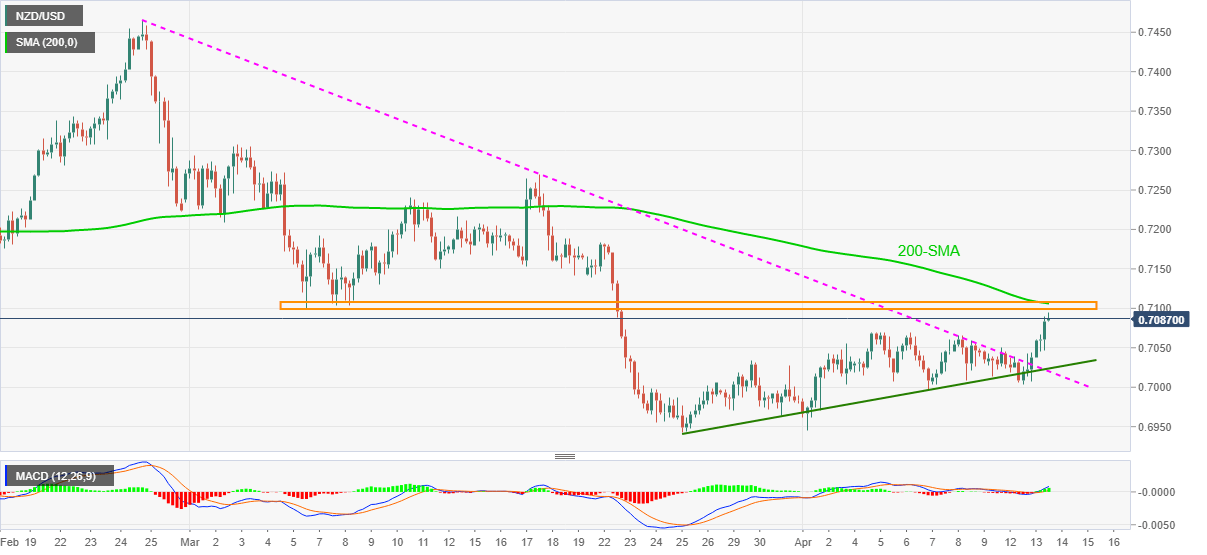

- NZD/USD eases from fresh three-week top, keeps upside break of short-term key resistance line, now support.

- 200-SMA, early March lows guard further advances, 0.7020 becomes the key support.

NZD/USD rises to the fresh high since March 23, before recently easing to 0.7087, while flashing 0.48% intraday gains ahead of Wednesday’s European session.

In doing so, the kiwi pair extends the previous day’s upside break of a descending trend line from February 25 amid bullish MACD.

However, 200-SMA and lows marked during March 05-09, around 0.7110, challenges the NZD/USD bulls.

The mid-March bottoms surrounding 0.7150 also act as an upside barrier ahead of fueling the quote towards the 0.7200 threshold and March 18 peak close to 0.7270.

Meanwhile, April 05 tops near 0.7070 can act as immediate support during the pair’s pullback.

Though, a confluence of a three-week-old rising trend line and previous resistance line, around 0.7020, followed by the 0.7000 psychological magnet, will be tough nuts to crack for the NZD/USD bears.

NZD/USD four-hour chart

Trend: Pullback expected