The important thing to note on Fed decision day is where the US economy has travelled from since the current level of asset purchases was introduced nine months ago. Most importantly, the unemployment rate has declined from 7.8% to 7.3%, whilst housing has continued its steady recovery and the growth wobbles seen in the past few years (late 3012, early 2011) have not returned. The question for markets is whether the Fed tapers the current pace of asset purchases and by how much. We expect that they will and by a modest USD 15 bln for two reasons. Firstly, to reflect the underlying improvement in the labour market since the end of last year. Secondly, to send the message to markets that asset purchases are not open-ended and that the exit strategy is live and in progress. The market has been more doubtful over the past 2 weeks, so such a move would give the dollar a decent boost initially, more so against the yen and much less so vs. the euro. Also see our blog “Fed perspective“ for more.

Update:

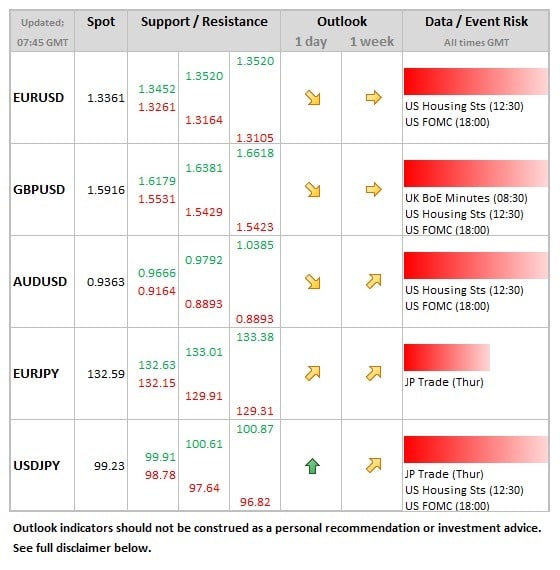

Data/Event Risks

USD: It’s all about the Fed (see below), not only the tapering decision, but also the statement language and the accompanying press conference. Dollar would rally on any tapering, mostly vs. the yen, less so against the euro.

GBP: The latest MPC minutes provide the only real distraction on the majors ahead of the Fed decision, but are not seen as a major risk event for sterling, unless there are any new perspectives on the impact of forward guidance.

Latest FX News

GOLD: Below USD 1,300, so near a 6-week low ahead of the FOMC meeting. Recent blog on gold can be found at “Good times over for gold“.

EUR: Generally holding steady below the1.3452 high of August. ZEW data for Germany was better than expected and underlying support in terms of flows remains good, especially ahead of the Fed meeting. Germany elections remain a focus towards the end of the week.

AUD: Sitting on the 100d moving average at the present, which currently sits at 0.9355. There are likely still some longer-term shorts to be squeezed out, but who may be waiting for a US dollar rally in the wake of the Fed. If not seen, then Aussie vulnerable to more protracted squeeze higher.

Further reading:

QE Tapering Preview: 5 Reasons, 6 Scenarios and 7 Potential Currency Reactions

EUR/USD September 18 – Unchanged as Spotlight on Federal Reserve