- NZD/USD has found acceptance above the 50-hour moving average, having clocked a low of 0.6561 yesterday.

- The risk reversals fell to fresh 7-month lows today, signaling a corrective rally will likely be short-lived.

The NZD/USD is trading well above the 50-hour moving average (MA) of 0.6587, having hit a low of 0.6561 yesterday.

The bullish RSI divergence seen on the hourly chart indicates scope for a stronger corrective rally to above 0.66.

Still, the upside in the NZD/USD is being capped around 0.6606, possibly because the China retail sales and industrial production data released earlier today disappointed market expectations.

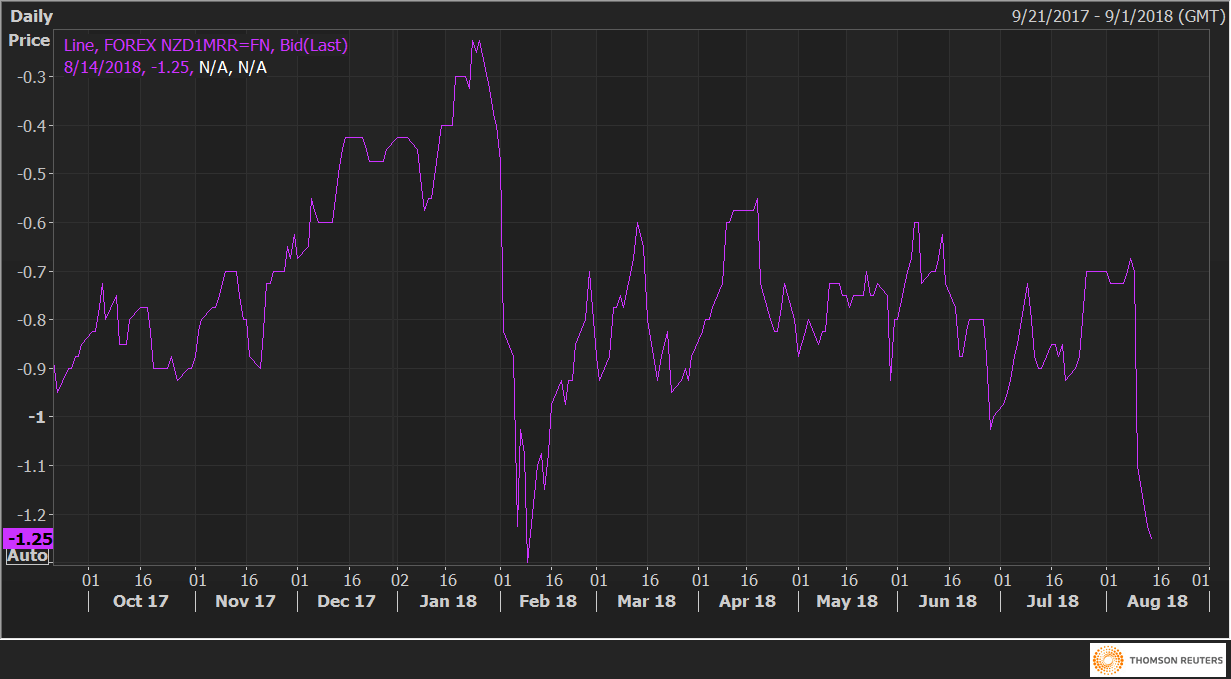

Further, the one-month 25 delta risk reversals (NZD1MRR) fell to -1.25 today – the lowest level since Feb. 9, signaling a rise in demand/rise in implied volatility premium for the NZD puts. So, it is safe to say that investors are expecting a deeper drop in the NZD/USD.

NZD/USD Technical Levels

Resistance: 0.6618 (resistance as per the hourly chart), 0.6637 (100-hour moving average), 0.6646 (daily pivot resistance 3).

Support: 0.6587 (50-hour moving average), 0.6568 (support on the hourly chart), 0.6561 (previous day’s low)

NZD1MRR