After a disappointing jobs report for March, economists expect a rebound in April. While it is hard to imagine a poor report after the Fed was sanguine about the economy, nothing can be ruled out. Will expectations for a June hike rise after the event pushing the dollar higher? Or will it provide a selling opportunity?

So how can we trade the event with EUR/USD? Here is a preview of the event.

Last time on the NFP

- Only 98K jobs were gained, around half the early expectations and half the average of around 200K

- The report included a downwards revision, which added insult to injury.

- Wages were up 0.2% m/m and 2.7%, as expected and in general healthy-looking

- Other: the unemployment rate dropped to 4.5% but without a drop in the participation rate at 63%.

All in all, it was poor on jobs growth but disappointing on wages. And that was the reaction: a drop in the dollar followed by a rapid recovery.

Full employment theory

If the unemployment rate is indeed so low and participation is unlikely to rise much further, perhaps we are nearing full employment. In this situation, employers find it harder to find employees and job growth slows down. And, employers are willing to pay higher salaries to workers.

The March report can tell that story, which is encouraging and dollar-positive. On the other hand, Canadian participation is around 65% compared with 63% in the US. Another 2% is a lot of slack. So, if we do get a 200K job gain, it will be good news but will smash the theory and show the economy has a long way to go. And, the Fed could wait before wages it raises rates once again.

The ultimate test of the theory is a consistent and accelerating rise in wages. So far, it has been two steps forward, one step backward.

April NFP Expectations

- 194K jobs gained

- Wages up 0.3% m/m

- Unemployment rate at 4.6%

The recent ADP report met early projections, keeping expectations unchanged. The Fed’s optimistic attitude probably raised expectations or at least confirmed the bounce back in jobs and the accelerated gain in wages.

The poor growth that was recently reported is a cause for worry. Eventually, weak growth generates slower employment and wage gains. And, after one disappointment, we cannot rule out another one.

Expected market reaction in EUR/USD

The reaction will like\ly be straightforward: a beat will push the dollar higher and miss will send it lower. There is no pre-Fed skewing and there are probably no whisper numbers that differ from these expectations.

Wages remain important and could even overshadow and more than compensate for poor job gains.

Examples:

- Yearly wages at 2.9% and only 150K jobs gained – USD can rise

- Yearly wages at the magic 3% level and only 100K jobs gained – still USD-positive

- But if wages slip back to 2.5% y/y, it will take a superb beat in job gains to compensate.

EUR/USD levels to watch

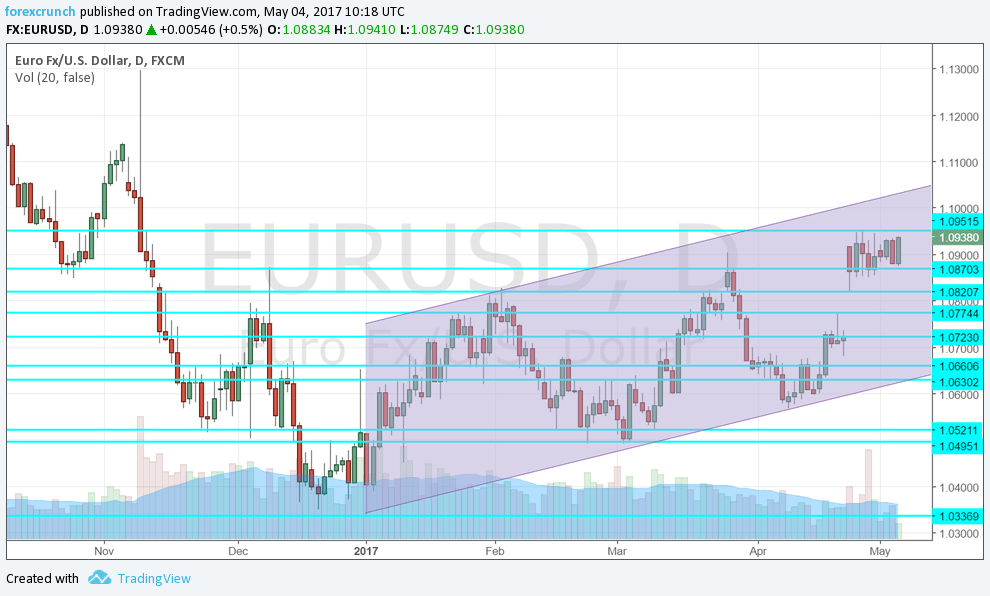

All in all, EUR/USD has been trading at the 1.0820 to 1.0950 range since the first round of the French elections. This range could be respected ahead of the second round as the tension could limit breakouts.

However, the pair is trading in an upwards channel and has more room to the upside than to the downside.

Upside levels:

- 1.0950, the highest this year

- 1.10 – a round number

- 1.1120 – the early November high

Downside levels:

- 1.0870 – the December high and a recent cushion

- 10820 – the post French-elections low

- 1.0775 – the pre-French elections high

- 1.0720 – worked as support in March and resistance in April.

More: NFP: Testing the “full employment” theory – watch wages [Video]

Chart: