- New Zealand has bounced back rapidly after the shock of the Covid-19 lockdowns last year.

- NZ CPI is on the cards and given the hawkish environment at central banks, there is a bias to the upside for the kiwi.

Today we have New Zealand’s fourth-quarter Consumer Price Index where the market expects a 1% outcome for the year due to a flat 0% result quarter on quarter.

The data is likely to show that food prices have eased off from their winter highs and that travel-related prices would be a smaller than usual contribution pertaining to behavioural habits.

There could also be disruptions to imports which would have impacted prices negatively.

However as analysts at ANZ Bank explained, ”there is scope for noise in the data”.

”We expect some areas of price rises on the back of supply disruption, less discounting, and payback from last quarter’s very weak print as measurement issues ease.

But underlying inflation will remain weak, reaffirming a cautious stance from the Reserve Bank of New Zealand.”

Meanwhile, analysts at Westpac explained that the economic activity in New Zealand has bounced back rapidly after the shock of the Covid-19 lockdowns last year.

”For the Reserve Bank, though, the piece of the puzzle that’s still missing is evidence of sustained inflation pressures.”

How might the data impact NZD/USD

Regardless of the data, risk sentiment is likely to remain elevated which would be expected to continue supporting investor’s appetite for high-beta currencies, such as the kiwi.

The correlation between US equities and the antipodeans throughout the pandemic era has been compelling.

SP 500 vs NZD weekly chart

The latest surge in US equities is down to investors banking on the unprecedented global central bank and government stimulus, and vaccine development.

Then, when we add the US dollar to the frame:

The expectations are for the correlations to continue and therefore, the USD should therefore weaken further and underpin the kiwi.

”In addition, the NZ economy’s performance since Covid has been stronger than expected, providing fundamental support for NZD outperformance,” analysts at Westpac argued.

Their analysts target 0.7400+ by March.

Meanwhile, when looking at the whole picture, we need to take into account the slight hint of hawkishness seeping from various central banks, including the Bank of Canada on Wednesday and the European Central Bank on Thursday.

The latter hurt the dollar more so on a weighted basis in the DXY in a clear push back from ECB President Lagarde about the potential for yield curve control in the euro area contributed to USD weakness.

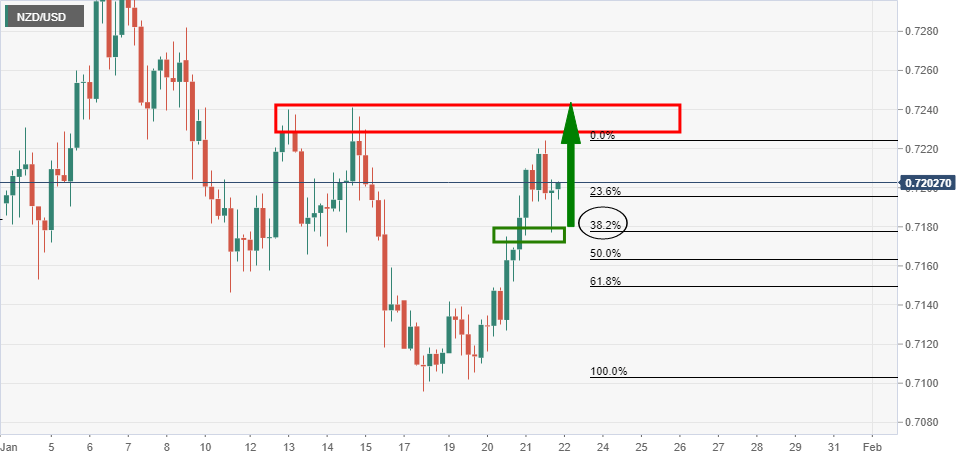

From purely technical analysis, NZD/USD has completed a 38.2% Fibonacci retracement on the 4-hour time frame and can be projected to extend to 0.7235:

Meanwhile, the market is bearish below 0.7170.

Description of the Consumer Price Index

Consumer Price Index released by the Statistics New Zealand is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services.

The purchasing power of NZD is dragged down by inflation.

The CPI is a key indicator to measure inflation and changes in purchasing trends.

A high reading is seen as positive (or bullish) for the NZD, while a low reading is seen as negative.

-637468578889516078.png)

-637468580454789371.png)