- The NZD/USD rallies 3.7% in three days to approach March highs at 0.6450.

- Confidence in a quick global recovery and upbeat macroeconomic data boost the kiwi.

The New Zealand’s dollar is on track to appreciate for its third consecutive day against the US dollar, posting a 3.7% rally to return to pre-pandemic levels, past 0.6400, nearing March’s top at 0.6450.

Kiwi strength has been supported by growing hopes of a strong economic recovery in the second half of the year, and a set of better than expected US economic indicators which have weighed on the safer US dollar.

Earlier today, the strong Chinese Caixin Services PMI Index, which reached its highest level in 10 years, at 55.00, have boosted optimism about a quick pick up in Asia, which has increased buying pressure on the Kiwi.

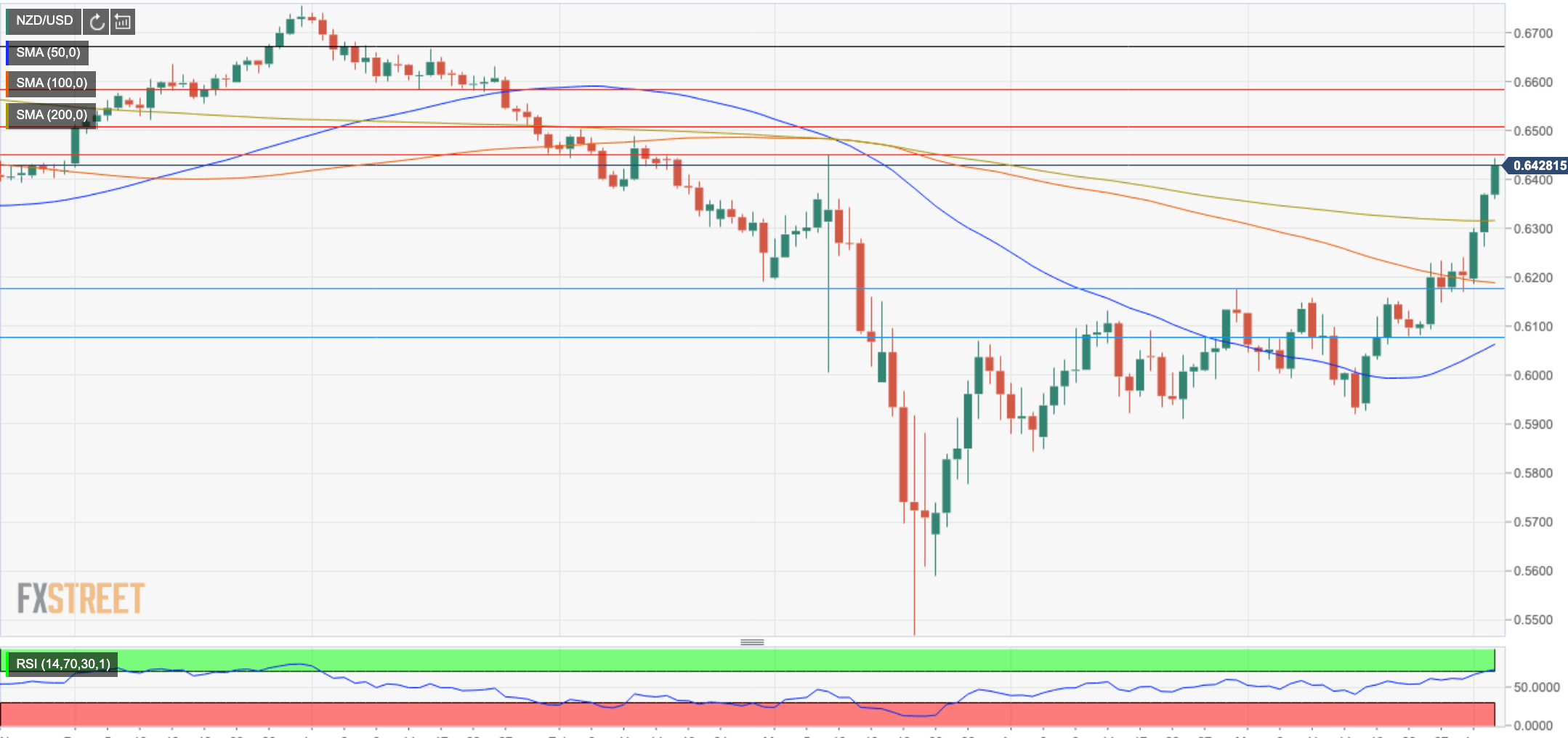

As of writing, the pair is moving well above the main moving averages on the daily chart, right below 0.6450 (March 9 high). Beyond here, next targets might be February’s top at 0.6508 and January’s 15, 22 and 23 lows at 0.6580/85.

The RSI index, however, shows the pair reaching overbought levels in daily and 4-hour charts, which suggests a possible pullback. On the downside, the NZD might find support at the 200-day SMA, now at 0.6315, and below here, April 30 high at 0.6175 and May 22 low at 0.6080.