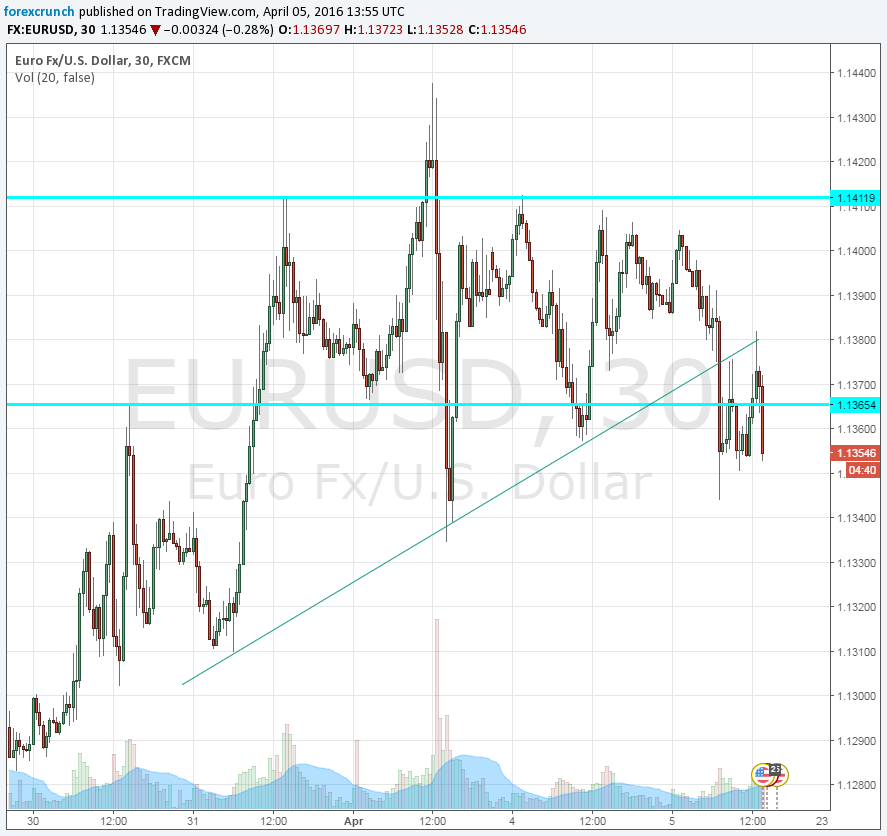

Currency reaction

- EUR/USD slips to a new low of 1.1335.

- GBP/USD is down at 1.14135.

- USD/JPY bounces back up to 110.60.

- USD/CAD is above resistance at 1.3170 and getting closer to 1.32.

- AUD/USD is slipping below 0.7530.

- NZD/USD is at 0.6767.

The US ISM Non-Manufacturing PMI was expected to rise from 53.4 points in February to 54 points. At the same time, the US released the JOLTs job openings publication, which was predicted to rise from 5.541 million to 5.55 million in February. Despite being a lagging indicator, the number is watched by the Fed and seen as a broad measure of employment.

The US dollar was attempting a recovery amid a worsening market mood.

Earlier, Markit’s final services PMI showed a score of 51.3 points, slightly above the 51 points initially published. ISM carries more weight in the US.

This survey is usually published ahead of the Non-Farm Payrolls report and provides a hint to the outcome. This time, we already have the data. Nevertheless, it is a forward looking indicator for the largest sector in the world’s No. 1 economy.

The US economy gained 215K jobs in March, slightly better than expected. In addition, wages advanced 2.3% y/y, also better than expected. The ISM Manufacturing PMI went back to positive ground, but that release was easily overshadowed by the NFP released only 90 minutes earlier.

The markets are worried about a wide array of issues: the Panama Papers, a potential Brexit, China’s economy and falling oil prices among other topics.

The US dollar was hit hard by Janet Yellen last week: the Fed Chair repeated her dovish stance. When her colleagues repeated some hawkish commentary, the market was “twice shy” after being bitten.

The US dollar is recovering mostly on the market mood, but the biggest winner is of course the Japanese yen – king of safe haven currencies.

More: Buy USD Dips Vs AUD, CAD; We Stay Short AUD/USD – Credit Agricole