The US dollar was seen weakening against the Swiss franc during the past session, as the USDCHF pair traded lower and tested the 0.9750 support area. The pair managed to hold the mentioned level and it looks like correcting higher in the near term. There is a major release lined up today, as the US retail sales data suggesting the total receipts of retail stores will be released by the US Census Bureau. The market is expecting the US retail sales to rise by 1.1% in March 2015. Let us see if the expectation is fulfilled or not in the near term. A miss might ignite losses in USDCHF.

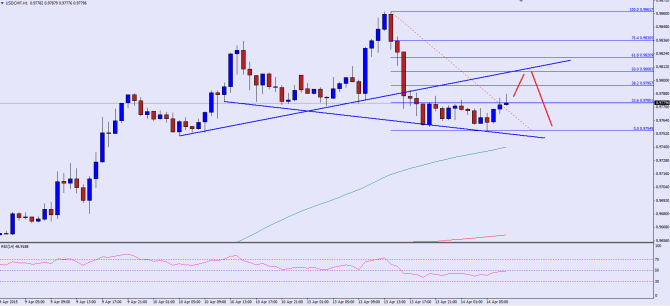

There were a couple of trend lines formed on the hourly chart of the USDCHF pair. First one was a bullish trend line, which was breached recently to open the doors for more downsides in the near term. Second, there is a support trend line, which prevented a slide in USDCHF around 0.9750. Currently, the pair is correcting higher and trading around the 23.6% fib retracement level of the last drop from the 0.9861 high to 0.9754 low. There is a major resistance forming around the 50% fib retracement level, which is also coinciding with the broken bullish trend line. So, the USDCHF pair might struggle around the 0.9800-10 levels in the near term where the US dollar sellers could defend upsides.

If the USDCHF pair moves lower from the current levels, then initial support is around the second support trend line.

Overall, one might consider selling rallies in the USDCHF pair as long as it is below the broken trend line.

————————————-

Posted By Simon Ji of IKOFX Technical Team: Online Forex Broker

Website: http://ikofx.com/

In this week’s podcast, we discuss: USDown or greenback comeback? And also touch other topics:

Subscribe to Market Movers on iTunes