NFP beats expectations with 235K and January revised higher to 238K. The unemployment rate drops to 4.7%. Wages are up 0.2% m/m, slightly below predictions but the previous month was revised up. The “real unemployment rate” falls to 9.2%. All in all, a solid report.

The dollar is sliding across the board. It seems like a “sell the fact” phenomenon. Perhaps this is a knee-jerk reaction to the February m/m wage growth of 0.2%, lower than expected. However, the 2.8% y/y alongside a long list of positive details makes it a solid jobs report. The Fed could even raise their forecasts given the strong report, or at least consolidate the plan for three rate hikes.

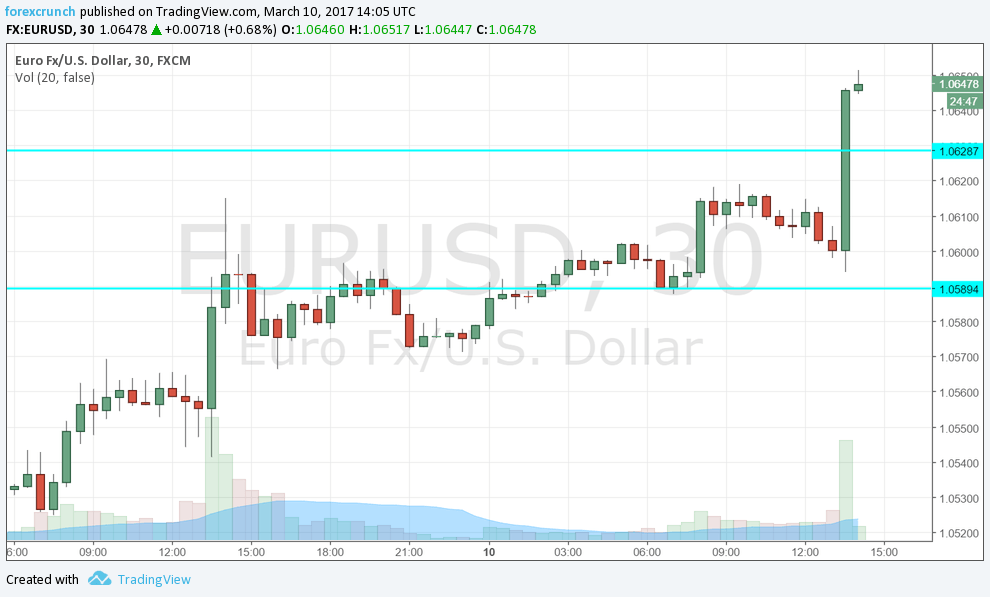

Here is how it looks on the EUR/USD chart. The euro is one of the biggest beneficiaries of the move:

The US Non-Farm Payrolls report was expected to show a gain of around 185K (or 220K after the strong ADP). More importantly, wages carried expectations for a rise of 0.3% m/m and around 2.8% y/y.

The bar was very low for a rate hike in five days time. Fed Chair Janet Yellen basically told us that a hike is coming barring any disaster. Given the late publication, on the tenth, the Fed may have already had the data.

February 2017 NFP Data (updated)

- Non-Farm Payrolls: 235K (exp. +185K, whisper 220K, last 227K before revisions)

- Average Hourly Earnings 0.2% m/m with an upgrade to January: 0.2% against 0.1%, 2.8% y/y(exp. +0.3% m/m, last month 0.1% m/m, 2.5% y/y)

- Revisions: +9K (-39KK last time).

- Participation Rate: 63% (62.9% last month )

- Unemployment Rate: 4.7% (exp.4.8%, last month 4.8%)

- Private Sector: 227K (ADP showed 298K).

- Real Unemployment Rate (U-6): 9.2% (previous: 9.4%).

- Employment to population ratio: 60% (previous: 59.9%)

- Average workweek: 34.4K (last month: 34.4).

NFP Currency Reaction

- EUR/USD was around 1.06 enjoying the Draghi boost. The pair advances and challenges resistance at 1.0630.

- GBP/USD was trading at low ground around 1.2160. A messy Brexit weighs. Cable advances to 1.2180.

- USD/JPY traded on high ground at 115.40, reflecting USD strength and ticks down to 115.30.

- USD/CAD was around 1.3507. CAD plunged with Crude. Dollar/CAD is plunging to 1.3430, but this is mostly due to the superb Canadian jobs report.

- AUD/USD traded around 0.7520 and gets a boost to 0.7540.

- NZD/USD traded around 0.6910, suffering the spilled milk and now trades around 0.6930.