Best Forex Brokers in Nigeria 2021

Interested in trading the trillion-dollar foreign exchange market? If so, then you’ll need a top-notch forex broker who provides a decent range of currencies to trade on, with low fees and commissions.

In this Best Forex Brokers in Nigeria 2021 guide, we go through the best brokers for forex trading and how to get started with one of the best forex trading accounts in the industry, completely FREE!

Best Forex Brokers Nigeria 2021 List

Below is a quick list of the top 10 forex brokers in Nigeria. Be sure to keep on reading as we go through them in more detail further down this guide.

- eToro – Overall Best Forex Broker in Nigeria with FREE Copy Trading Service!

- Capital.com – Best Forex Brokers for Beginners with $20 Minimum Deposit

- Libertex – Best Forex Broker in Nigeria with Tight Spreads

- VantageFX – Best Forex Broker for ECN Accounts

- Avatrade – Best Broker for Range of Accounts (CFD, Options, Copy)

- Pepperstone – Top-Rated Forex Broker for Range of Trading Platforms Offered

- OANDA – Best Forex Broker Offering Advanced Trading Tools

- IG – Top-Rated Broker for Web and Mobile Trading

- Interactive Brokers – Best Broker for Professional Traders

- Forex.com – Top-Rate Broker for Range of Forex Instruments

Best Forex Brokers in Nigeria

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$50

Spread min.

-

Leverage max

50

Currency Pairs

52

Trading platforms

Funding Methods

Regulated by

FCACYSECASICCFTCNFABAFIN

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

2.5

EUR/USD

1

EUR/JPY

2

EUR/CHF

5

GBP/USD

2

GBP/JPY

3

GBP/CHF

4

USD/JPY

1

USD/CHF

1.5

CHF/JPY

2.7

Additional Fee

Continuous rate

-

Conversión

-

Regulation

Yes

FCA

Yes

CYSEC

Yes

ASIC

Yes

CFTC

Yes

NFA

Yes

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

Min.Deposit

$20

Spread min.

0.0 pips

Leverage max

20

Currency Pairs

100

Trading platforms

Funding Methods

Regulated by

FCACYSECASICCFTCNFABAFIN

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

1.4

EUR/USD

0.6

EUR/JPY

1.5

EUR/CHF

2.2

GBP/USD

0.8

GBP/JPY

1.9

GBP/CHF

2.4

USD/JPY

1.3

USD/CHF

1.3

CHF/JPY

2.6

Additional Fee

Continuous rate

-

Conversión

0.0 pips

Regulation

Yes

FCA

Yes

CYSEC

Yes

ASIC

Yes

CFTC

Yes

NFA

Yes

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

Min.Deposit

$0

Spread min.

-

Leverage max

2

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSEC

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

from 0,0003%

EUR/USD

from 0,0003%

EUR/JPY

from 0,0003%

EUR/CHF

from 0,0003%

GBP/USD

from 0,0003%

GBP/JPY

from 0,0003%

GBP/CHF

from 0,0003%

USD/JPY

from 0,0003%

USD/CHF

from 0,0003%

CHF/JPY

from 0,0003%

Additional Fee

Continuous rate

-

Conversión

-

Regulation

No

FCA

Yes

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

70.8% of retail investor accounts lose money when trading CFDs

Find the Best Forex Brokers Nigeria – Comparison

Top Nigerian Forex Brokers Reviewed

To meet the surging demand in forex trading, there are now more forex brokers than ever before. But how do you find a reliable forex broker, or a no deposit bonus forex broker to get started with? Have you checked they are regulated? What are their fees? What platforms and tools do they offer?

As you can see, it can be very time consuming to do all of this research for you. But, to save you time we have done it all for you! Below, you will find a list of the top five best forex brokers in Nigeria reviewed.

1. eToro – Overall Best Forex Broker in Nigeria with FREE Copy Trading Service!

eToro is by far one of the best forex brokers in Nigeria and the rest of the world! Of all Nigerian forex brokers, eToro provides a complete offering to navigate the trillion-dollar forex market.

First of all, eToro is heavily regulated by the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC).

This means eToro provides a HIGH level of safety and security of your funds and will also provide a negative balance protection policy for retail traders.

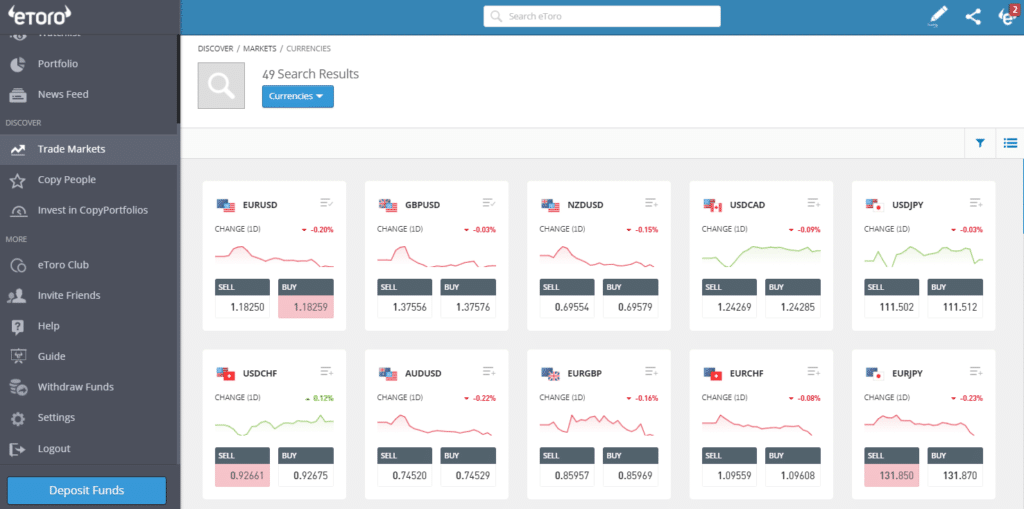

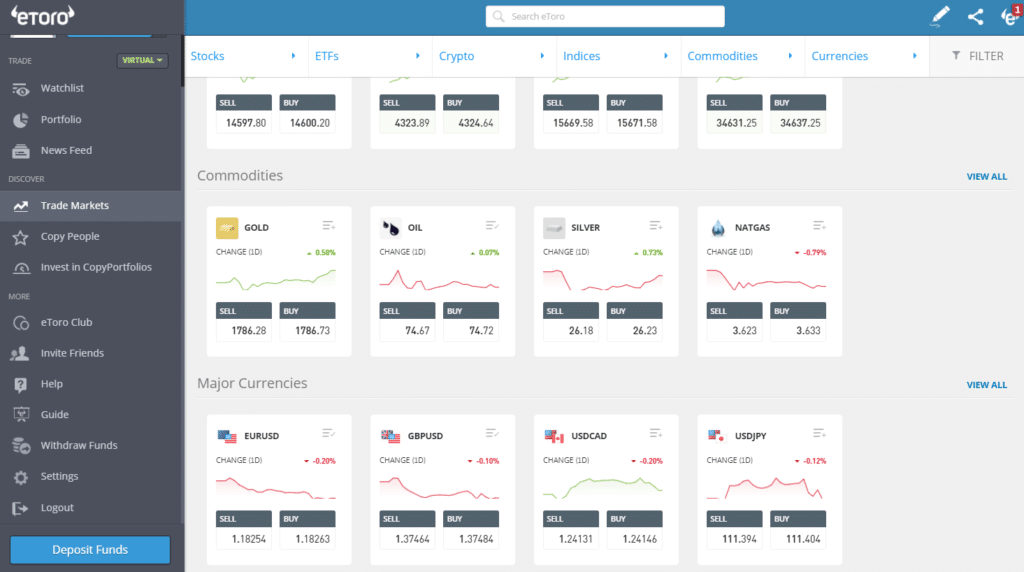

Furthermore, the eToro trading platform is web-based and is really simple to use from your web browser or mobile phone. You can trade all the major, minor and exotic currency pairs, as well as thousands of other instruments across cryptocurrencies, commodities, stocks and indices.

Better yet, you can trade thousands of instruments 100% commission-free with really tight spreads. This is essential to make sure you keep the most of your trading profits! But, where the eToro platform really excels is from its copy trading feature where you can effectively your own human forex robot!

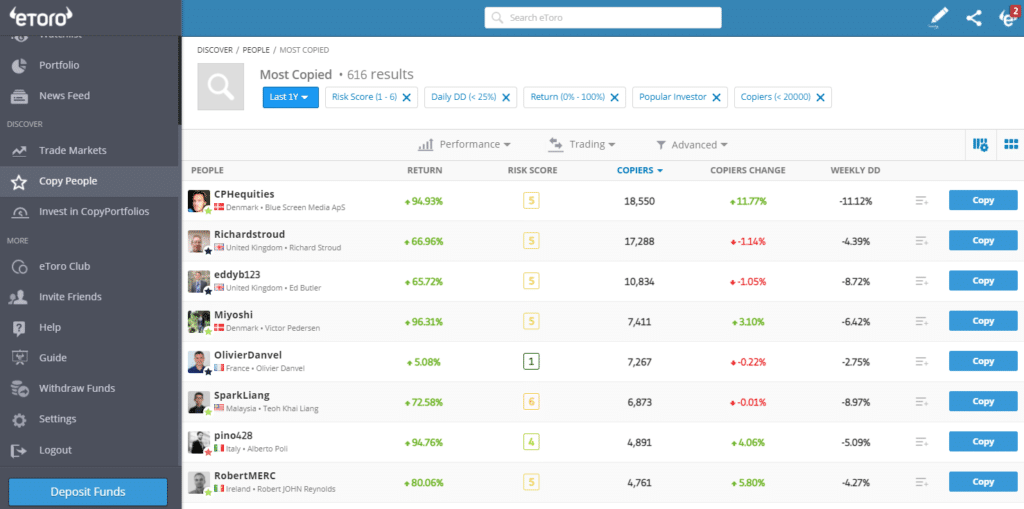

From the Copy People tab shown below, you view the performance of different traders and find the best trader to copy. From the click of a button every trade the trader takes will be copied onto your own account!

This is a great way to build a passive revenue stream. You may also fancy become a Popular Investor yourself and earn income from people copying YOUR forex signals. More than 20 million people use eToro because of these features so it’s a Nigeran forex broker you really want to look into.

You can open an account with eToro with a minimum deposit of just $200 and deposit funds fee-free using bank transfer, debit/credit cards and e-wallets such as PayPal.

- FCA, CySEC and ASIC regulated

- Trade currencies 24/5

- Access 2,400+ global markets

- Access CopyPeople and CopyPortfolio for passive trading

- Access exclusive, premium events from the eToro Club

- Simple to use, feature-rich trading platform

- 100% commission-free!>

Cons

- Short-term technical traders may experience limited technical analysis tools

67% of retail investors lose money trading CFDs at this site

2. Capital.com – Best Forex Brokers for Beginners with $20 Minimum Deposit

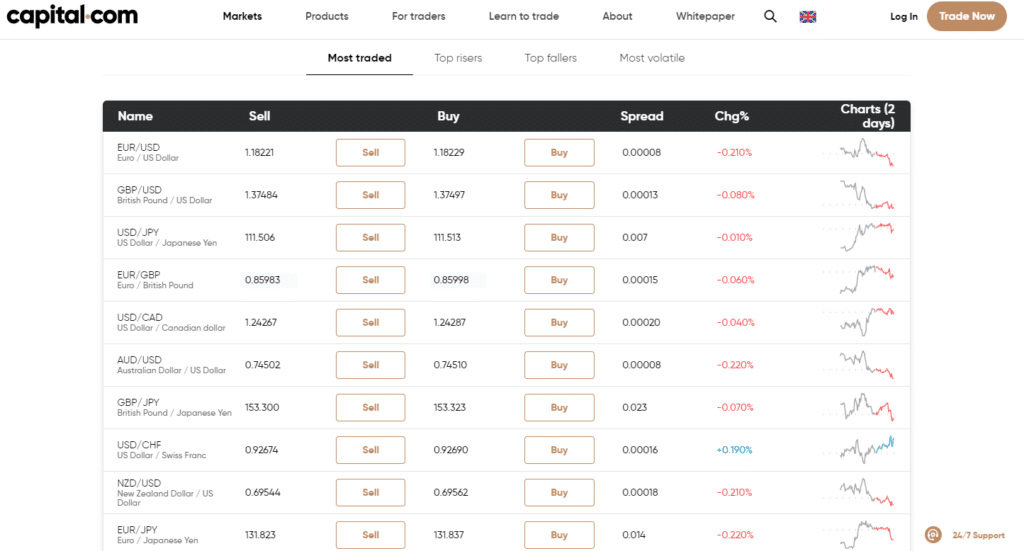

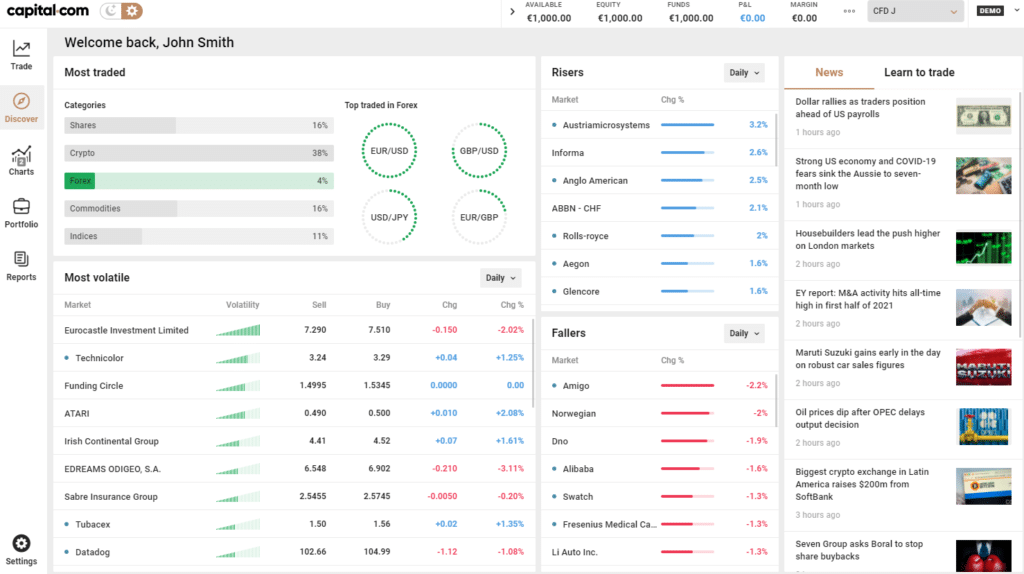

Capital.com is another popular Nigerian forex broker as they are ideal for beginners. You only need a minimum deposit of $20 to open an account and start trading. The broker also happens to provide access to more than 3,000+ global markets and is considered a top cryptocurrency trading platform as well.

This includes major, minor and exotic currency pairs, as well as one of the biggest cryptocurrency lists we’ve seen and stocks, commodities and indices. No wonder they have more than 780,000 traders worldwide and growing at an exponential rate.

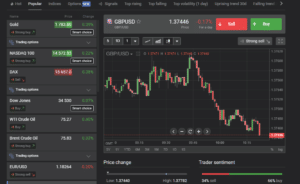

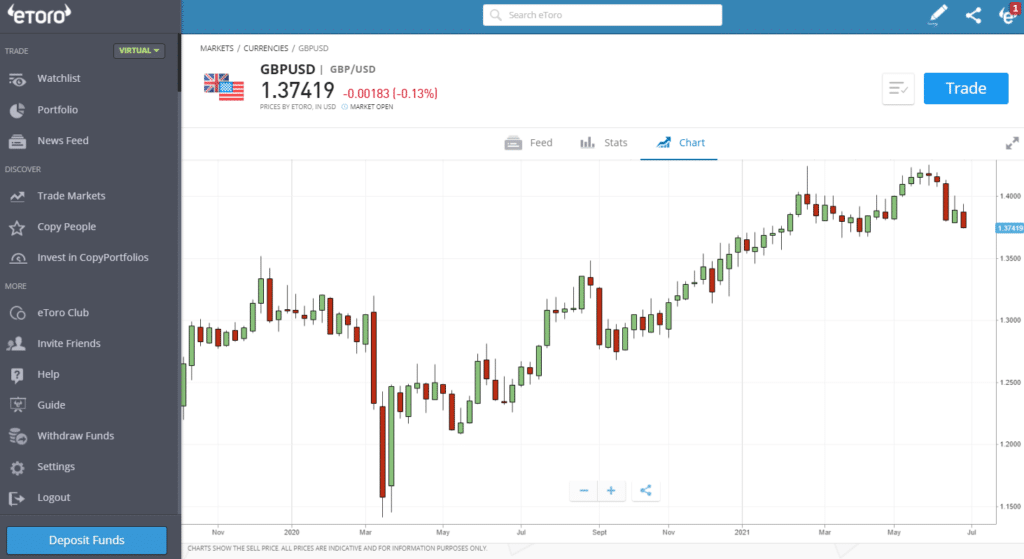

With Capital.com, you can trade currencies like GBP/USD via CFDs, or contracts for difference. This product allows you to potentially profit from both rising AND falling markets by trading long and short!

Better yet, you can trade currencies and more than 3,000+ other instruments 100% commission free! The broker also provides access to very low spreads, which at the time of writing was just 1.3 pips for GBP/USD making it one of the best forex brokers in Nigeria!

The broker’s trading platform is web-based and is very simple to use. The layout is very user-friendly and clean. From this one platform, you can access live charts, trading tickets and a research section shown above.

While trading is 100% commission-free, you can also deposit and withdraw funds 100% commission-free too! With only a $20 minimum deposit, you can see why it is number two on our list of forex brokers in Nigeria offering the best service.

- FCA and CySEC regulated

- Fee-free deposits and withdrawals

- Low and competitive spreads

- 100% commission-free trading

- Trade more than 3,000+ global markets

- Simple to use web-based platform

Cons

- No investing account available yet

72.6% of retail investors lose money trading CFDs at this site.

3. Libertex – Best Forex Broker in Nigeria with Tight Spreads

Libertex had to make it to our best forex brokers in Nigeria list because it offers access to tight spreads! The spread is the difference between the buy price and sell price and is a cost of trading from most brokers.

With Libertex, you can trade a variety of asset classes including the major, minor and exotic currency pairs – all with tight spreads. Instead, you just pay a small commission each time you trade. For example, the commission for trading AUD/USD is just 0.014%.

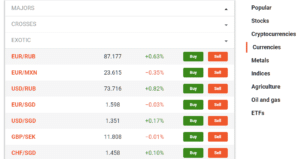

If you’re interested in trading exotic currency pairs, then Libertex is definitely for you. They have a huge list of exotic currency pairs to focus on. You can also trade other asset classes with them as well, including cryptocurrencies.

As Libertex offers CFD trading accounts this also means you can trade using leverage. This means you can control a much larger position with a small deposit. For example, Libertex offers 1:30 leverage on forex pairs which means you can open a $100,000 position with just $3,333 in your account.

Libertex offers a very simple to use yet feature-rich web trading platform as shown above, as well as the globally recognised MetaTrader 4 trading platform. The web platform has additional features included such as trader’s sentiment indicators.

The broker is also authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC). This means they offer a high level of safety and security of your funds, making it one of the best forex brokers in Nigeria.

- CySEC regulated

- Access more than 213+ global markets

- Wide range of exotic currencies

- Easy to use trading platform

- Low minimum deposit

- Live analysis and news in the platform

- Tight spreads!

Cons

- CFD trading only – no ownership of assets

83% of retail investors lose money trading CFDs at this site.

4. VantageFX – Best Forex Broker for ECN Accounts

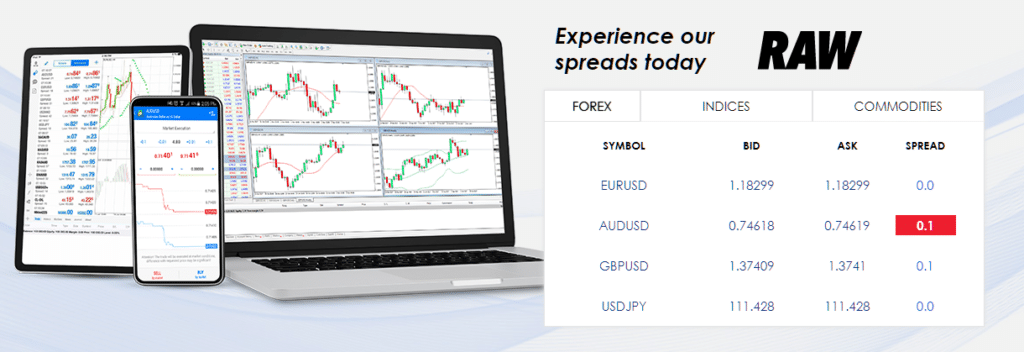

VantageFX offers a variety of different accounts types that range from commission-free trading to accessing raw spreads from 0 pips from its ECN account. This type of account allows you to buy and sell directly into the interbank market and used by professional and high-frequency traders.

You can trade 44 currency pairs via ECN, as well as other markets such as stocks, indices and commodities. This can be done from the MetaTrader 4 and MetaTrader 5 trading platforms for desktop, web and mobile.

While you can open a 100% commission-free trading account, the ECN account which provides raw spreads from 0 pips has a very small commission of $1 per lot, per side. This is one of the most competitive fees for ECN trading in the industry making it one of the best forex brokers in Nigeria.

- Low commission for ECN trading

- Access raw, interbank market spreads

- Commission-free trading available

- Trade from MetaTrader 4 and MetaTrader 5

- Access a wide variety of asset classes

- Premium trader tools provided

Cons

- VantageFX App takes getting used to

Your capital is at risk when trading financial instruments at this provider

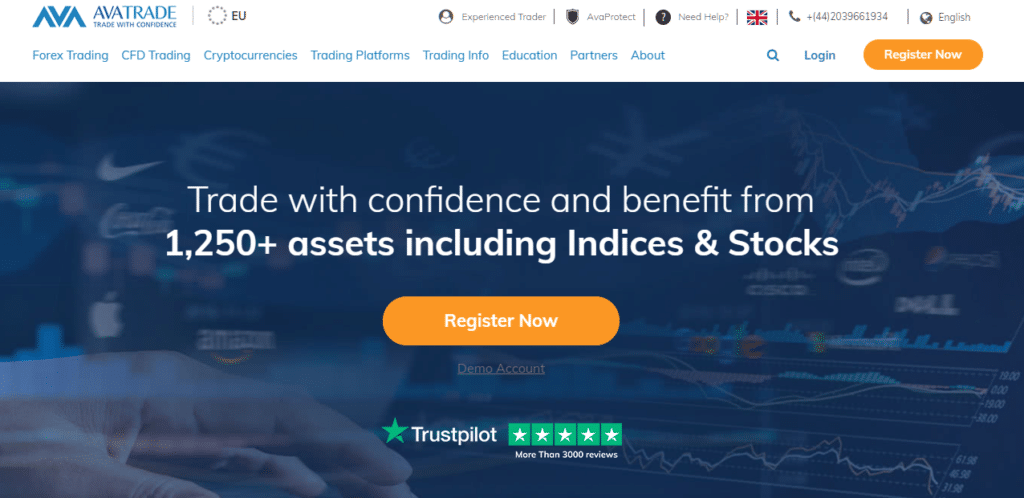

5. Avatrade – Best Broker for Range of Accounts (CFD, Options, Copy)

AvaTrade provides a great range of different trading accounts. This includes CFD, Options and Copy trading accounts via AvaSocial – a forex app that is a partnership between AvaTrade and FCA-regulated firm Pelican Trading.

The options trading account is particularly useful for positional traders and can be done easily from the specialised AvaTrade Options platform. You can also access a simple to use web trader platform and the more popular MetaTrader 4 and MetaTrader 5 platform.

You can trade 100% commission-free with AvaTrade AND enjoy access to low spreads. For example, the spread on EUR/USD starts at just 0.9 pips. You can also trade on a variety of other asset classes including cryptocurrency, stocks, indices, ETFs and FX options.

AvaTrade also provides access to a variety of additional trading tools from Trading Central which include correlation and sentiment indicators. But the broker also provides peace of mind as it is regulated in six different jurisdictions making it one of the best forex brokers in Nigeria.

- Regulated in six different jurisdictions

- Large range of trading platforms available including MT4/MT5

- 0% commissions with just spreads and swaps payable

- FX Options available

- Access more than 1,250 markets worldwide

- Zero deposit and withdrawal fees

Cons

- Inactivity fees

71% of retail investor accounts lose money when trading CFDs with this provider

Best Forex Brokers in Nigeria Comparison

Now that we’ve looked at a few of the top Nigerian forex brokers, how do they each compare with one another? Below is a table summarising some of the most important elements when choosing a broker such as commissions, spreads, deposit and withdrawal fees and maximum leverage.

| Forex Broker | Commission | Min. Spread (GBP/USD) | Deposit Fee | Withdrawal Fee | Max. Leverage (Retail) |

| eToro | Zero | 2 pips | Free | $5 | 1:30 |

| Capital.com | Zero | 1.3 pips | Free | Free | 1:30 |

| Libertex | From 0.006% | Zero | Free | Free or from €1 | 1:30 |

| VantageFX | Zero (STP)

$1 per lot (ECN) |

0.1 pip | Free | Free or 20 units of base currency | 1:500 |

| AvaTrade | Zero | 1.6 pips | Free | Free | 1:30 |

The above values may change if you are categorised as a professional trader. Different regions may also provide different leverage depending on the regulator.

How to Choose the Right Forex Broker for You

So far, we have had an in-depth look at some of the best forex brokers in Nigeria. The list was created using certain metrics. Below are some of the most important metrics and factors to look at when choosing a forex broker.

Safety

One of the most important metrics in choosing a broker is to make sure they are safe and secure. This is where you want to focus on forex brokers that are regulated. In the list of the best forex brokers above, one commonality is that they are all licenced and regulated.

For example, eToro is one of the most regulated brokers in the industry. It has a licence to operate and is overseen by the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC).

This means they have to stock to strict regulatory standards when holding your money – such as keeping it in a segregated account, away from company funds. Nowadays, there are many offshore and unregulated brokers popping up but be very careful, as their activities are not overseen by a proper financial regulator.

Fees

For a forex broker to provide you with a service, they need to make money to do so. This usually comes in the form of fees. It’s worthwhile keeping an eye out on all the different fees associated with a broker.

This could include a commission for buying and selling, the spread, overnight swap fees and inactivity fees. Nowadays, many brokers incorporate the commission inside of the spread.

For example, eToro offers 100% commission-free trading with low spreads. Working out your profit and loss becomes a lot easier in this situation.

Range of Assets

The world’s financial markets are all interconnected. Therefore, having a wide range of assets to trade on is essential in navigating moves around the globe.

If you just trade foreign exchange, make sure your broker provides access to the majors, minors and exotic currency pairs so you have a decent range to trade from.

Many forex traders also like to trade on other asset classes such as cryptocurrencies, indices, commodities and stocks.

With eToro, you can trade on more than 2,400+ instruments covering currencies, stocks, indices, commodities and cryptocurrencies.

Bonuses

Most regulated brokers from a well-known jurisdiction are not allowed to offer bonuses or promotions. For example, if a broker is regulated by US, UK, EU and Australian authorities they cannot provide bonuses to entice people to trade.

However, there are many offshore regulated brokers that have much lower regulatory standards and offer bonuses such as no deposit required. But, these no deposit bonus forex brokers can only offer it as they have very little regulatory oversight.

While it may sound enticing, be careful and try to stick with high-quality regulated brokers as discussed in the best forex brokers in Nigeria list above.

Trading Tools

To navigate the trillion-dollar foreign exchange market, you will need some trading tools to help you make decisions. Fortunately, there are brokers who provide access to additional tools not covered in the platform.

For example, some brokers may offer a set of additional trading tools to your MetaTrader trading platform. This can help to elevate your trading decisions but make sure they are also free to use. Some brokers may require a fee or a much higher deposit in your account to access them.

From our research, we love the eToro Copy Trading tool which is completely free to use. Copy the trades of other successful traders is a great way to get started.

Platforms

It goes without saying that every forex trader needs a top-notch trading platform. Many brokers may offer the globally recognised MetaTrader 4, MetaTrader 5 or cTrader trading platforms. These are great to use for beginner and advanced traders.

Nowadays, many brokers also offer their own custom-built trading platforms. These can range from really bad to really good so make sure you do your own research. From our testing, we like the custom-built eToro, Capital.com and Libertex web trading platforms – simple to use and packed full of different features.

Account Types

From our list of the best forex brokers above, each one offers a range of different account types. Some account types may be commission-free with slightly higher spreads and some account types – such as ECN accounts – are commission-based with access to raw spreads.

This allows you to find the right forex trading account for yourself. You can also open a demo trading account so you can see the difference between each account type in real-time when trading.

Many brokers have also now expanded the range of accounts and products you can use. For example, with eToro, you can open a CFD trading account and a real stocks and shares investment account. With Libertex, you can trade CFDs and options, providing you with a range of account types.

Payments

One of the most important elements in choosing a forex broker is to know how much you will be paying to deposit and withdraw your funds. Most brokers will offer fee-free deposit methods but not all of them.

It’s more common, that a broker will charge a fee for withdrawals as they’d rather you keep trading with them of course. However, there are brokers like Capital.com who charge zero fees for both deposits and withdrawals so it’s worthwhile doing your own research.

Another thing to look out for are the payment methods supported such as bank transfer, credit/debit card and e-wallets like PayPal and Neteller.

How to Get Started with a Forex Broker

In this section, we go through a step by step process on how to get started with one of the overall best forex brokers, eToro.

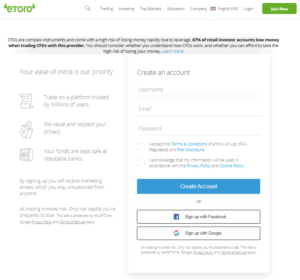

Step 1: Open an Account

With eToro, you can open an account in a matter of minutes. All you need to do to create your account is simply click on the Join Now button on the broker’s website and fill in your personal details.

Once you have filled in your details and accepted the Terms and Conditions, you will be instantly redirected to the eToro trading platform so you can get started right away. As with all high-quality, regulated brokers, you will need to fill in a short questionnaire so the broker knows more about you.

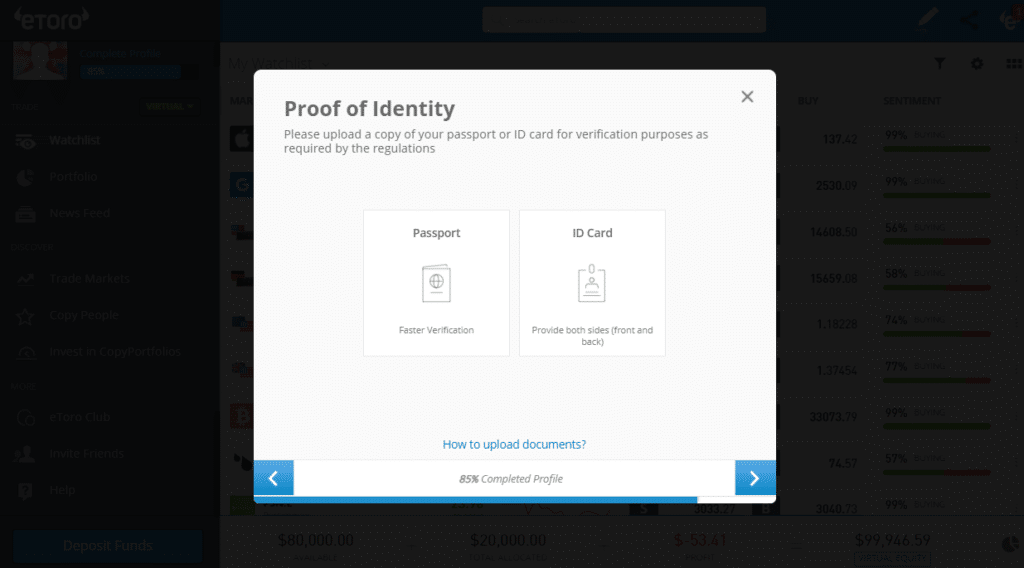

Step 2: Upload your ID

All regulated brokers will need you to go through a verification process to comply with AML and KYC regulations. With eToro, you just need two documents to verify your address and identity which can then be uploaded directly from the platform.

The documents needed, include:

- A valid passport or driver’s licence

- A bank account statement or utility bill issued within the last six months

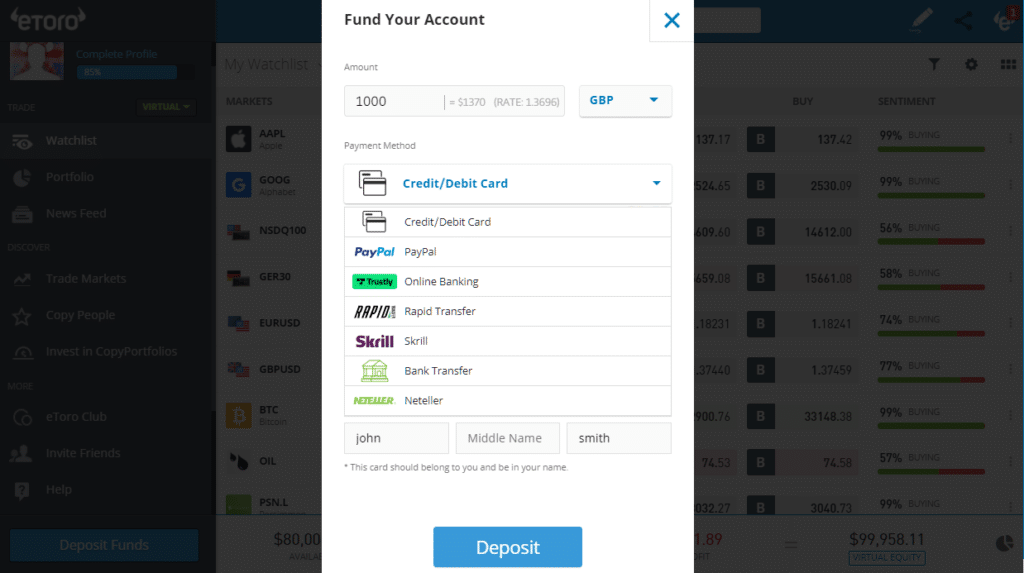

Step 3: Deposit funds

To get start trading, you will need to deposit funds. The great thing with eToro is the fact you can deposit funds fee-free using the following methods:

- Bank wire transfer

- Debit/credit card

- Neteller

- Skrill

- PayPal

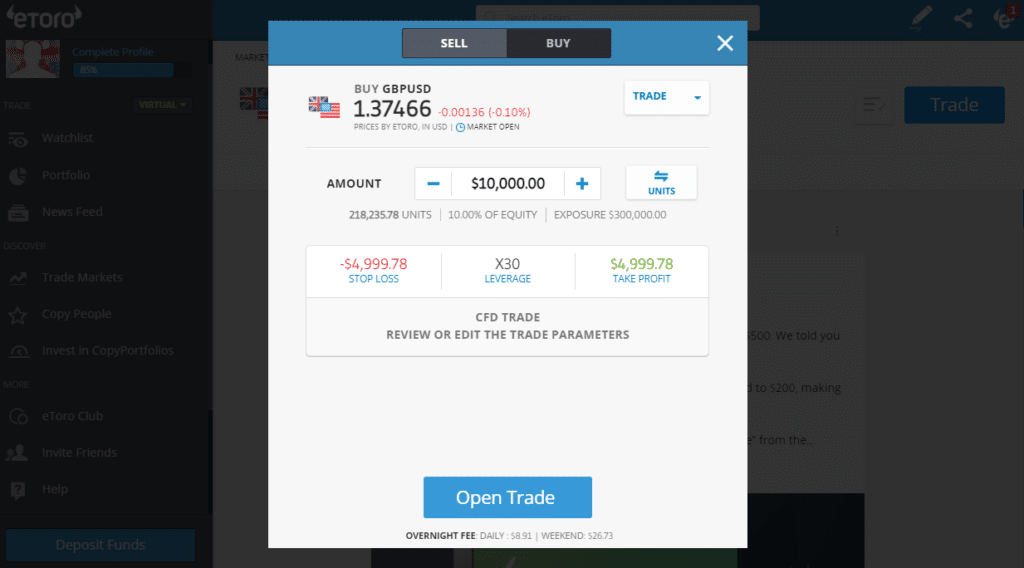

Step 4: Choose your market and trade!

You are now ready to start trading! Simply choose from the 2,400+ instruments available across currencies, stocks, indices, commodities and cryptocurrencies. Once you’ve found the right instrument simply click Trade to open a trading ticket.

The trading ticket will allow you to input your trade size and set a stop loss and take profit level. It will also tell you your total exposure using leverage and any fees with holding trades overnight.

For example, the above trading ticket shows a trade size of $10,000 will give me exposure to a $300,000 position on GBP/USD. That’s the leverage effect!

Conclusion

In this guide, we have covered a variety of brokers for trading forex. However, from our research and testing the best broker forex is eToro. There are a variety of reasons for this, including the fact it is regulated by three of the world’s biggest and well-known financial regulators.

Furthermore, you can trade 100% commission free on more than 2,400+ instruments covering a range of asset classes. This can all be done from a very simple to use and feature-rich web trading platform and mobile app.

But, what really stands eToro apart is the fact it is also one of the best copy trading platforms around. You can find other profitable traders and simply copy their trades onto your own account at the click of a button! You can even become a trader and get paid when people copy your own trades!

eToro – Best Nigerian Forex Broker

67% of retail investor accounts lose money when trading CFDs with this provider.