- Kiwi falls back as Monday’s bullish start washes out early.

- NZ Retai lSales couldn’t provide support for Kiwi bulls as data slumps.

The NZD/JPY is falling back after the week’s opening bids, and the pair is backing into 76.50 as the week’s early jump washes out as data for the Kiwi continues to play to the soft side.

Asia markets popped following headlines the US and China have stood down from their recent trade hostilities, though the bullish spin to headlines took a turn as conflicting statements from US trade representatives threw the US-China cool-off into question.

NZ Retail Sales fail to bolster bulls

New Zealand’s Retail Sales for the first quarter of 2018 slumped, printing at 0.1% compared to the previous reading of 1.7%, and the Kiwi lost its early bullish stance, falling off of Monday’s early high of 0.7686.

The Japanese Merchandise Trade Balance is also expected to show a corrective reading, with the trade balance for April expected to show ¥405.6 billion, a contraction from the previous reading of ¥797.3 billion.

NZD/JPY levels to watch

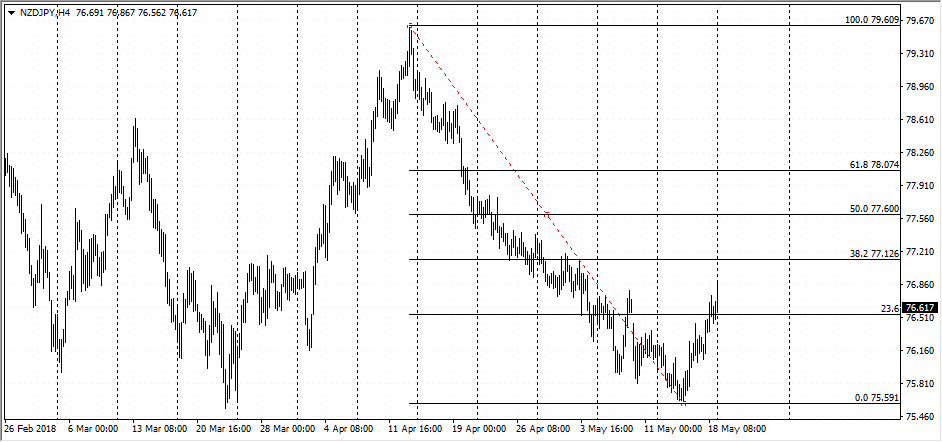

The pair is pricing in a correction from the current low of 75.60, and the recovery’s next challenge rests at the 38.2 Fibo retracement level near 77.15, and 77.60 beyond that could cap the pair’s bullish correction. The pair has consistently bounced from the 75.50 region since first falling into the region in March, though descending highs with the last at 79.85 is beginning to build bearish pressure into the pair.