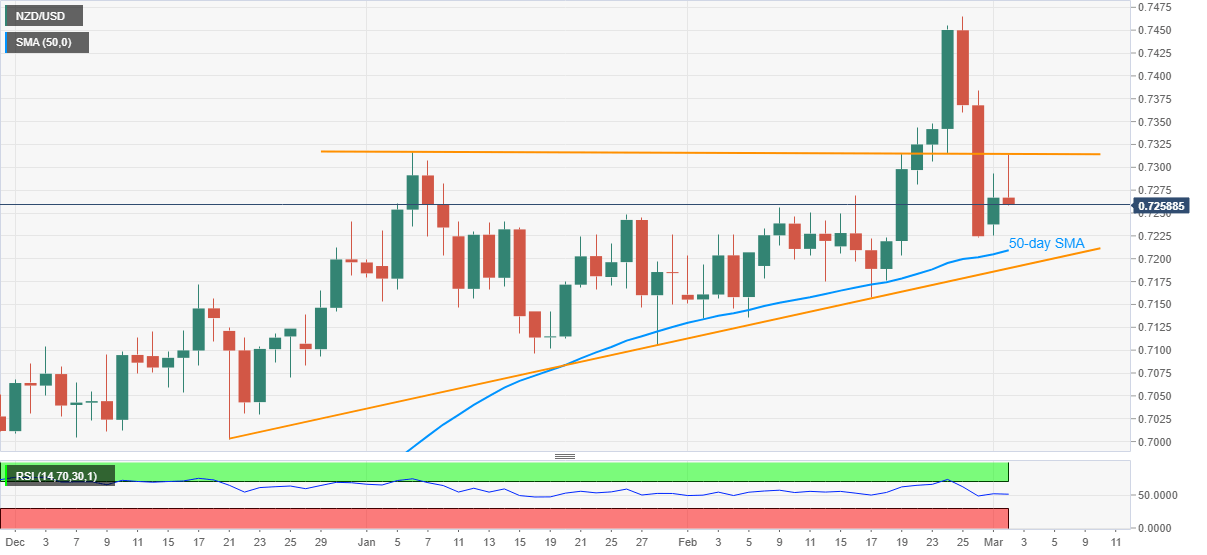

- NZD/USD steps back from early-January tops, eases in a range between 0.7255-85.

- Strong RSI, repeated bounces off 50-day SMA and 10-week-old support line favor bulls.

NZD/USD drops to 0.7260, with an immediate trading range, during Tuesday’s Asian session. In doing so, the kiwi pair trims the previous day’s gains while easing from January high.

Although the quote’s latest weakness drags NZD/USD towards a 50-day SMA level of 0.7209, its further downside will be tamed by the 0.7200 threshold and an upward sloping trend line from late-2020, around 0.7190.

In a case where the NZD/USD bears dominate past-0.7190, 0.7130 and the 0.7100 round-figure, also comprising multiple lows marked during January, could become their favorites.

On the flip side, a successful break above 0.7315 horizontal line including January high and February 24 low guards the pair’s immediate upside.

Should the NZD/USD buyers manage to conquer the 0.7315 hurdle, the 0.0.7370 holds the key to further run-up towards a multi-month-old peak surrounding 0.7465.

NZD/USD daily chart

Trend: Further weakness expected