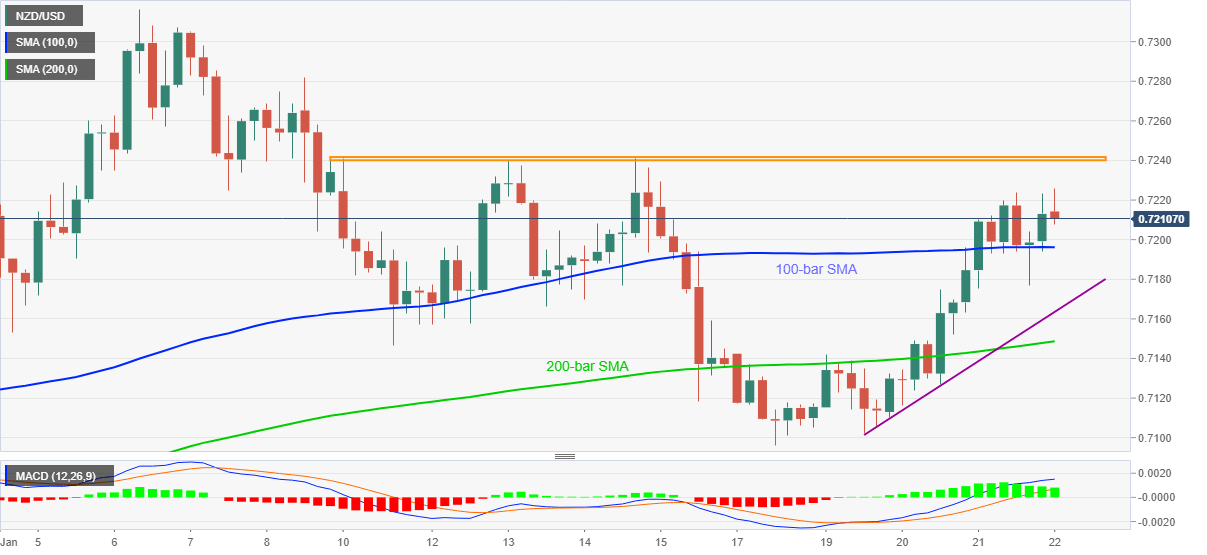

- NZD/USD extends pullback from the recently refreshed one-week high of 0.7226

- Bullish MACD and successful trading above 100-bar SMA keep buyers hopeful.

- Immediate rising trend line, 200-bar SMA adds to the downside filters.

NZD/USD drops to 0.7211 while consolidating recent gains during Friday’s Asian session. Even so, the kiwi pair marks 0.15% intraday upside, triggered mainly after New Zealand’s (NZ) upbeat fourth quarter (Q4) Consumer Price Index (CPI) data.

Read: NZD/USD jumps above 0.7200 on strong New Zealand Q4 CPI

Although the recent pullback eyes to revisit 100-bar SMA, at 0.7196 now, bullish MACD and sustained trading beyond an ascending trend line from Tuesday as well as 200-bar SMA favor the NZD/USD buyers.

It should, however, be noted that a horizontal area comprising multiple highs marked since late-January 08, around 0.7240/45 restricts the quote’s short-term upside.

As a result, NZD/USD traders should wait for a clear break of either 0.7196 or 0.7245 for fresh moves.

While an upside break of 0.7245 will target the monthly high of 0.7316, the quote’s declines below 0.7196 will have to break the immediate support line, at 0.7163 now, followed by a 200-bar SMA level of 0.7148, to please sellers.

Should NZD/USD bears keep the reins past-0.7148, the monthly’s low around 0.7096 should return to the chart.

NZD/USD four-hour chart

Trend: Pullback expected