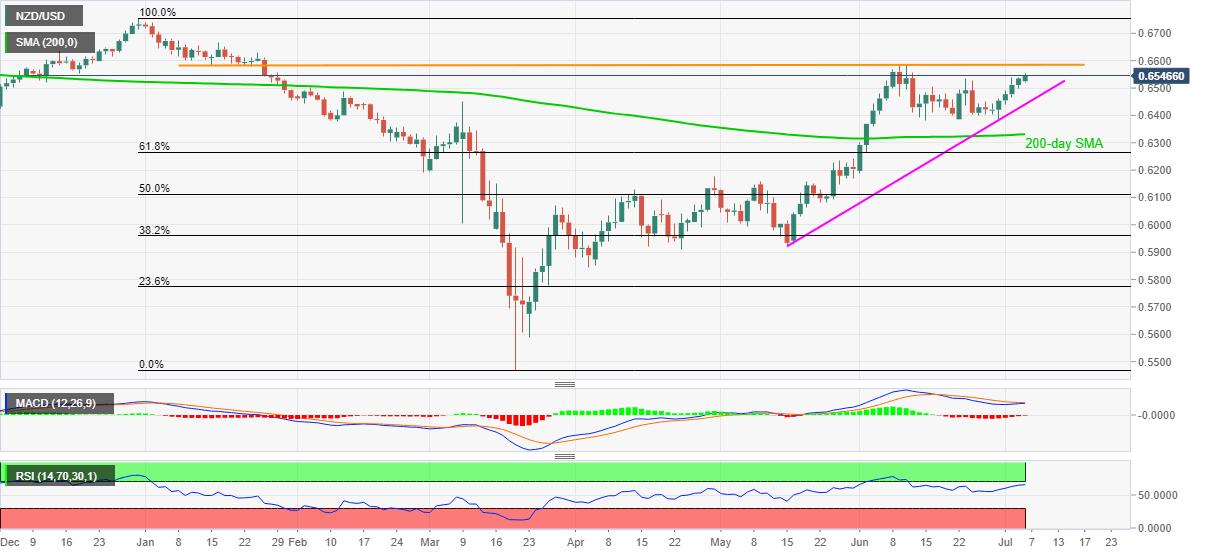

- NZD/USD prints six-day winning streak while attacking 0.6550.

- January low, June top constitute a tough nut to crack for buyers.

- MACD teasing bulls, seven-week-old support line question the bears above 200-day SMA.

NZD/USD takes the bids near 0.6550, up 0.20% on a day, during the early Monday. In doing so, the kiwi pair rises to the highest levels in three weeks. Also portraying the bullish momentum is the MACD histogram that is about to turn green and favor the further upside.

As a result, optimists can have eyes on the horizontal area around 0.6480/85 comprising multiple lows marked during January month and the high of June.

Although RSI conditions might question the bulls beyond 0.6485, a sustained break of the same might not refrain from challenging the January 16 top near 0.6660/65. Though, 0.6500 could offer an intermediate halt to the pair’s further upside.

On the downside, June 23 top near 0.6530 can offer immediate support to the pair during its pullback, a break of which may drag the quote towards an ascending trend line from mid-May, at 0.6440.

Should the bears dominate past-0.6440, the mid-June low near 0.6380 and 200-day SMA surrounding 0.6330 could lure the bulls.

NZD/USD daily chart

Trend: Bullish