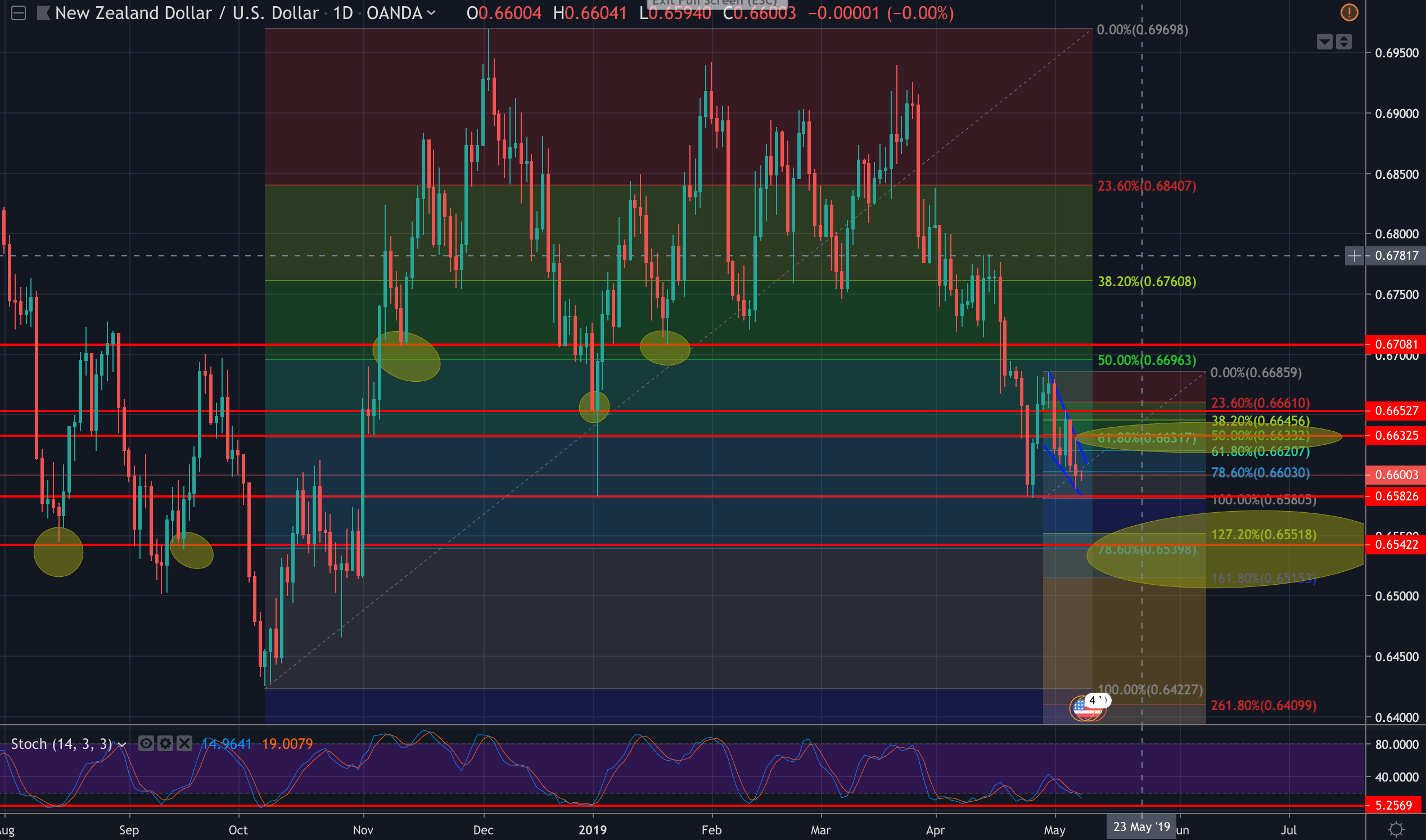

- NZD/USD is trading within a steep descending wedge (the bird’s cage if you like) and today’s RBNZ could be the key to open things up and set the bird free, one way or the other.

- The targets are mapped out and justified by the series of eclipses, prior supports and resistances.

- The prior session’s high at the 61.8& is a double fib target meeting the recent swing high and low’s 50% Fibo retracement and a potentially strong level of resistance on steady hand from the RBNZ hold scenario; (The Aussie rallied between an open of 0.6980 to 0.7048, 68 pips on the RBA holding the prior session).

- Higher up, the next level comes in 50 pips to 3rd May highs at 0.6653. On something unexpected, and a sustained break above the resistance of the wedge, the 50% Fibo and 19th April highs guards a run to 0.6708.

- On the downside, a rate cut would open risk to 0.6540 and a confluence of prior lows/support and Fib levels.

Daily chart