The big event of the week is coming today: the Fed decision. While no rate hike is expected, markets seem to be sitting on the edge of the chair in anticipation. What’s next? Goldman Sachs have a clear view:

Here is their view, courtesy of eFXnews:

With the US economy continuing to grow above trend, printing very robust employment gains month after month, and with unemployment at 4.9% and a sharper-than-expected acceleration in core inflation, rates hikes will be on the agenda for this FOMC meeting.

Goldman Sachs economists expect the next 25bp hike in June but also think that a hike in April is not inconceivable. The Fed is close to meeting its dual mandate and, if it were to wait too long to continue the hiking cycle, it could run the risk of letting the economy over-heat, only to then hike rates much faster and potentially to a higher level. We consider that in the March and subsequent FOMC meetings, the Fed’s leadership, most of whom are primarily academic economists, should give more weight to such considerations and to the positive economic backdrop than to temporary moves in asset prices, particularly if the evidence shows that such volatility does not impact the real economy.

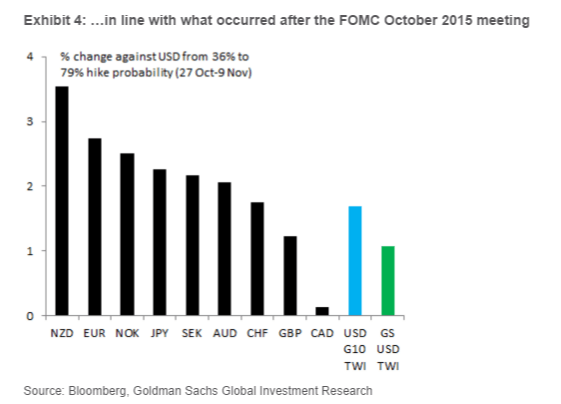

We discuss (i) why we expect the FOMC to turn progressively more hawkish, tactically supporting our long USD view, and the risks around this outcome; (ii) by how much we expect the USD to appreciate if our view on the Fed will prove right; and (iii) which G-10 currency offers, in the near term, the best risk-reward for tactically playing our view on the Fed, where last week’s shift by the ECB into credit easing may make meaningful EUR/$ downside more difficult in the near term.

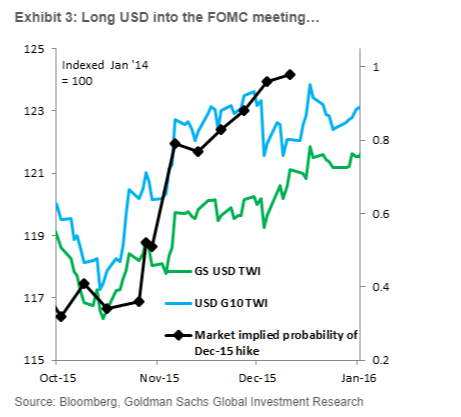

Long USD into the FOMC meeting: If we are right and the Fed again uses this meeting to lead the market toward the next rate hike, this should be Dollar positive.

Currency sensitivity to USD rates changes: While we find evidence that since the beginning of the year the sensitivity of the EUR/$ and GBP/USD to changes in the 2-year USD rate has declined somewhat, the current coefficient would still imply that a change in the 2-year USD swap rate similar to that observed in the aftermath of the October meeting would (all else equal) move the EUR/$ down by 3 big figures (from 1.11 to 1.08), $/JPY higher from 113.68 to 116.4 and the GBP/$ down from 1.43 to 1.408.

Short Cable to offer best risk reward: This week the Bank of England also holds its policy meeting and Andrew Benito expects a dovish communication from the MPC. This bias might be stronger if a tighter 2016 budget is announced this coming Wednesday. With uncertainty around the approaching Brexit referendum, we expect GBP to fall and this week offers an opportunity to position for a fall in the GBP/USD given the divergent views we have for the respective central banks’ meetings.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.