- NZD/USD bulls will seek a break of the 21-day EMA.

- The risk-on mood on Wall Streeet could support the higher beta currencies in the open.

NZD/USD ended on Friday at 0.7030 having travelled from a high of 0.7065 to a low of 0.7009, finishing lower by almost 0.3%.

For the open, the risk-on mood from Friday’s Wall Street session could transpire into a bid from the get-go on Monday in Asia opening.

”Stronger US growth should benefit all global cyclical assets, including the NZD and Asian currencies, and as we noted on Friday, this theme appears to be at play,” analysts at ANZ Bank explained.

”The local economic picture is good (but not exceptional) and at the margin, that should support the NZD more than others during a cyclical risk uplift.”

That all being said, the technical outlook is less convincing on the demand side while below critical daily resistance.

NZD/USD techcnial analysis

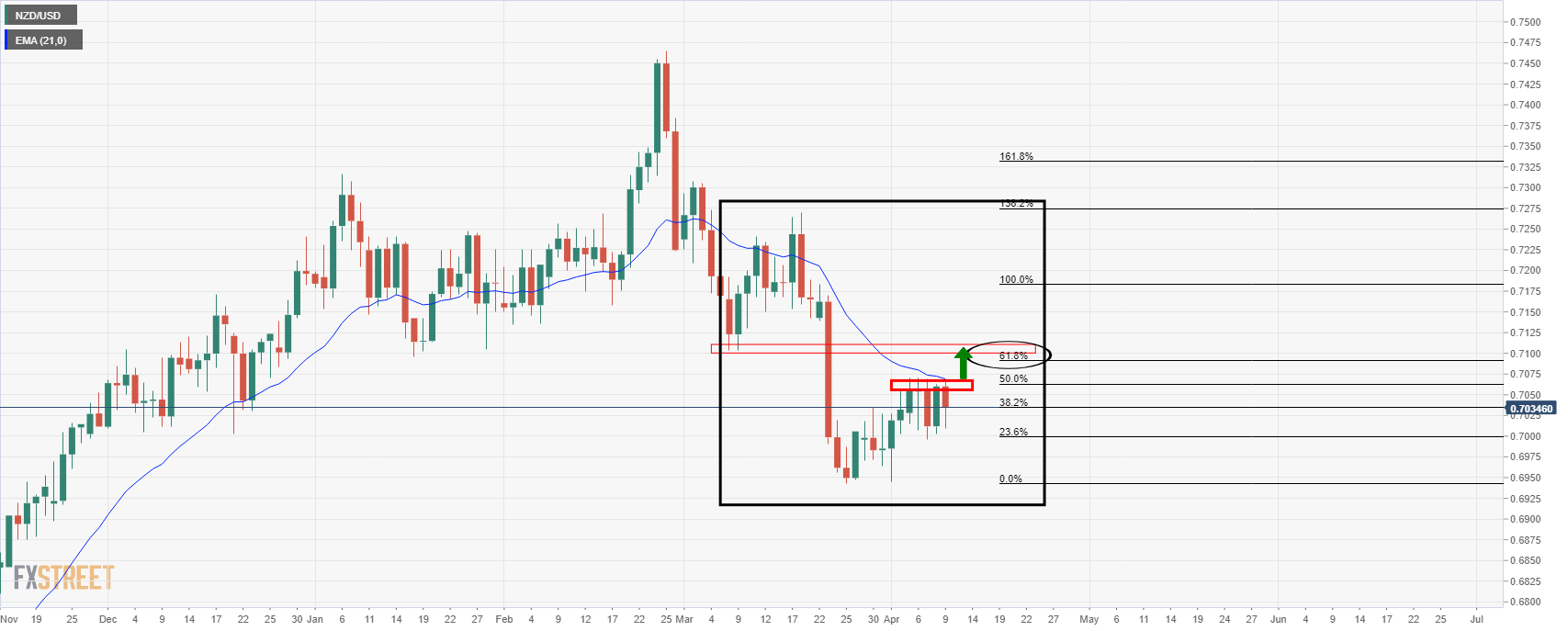

From a daily perspective, the price is struck below a confluence of daily resistance, the 21 EMA and has made a 50% mean reversion of the latest daily impulse already.

Having said that, the neckline of the M-formation is compelling on a break of the near term resistance in order to complete a full 61.8% Fibonacci retracement of the lastest daily impulse to the downside.