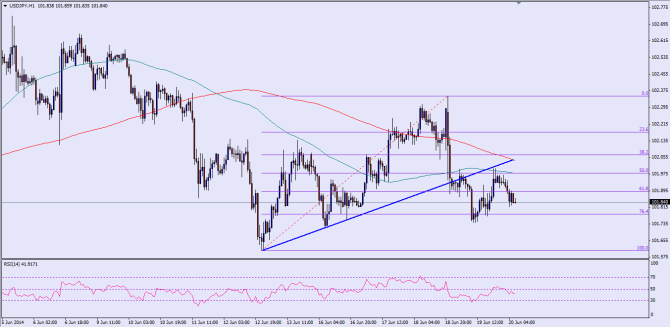

The US dollar continued its decline against most of its major counterparts including the Japanese yen. The USDJPY pair after creating a short-term top around the 102.40 resistance zone moved lower. There was a bullish trend line formed on the hourly timeframe for the pair.

The US dollar sellers were seen aggressive during yesterday’s trading sessions, and as a result the pair breached the highlighted trend line. This particular break might be seen as crucial, as it has the potential to take the pair back towards the last low of 101.60 level.

New Weekly Low?

The broken trend line acted as a resistance yesterday, and might continue to hold the upside in the pair. If the pair breaks the 76.4% fib level of the last leg higher from the 101.60 low, then it might open the doors for a test of previous low. If sellers take control, then it could create a new weekly low as well. One important thing to note here is that the pair is trading below both major simple moving averages on the hourly timeframe – 100 and 200, which can be considered as a bearish sign in the short term.

If the pair fails bounces from the current levels, then it would be interesting to see whether it can close back above the broken trend line or not, which is also coinciding with the 100 hourly SMA. A break and close above the 100 SMA could take the pair back towards the previous swing high of 102.20 level.

The hourly RSI is below the 50 level, which adds value to the bearish bias. As long as the pair is trading below the 100 hourly SMA more losses cannot be denied in the short term.

Posted By Simon Ji of IKOFX