The New Zealand economy grew by 0.9% in the second quarter of 2016. On its own, this kind of growth rate is far above other developed economies. Nevertheless, the figure came out below expectations of 1.1%. Year over year, New Zealand saw a growth rate of 3.6%, within expectations.

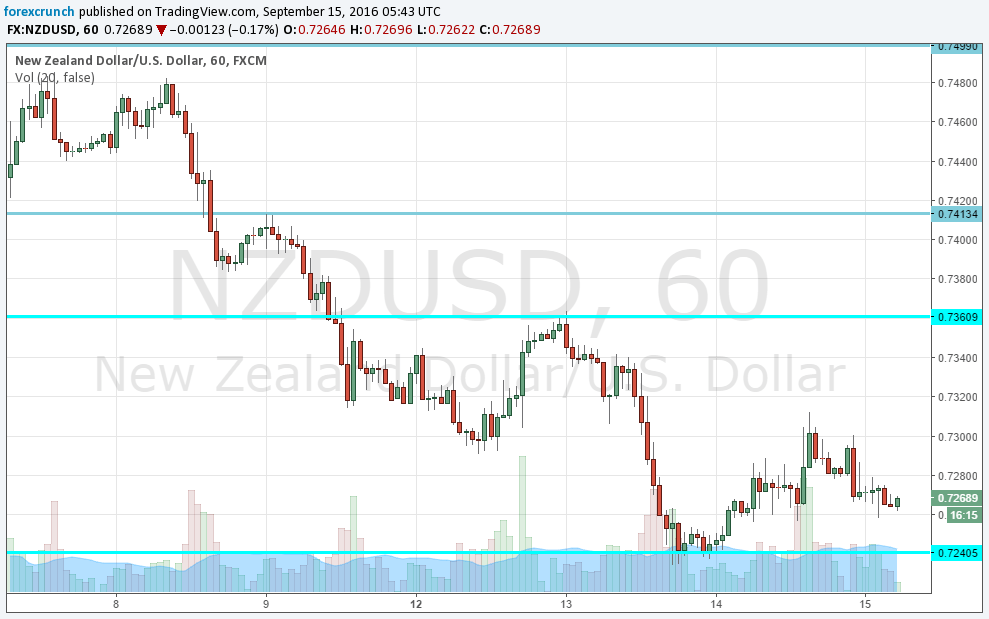

NZD/USD is trading around 0.7270, off the highs seen last week, but certainly not due to the kiwi’s weakness, but rather on USD strength.

The reaction to the miss of on the headline number was muted, showing the kiwi is quite resilient.

Support for the pair awaits at 0.7240, followed by 0.7160, which was not visited for many days. On the top side, we find 0.7360, at the head of the current range. Further, above, 0.7410 serves as the next cap. The top line is 0.75, a round number.

The NZD is getting closer to the AUD in recent weeks. Australia also released a key indicator overnight: employment data, which also-also missed on the headline but was OK in the details.

Will we see AUD/NZD parity? A lot depends on the RBNZ, that convenes next week. With this kind of GDP growth, there is no reason for Wheeler and his colleagues to cut interest rates or hint about cuts. They could and probably will try to talk down the currency.

More:

- NZD/USD could be vulnerable to a December Fed Hike – CIBC

- Risk Of RBNZ Intervention As AUD/NZD Parity Looms – Credit Agricole