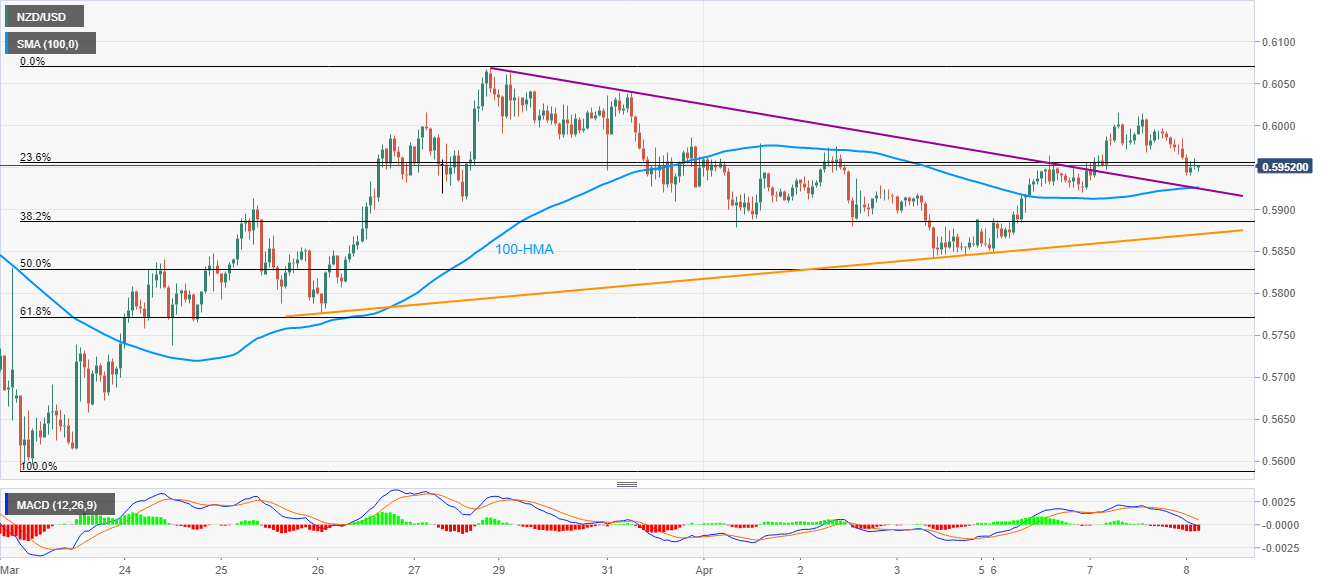

- NZD/USD slips below 23.6% Fibonacci retracement.

- 100-HMA, short-term resistance-turned-support line limit immediate declines.

- A fortnight-old rising trend line adds to the support.

- Buyers will wait for fresh weekly high for a fresh position.

Having dropped from one-week high, NZD/USD seesaws around 0.5950, down 0.45%, amid the early Wednesday’s trading session.

While the recent declines dragged the quote below 23.6% Fibonacci retracement of its late-March upside, sellers are likely to be challenged by 100-HMA and the resistance-turned-support line stretched from March 27, around 0.5925.

Also challenging the bears will be an ascending trend line since March 26, 2020, currently at 0.5870.

Meanwhile, an upside clearance of 23.6% Fibonacci retracement level of 0.5960 needs validation from 0.6000 and a sustained run-up beyond the weekly high surrounding 0.6015.

NZD/USD hourly chart

Trend: Pullback expected