- NZD/USD drops after taking a U-turn from the short-term resistance line.

- Last Wednesday’s top on the sellers’ radar, 200-HMA could question further declines.

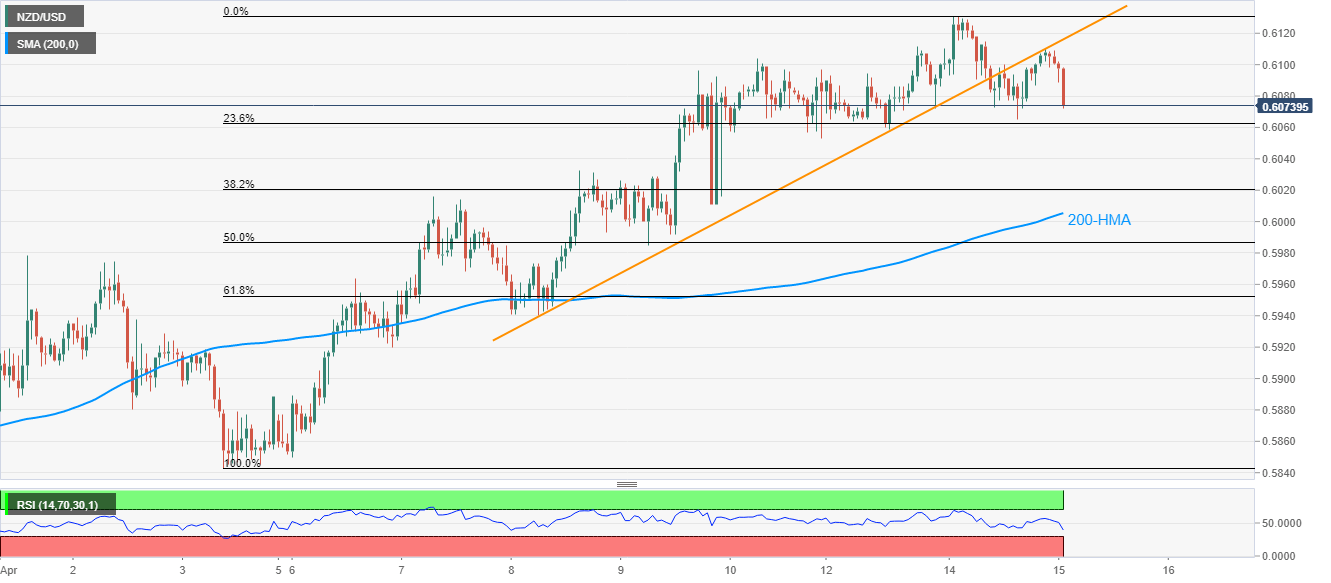

NZD/USD registers 0.50% loss on a day, currently around 0.6075, while reversing from one-week-old resistance line, previous support, during the early Wednesday.

The pair’s sustained trading below the support-turned-resistance keeps directing sellers towards the previous Wednesday’s top around 0.6030.

However, the pair’s further downside could be restricted by a 200-HMA level of 0.6005, if not then 61.8% Fibonacci retracement of the pair’s current month upside, near 0.5950, will lure the bears.

Meanwhile, 0.6100 can offer immediate resistance ahead of another attempt to challenge the support-turned-resistance, at 0.6116 now.

Should there be a successful break above 0.6120, the latest high surrounding 0.6130 and the further rise to 0.6200 can’t be ruled out.

NZD/USD hourly chart

Trend: Pullback expected