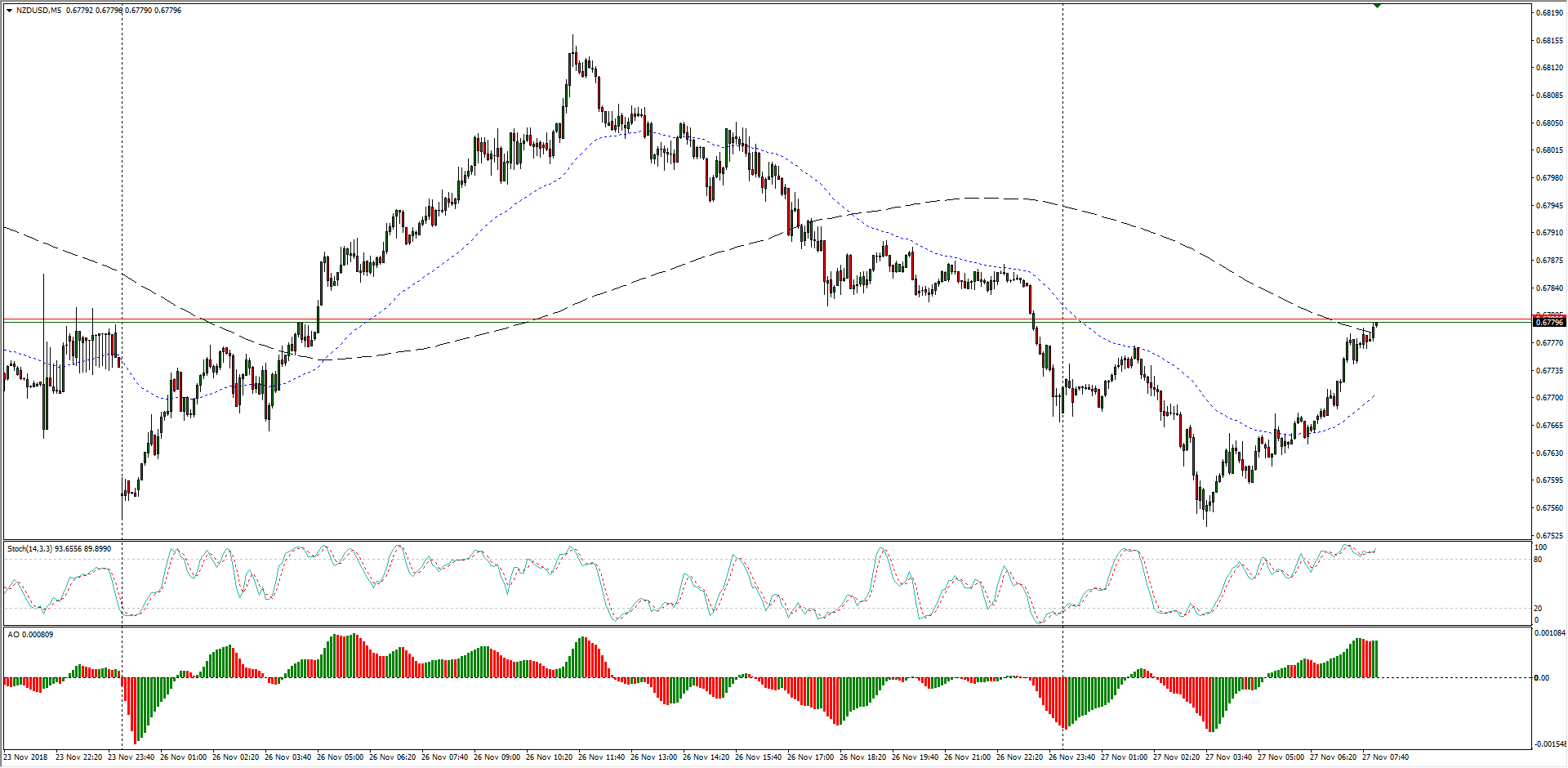

- The Kiwi is seeing another intraday cyclical rebound from lows near 0.6750 in a repeat of Monday’s market action that saw the NZD/USD lurch to 0.6815 before bedding back down as broader market action saw overall flows push out of and then back into the US Dollar.

NZD/USD Chart, 5-Minute

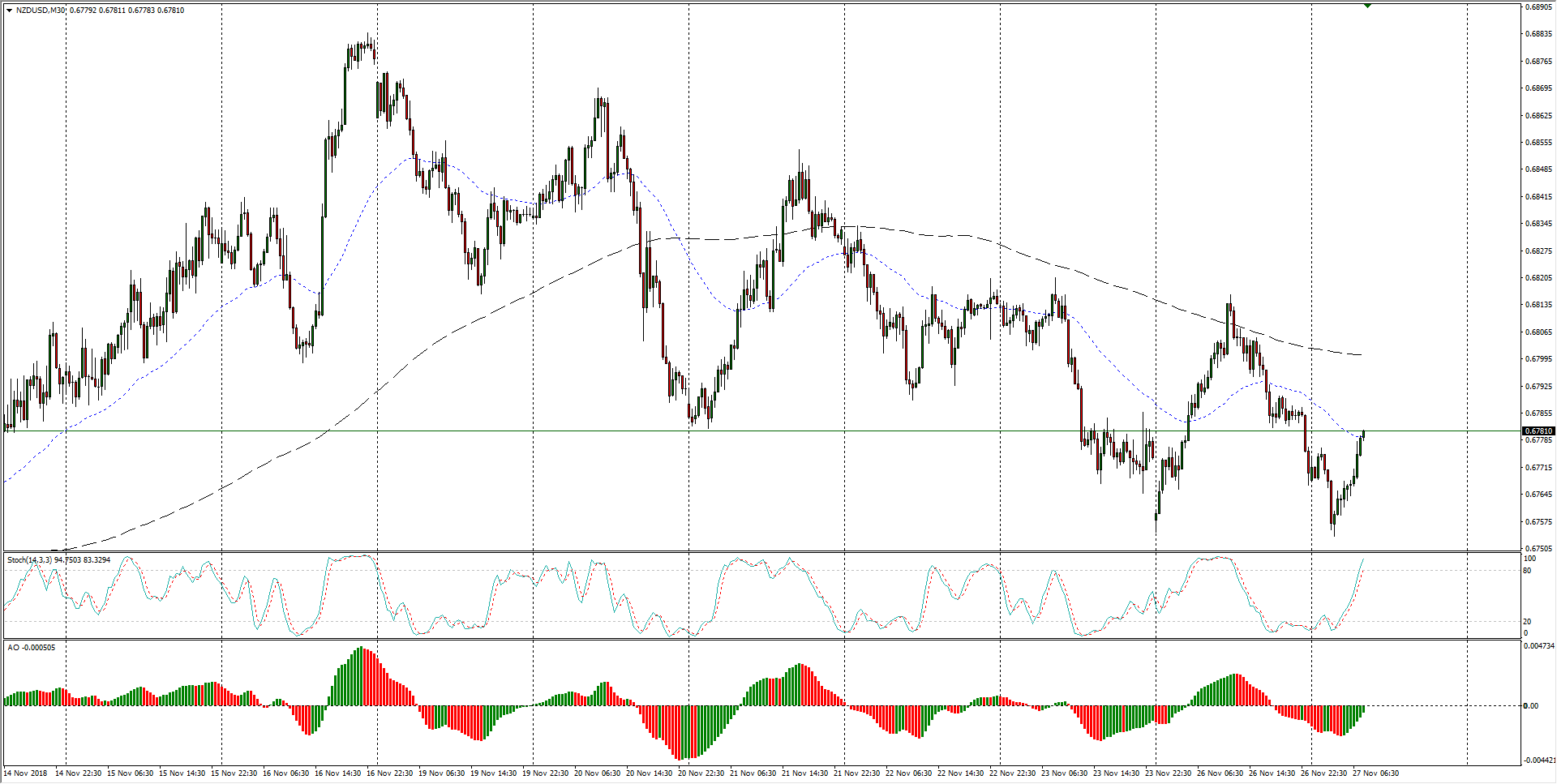

- The past two weeks shows the Kiwi steadily cycling lower in large swings, marking out a rough channel that threatens to lose momentum from a lateral swing low at the 0.6750 level.

NZD/USD Chart, 30-Minute

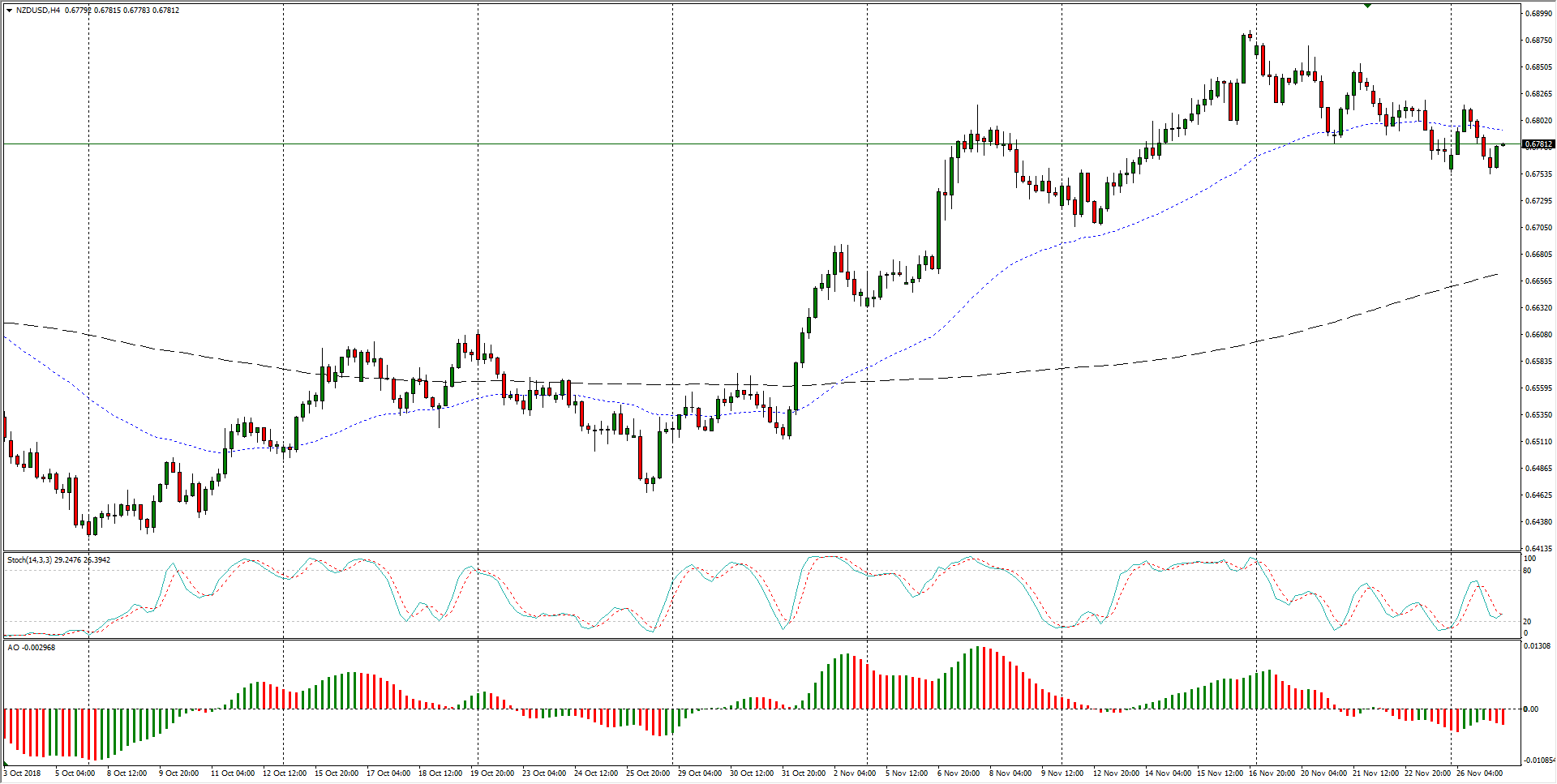

- The past two months have seen the NZD/USD pair recover from medium-term lows at the 0.6440 level, but the last move towards the upside appears to have run out of momentum as the Kiwi becomes entangled in the 50-period moving average at the 0.6800 handle.

NZD/USD, 4-Hour

NZD/USD

Overview:

Today Last Price: 0.6778

Today Daily change: -7.0 pips

Today Daily change %: -0.103%

Today Daily Open: 0.6785

Trends:

Previous Daily SMA20: 0.674

Previous Daily SMA50: 0.6632

Previous Daily SMA100: 0.6659

Previous Daily SMA200: 0.6877

Levels:

Previous Daily High: 0.6818

Previous Daily Low: 0.6756

Previous Weekly High: 0.6876

Previous Weekly Low: 0.6767

Previous Monthly High: 0.663

Previous Monthly Low: 0.6424

Previous Daily Fibonacci 38.2%: 0.6779

Previous Daily Fibonacci 61.8%: 0.6794

Previous Daily Pivot Point S1: 0.6755

Previous Daily Pivot Point S2: 0.6724

Previous Daily Pivot Point S3: 0.6693

Previous Daily Pivot Point R1: 0.6816

Previous Daily Pivot Point R2: 0.6848

Previous Daily Pivot Point R3: 0.6878