- NZD/USD moved back towards 0.7250 on Tuesday amid a softer US dollar.

- Kiwi was an outperformer versus its G10 peers as markets bet on a less dovish RBNZ.

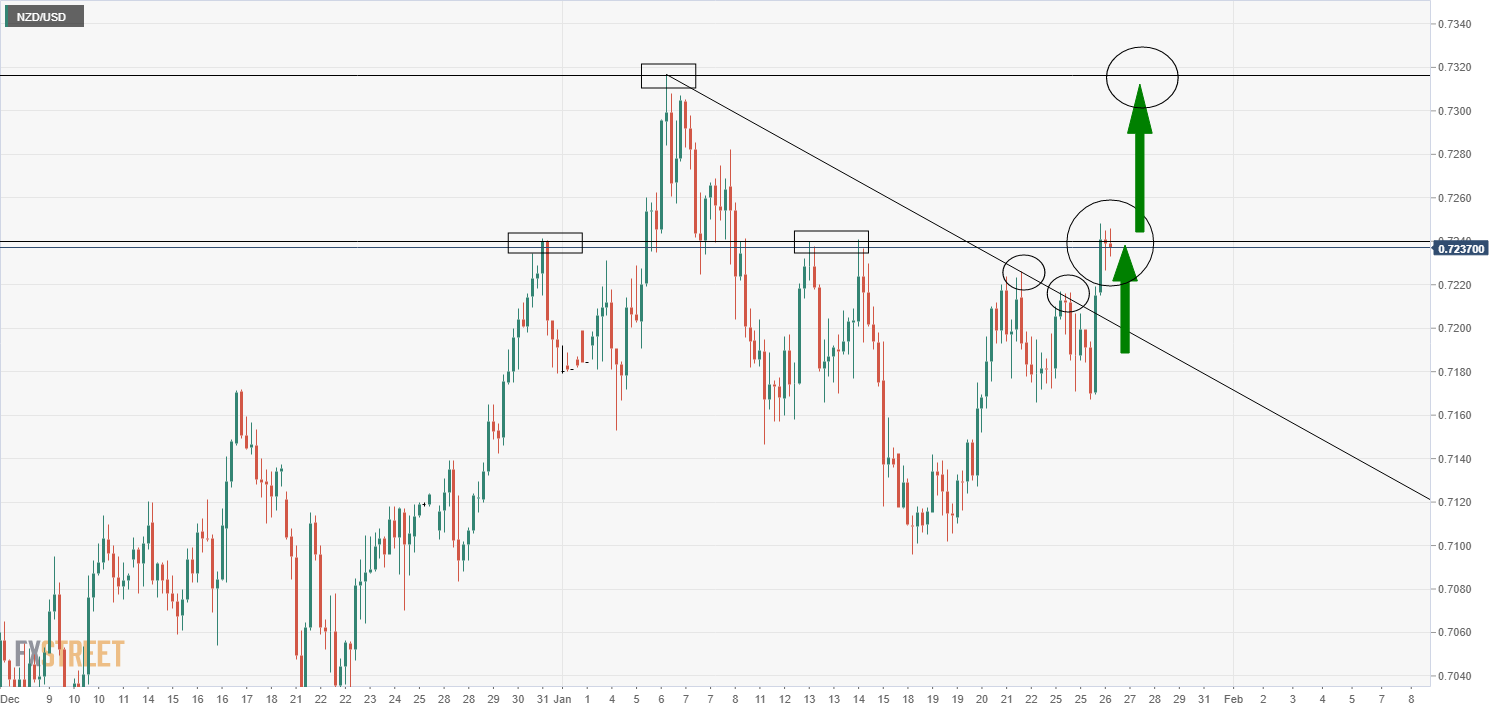

NZD/USD closed Tuesday FX trade with solid 0.5% or 35 pip gains, making the kiwi the best performing currency in the G10. The pair rallied from Tuesday Asia Pacific lows in the 0.7160s to nearly as high as the 0.7250 mark and broke above a short-term downtrend linking the 6, 22 and 25 January highs. Bulls will now eye a move back towards annual highs of just above the 0.7300 level. Trade is now quietening down as the Asia Pacific session gets underway and the kiwi will likely be on notice for Australian Q4 CPI numbers and Chinese Industrial Profits.

Driving the day

NZD/USD was supported by a weaker USD amid a lack of demand for safe-haven currencies as risk appetite took a turn for the better; better vaccine news (Pfizer and Moderna both looking at booster shots to address Covid-19 variants and the J&J CFO hinting that next week’s vaccine trial results will be good) was the main contributor.

As to NZD outperformance versus its G10 peers, there was no specific fundamental catalyst. ANZ comments that “market confidence that the RBNZ is at, or close to, the trough in the monetary policy cycle remains a key driver of the NZD and dips are a buying opportunity”. The antipodean bank thinks that “a dovish FOMC meeting tomorrow will play into that theme although further gains might be limited in the near term by congestion in the 0.7250/0.7300 area”.

Capital Economics calls for RBNZ hikes in 2022

A few weeks ago, most institutions were still calling for negative interest rate policy to be implemented in New Zealand in 2021. Crucially, last week Westpac Bank dropped their forecast for the RBNZ to cut rates into negative territory this year, leading to markets reducing their NIRP bets.

Capital Economics are going one step further. The economic consultancy is now calling for the RBNZ to start hiking rates in 2022. They give three reasons as to why they do not expect any more stimulus from the RBNZ;

1) “The recovery in output occurred much faster than we had anticipated as GDP returned to pre-virus levels in Q3. And while the RBNZ is forecasting a renewed decline in output in the first half of this year, recent data suggest GDP has continued rising.”

2) “Most measures of underlying inflation surged in Q4. All of them are now close the RBNZ’s target mid-point.”

3) “Third, the housing market in New Zealand is running red hot. House prices are up nearly 20% from a year ago and show little sign of coming back down to earth. The surge in house prices prompted the Minister of Finance to write to RBNZ Governor Adrian Orr suggesting that house prices be added to the Bank’s monetary policy mandate. While the Bank rebuked that suggestion, we doubt Orr would be keen to exacerbate these political tensions by cutting interest rates further.”

CapEco’s forecast of a rapid recovery in output means that “we expect the unemployment rate to decline to around 4.5% by the end of 2022, consistent with employment being above its maximum sustainable level”. “Taken together with our forecast that underlying inflation will remain close to the Bank’s target mid-point”, they continue, “we think the Bank will turn its focus to policy tightening before long.”

CapEco suspects the bank will end QE purchases around the middle of this year and have penciled in three rate hike to 1.0% by the middle of 2023, making the RBNZ the first central bank in the developed world to lift rates following the Covid-19 outbreak.

NZD/USD four hour chart