The US dollar had an excellent 2015 and is beginning 2016 on a strong footing against most currencies. Can this last? The team at HSBC sees a sour 2016 for the dollar against the euro and the yen, and sets targets:

Here is their view, courtesy of eFXnews:

In contrast to a consensus that expects the USD rally to extend in 2016, HSBC holds a contrarian view projecting that the USD will fall this year. The following are the 3 main reasons behind HBCS’s argument along with its forecasts for EUR/USD, and USD/JPY.

“In March 2015, we called the end of the USD bull run, a counter-consensus view at the time which has proven accurate. Our battle against the prevailing wisdom now extends into 2016, but rather than merely arguing the USD has stalled, we believe there are grounds to anticipate weakness,” HSBC argues.

There are three main strands to HSBC’s argument for USD weakness:

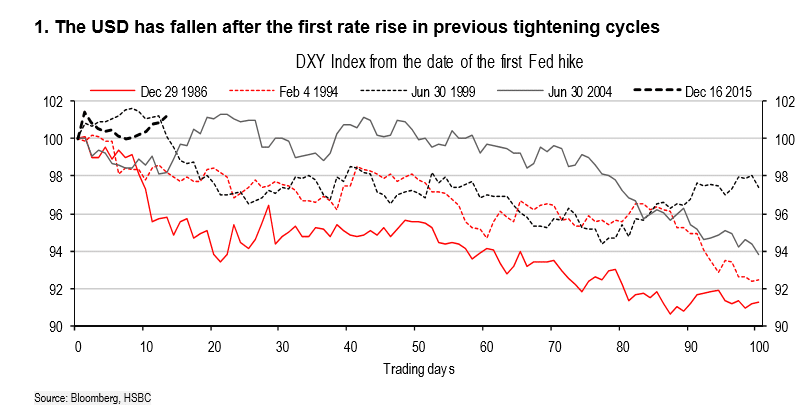

1) The Fed tightening cycle will see the USD weaken not strengthen.

“History shows the USD weakens once the Fed starts to hike rates. In addition, we believe the conversation about the pace of Fed hikes will retain a very dovish tone in 2016, mirroring the experience of other central banks which have tried to raise rates after the 2008/09 financial crisis,” HSBC clarifies.

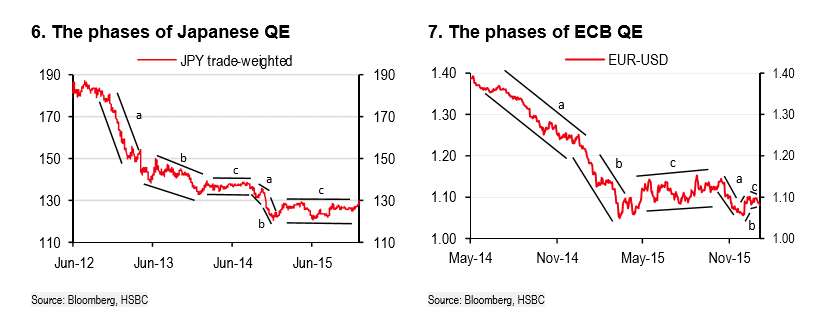

2) The ECB’s power to engineer a weaker EUR is low.

“The ECB faces constraints on how much further it can expand QE, both in terms of the amount of bonds available to buy, and internal support for further monetary easing,” HSBC adds.

3) The BoJ is unlikely to expand QE further in 2016.

“Like the ECB, the BoJ’s QE programme is reaching its limit, and we believe the central bank will move to a rates-based policy framework in 2016. In any event, the pressure for additional easing is on the wane given the BoJ’s focus on the new (and higher) core inflation measure,” HSBC notes

HSBC forecasts EUR/USD at 1.20 and USD/JPY at 115 for year-end 2016.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.