- NZD/USD nears the weekly low.

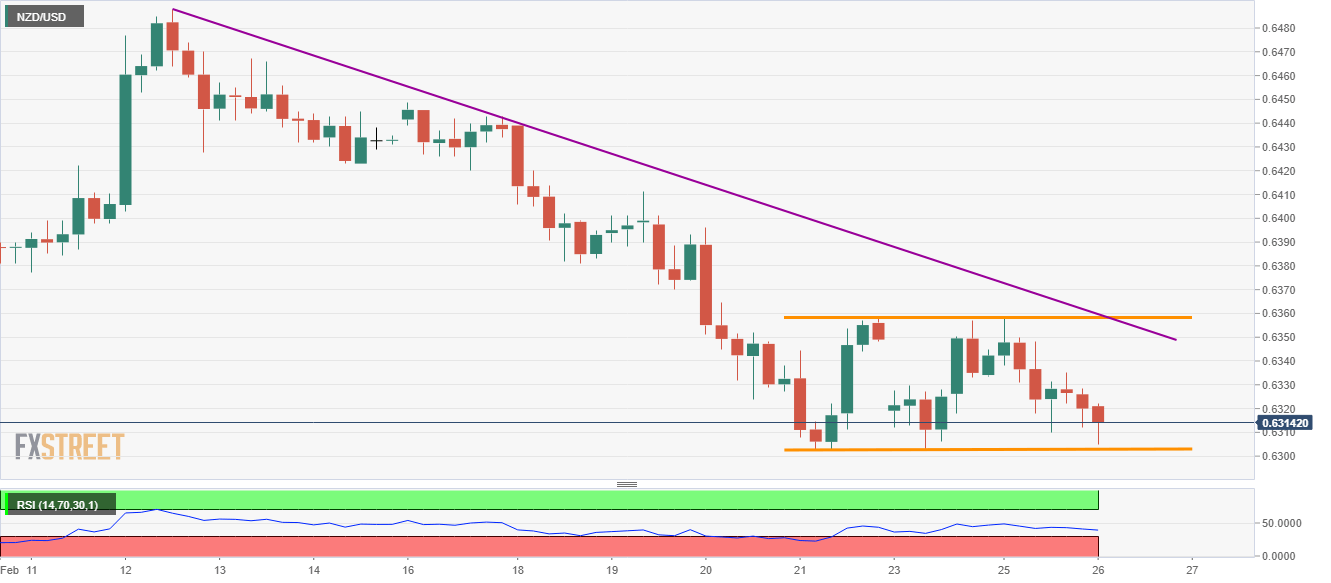

- A descending trend line from February 12 adds strength to the range’s resistance.

- Lows marked during October 2019 will gain traders’ attention during the further downside.

Despite carrying Tuesday’s weakness forward, NZD/USD stays inside a three-day-old trading range while trading around 0.6315, down 0.10%, during the early Wednesday.

The pair is near to the support of the said trading range, around 0.6300, a break of which could divert the bears towards October 16, 2019 low near 0.6240.

If at all the sellers keep ignoring weak RSI conditions below 0.6240, October 2019 bottom close to 0.6200 will return to the chart.

Alternatively, 0.6335 can offer an intermediate halt, during the pair’s bounce, ahead of highlighting the 0.6360 resistance confluence that includes the range-resistance and a bit longer falling trend line.

It should, however, be noted that the pair’s ability to cross 0.6360 enables it to challenge February 19 high surrounding 0.6410.

NZD/USD four-hour chart

Trend: Bearish