- NZD/USD snaps four-day winning streak after RBNZ comments.

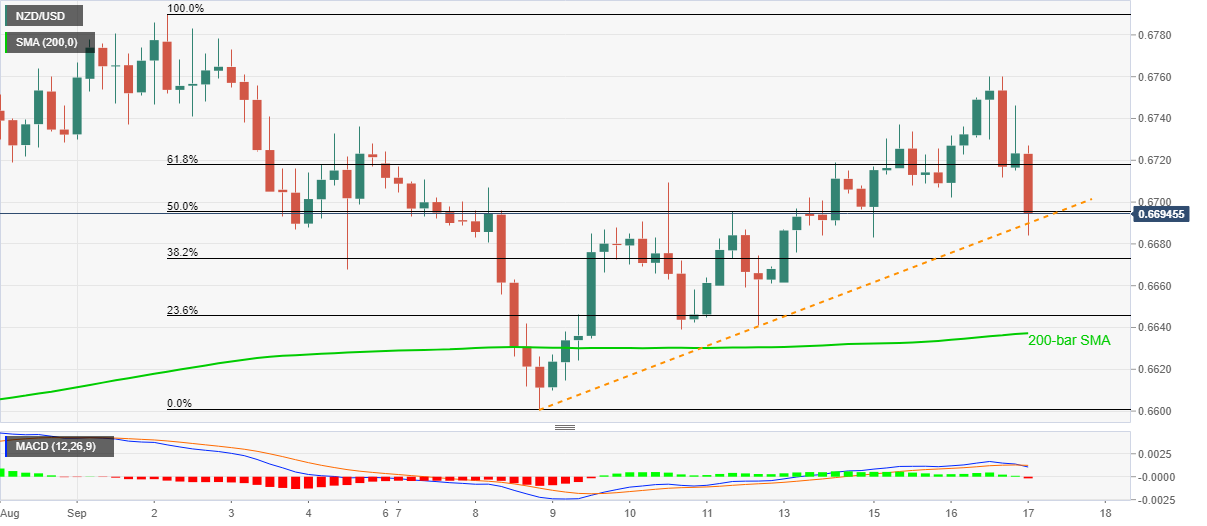

- MACD turns the most bearish in a week as sellers dominate below the key Fibonacci retracement levels.

- 200-bar SMA on the bears’ radar, 0.6800 can lure the bulls during the fresh rise.

NZD/USD drops to 0.6693, down 0.58% intraday, after RBNZ’s stress test conveyed the severity of coronavirus (COVID-19) led economic conditions during early Thursday. In doing so, the pair broke an ascending trend line from September 08 while slipping below 61.8% and 50% of the Fibonacci retracement of September 02-08 downside.

Read: Banks stress test outcome reinforces need tor strong capital buffers – RBNZ

As a result, the sellers are preparing to revisit a 200-bar SMA level of 0.6637 before targeting the monthly low near 0.6600.

However, an extended break of the trend line, at 0.6689 now, becomes necessary to confirm NZD/USD weakness.

Meanwhile, the key Fibonacci retracement levels can offer immediate resistances around 0.6695 and 0.6720 ahead of the recent high near 0.6760.

Though, any further upside past-0.6760 will depends upon how well the bulls manage to cross the monthly high of 0.6790 and remain strong beyond the 0.6800 threshold.

NZD/USD four-hour chart

Trend: Bearish