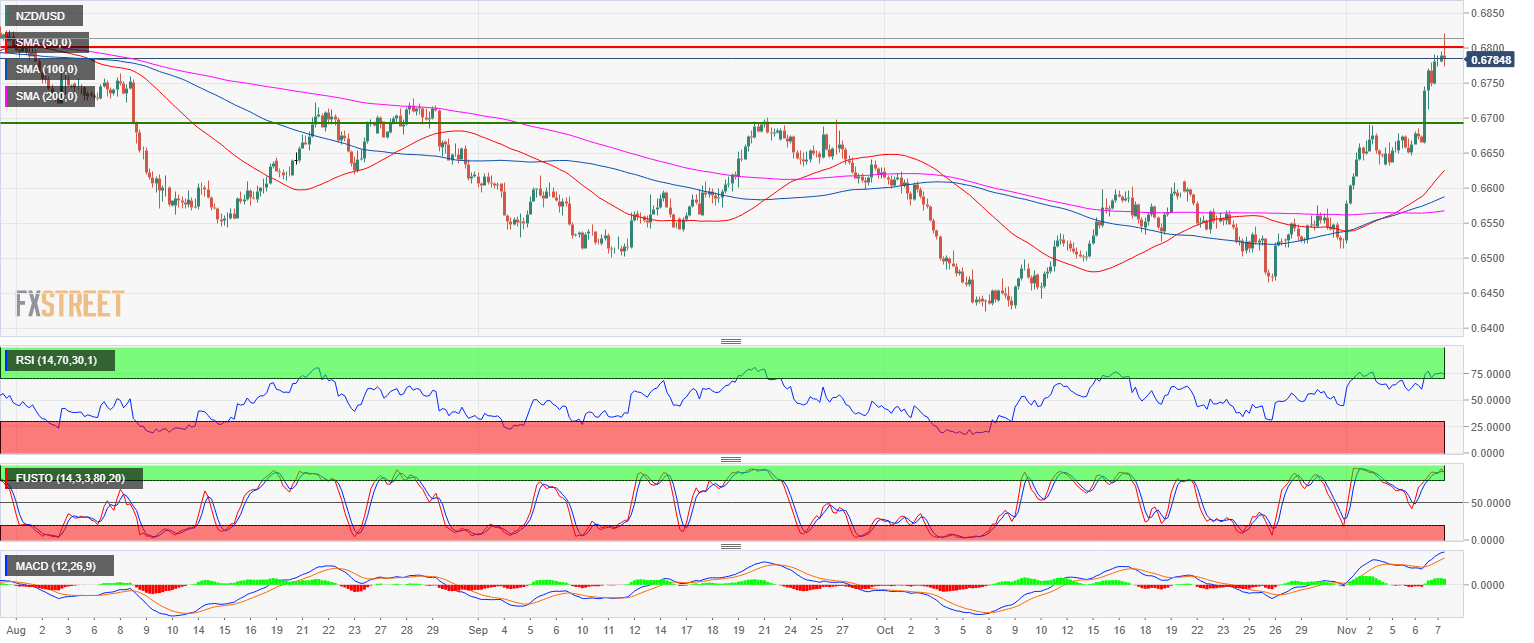

- NZD/USD is trading in a bull trend above the 200-period simple moving average on the 4-hour chart.

- NZD/USD found resistance near the 0.6800 resistance after the RBNZ (Reserve Bank of New Zealand) left interest rates unchanged at 1.75%. While the trend is bullish the bulls might have overextended themselves with technical indicators in oversold conditions.

- Supports to the downside can be seen near 0.6750 and 0.6700 figure.

NZD/USD 4-hour chart

NZD/USD

Overview:

Last Price: 0.6784

Daily change: 1.1e+2 pips

Daily change: 1.71%

Daily Open: 0.667

Trends:

Daily SMA20: 0.656

Daily SMA50: 0.6574

Daily SMA100: 0.6662

Daily SMA200: 0.6913

Levels:

Daily High: 0.6684

Daily Low: 0.6646

Weekly High: 0.669

Weekly Low: 0.6513

Monthly High: 0.663

Monthly Low: 0.6424

Daily Fibonacci 38.2%: 0.667

Daily Fibonacci 61.8%: 0.6661

Daily Pivot Point S1: 0.6649

Daily Pivot Point S2: 0.6628

Daily Pivot Point S3: 0.6611

Daily Pivot Point R1: 0.6688

Daily Pivot Point R2: 0.6705

Daily Pivot Point R3: 0.6726