A new week and new pressure on EUR/USD. The post-Easter hangover continues.

The team at Goldman Sachs explains why there is more to come:

Here is their view, courtesy of eFXnews:

Goldman Sachs has little sympathy for the arguments currently being made for why EUR/USD downside is limited from here.

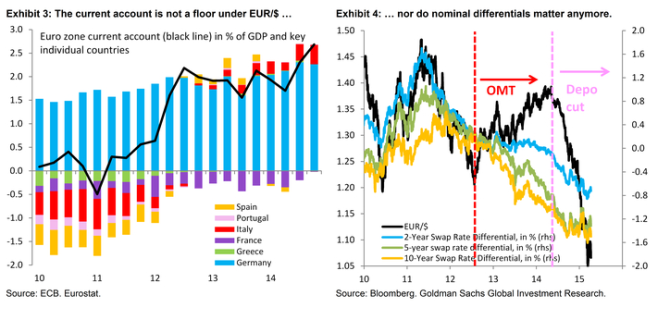

“There are three basic arguments: (i) a cyclical rebound in Europe will drive EUR/$ higher; (ii) EUR/$ has overshot nominal rate differentials; and (iii) the Euro zone current account puts a floor under the single currency,” GS clarifies.

Here are GS’ thoughts on each of these:

(i) A cyclical rebound in Europe is not EUR/$ positive because ECB QE is capping nominal interest rates, preventing the usual transmission of a growth rebound into stronger FX, which runs via higher interest rates. In fact, in the presence of QE it is possible that stronger growth could actually be Euro negative, if part of that growth stems from a recovery of consumption on the periphery and overheating in Germany. In such a setting, the Euro zone current account could fall, weighing on EUR/$.

(ii) QQE in Japan taught us that nominal rate differentials stop working in the run-up to quantitative easing. This is because – even at the long end – interest rates converge towards zero, so that there is limited room for nominal rate differentials to move. Instead, the focus shifts to inflation expectations and implicitly real rate differentials. As a result, we don’t see the undershoot of EUR/$ vis-Ã -vis nominal rate differentials as remotely alarming. Instead, we are surprised that the lessons from Japan have been so quickly forgotten.

(iii) With respect to the current account, exchange rates are forward-looking market prices. As such, they incorporate the presence of a current account surplus or deficit, i.e. this is priced.What will boost EUR/$ is if the Euro zone current account ends up larger-than-expected. As we laid out above, there is a reasonable case that ECB QE (and a cyclical rebound) could do the opposite.

In line with this view, GS targets EUR/USD at 1.02 by September, and 0.95 by March of 2016.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.