The NZD/USD pair is currently trading at 0.6650, having hit a low of 0.6627 earlier today.

The Kiwi was offered in early Asia after New Zealand reported a 0.2% drop in employment as opposed to Reuters poll expectation of a 0.5% increase. The wage price inflation also cooled, sending the 10-year and two-year New Zealand government bond yields lower.

The data reinforced fears that the Reserve Bank of New Zealand may cut rates next month.

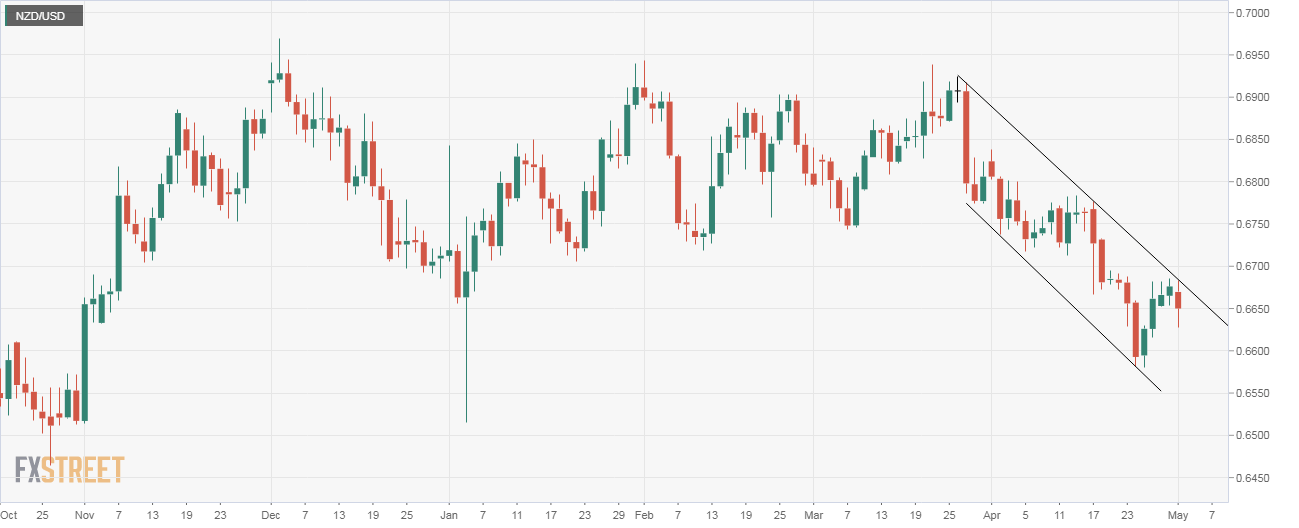

Technically speaking, the weaker data ensured the pair remains trapped in a bearish (falling) channel, as seen in the chart below.

Daily chart

- As seen above, the pair faced rejection at the upper edge of the channel earlier today and fell to session lows below 0.6630.

- A daily close above the trendline would neutralize the short-term bearish setup. The outlook would turn bullish if and when the pair violates the bearish lower highs pattern with a move above 0.6783 (April 15 high).

- A repeated rejection at trendline would open the doors for a deeper drop below the recent low of 0.6580.

Trend: Bearish while trapped in a falling channel

Pivot points