“¢ The pair faded a knee-jerk bullish spike back closer to weekly tops, albeit remained well bid for the second consecutive session on Wednesday.

“¢ A rebound in the NZ business confidence in September was largely negated by larger than expected NZ trade deficit and exerted some downward pressure.

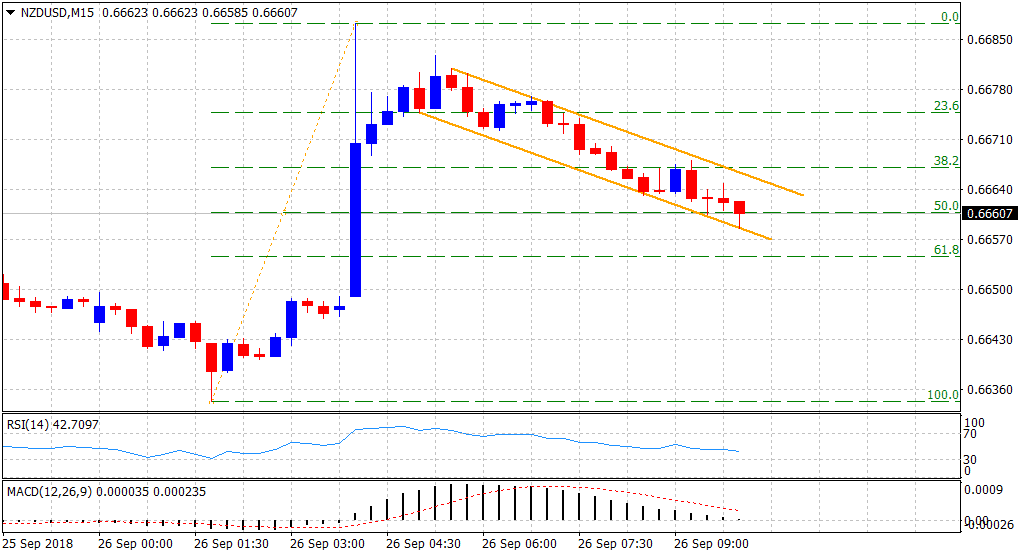

“¢ The pair has been retracing along a short-term descending trend-channel formation on the intraday chart and is currently placed at a confluence support.

“¢ The mentioned support marks the lower end of the trend-channel and 50% Fibonacci retracement level of the up-move over the past two trading session.

“¢ A convincing break below might now turn the pair vulnerable to resume with last week’s corrective slide from the 0.6700 handle, or over three-week tops.

Spot Rate: 0.6661

Daily High: 0.6687

Daily Low: 0.6634

Trend: Turning bearish

Resistance

R1: 0.6687 (current day swing high)

R2: 0.6700 (round figure mark)

R3: 0.6711 (upper end of the daily Bollinger band)

Support

S1: 0.6630 (overnight swing low)

S2: 0.6616 (S2 daily pivot-point)

S3: 0.6600 (round figure mark)