- NZD/USD stays firm above the near-term key moving average.

- A downside break can fetch the quote previous resistance while 0.6400 seems nearby resistance.

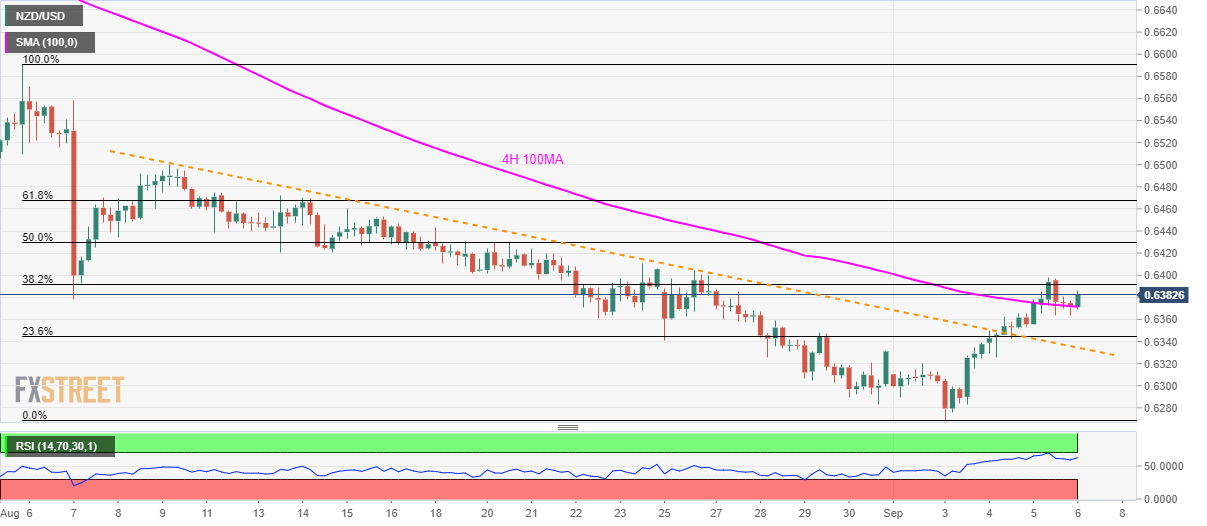

Even if overbought relative strength index (RSI) triggered the NZD/USD pair’s pullback, the quote remains firm above 100-bar simple moving average on the four-hour chart (4H 100MA) while taking the bids to 0.6380 during the initial trading session on Friday.

With this, prices are likely extending recent upside to the latest high near 0.6400 ahead of targeting 50% Fibonacci retracement level of August month downpour, at 0.6430.

In a case of pair’s run-up beyond 0.6430, 61.8% Fibonacci retracement near 0.6470 and August 09 high near 0.6500 will please the bulls.

Meanwhile, sellers are waiting for the pair’s dip below 4H 100MA level of 0.6370 in order to initiate fresh short positions targeting previous resistance-line (now support) at 0.6335.

Should there be additional downside below 0.6335, 0.6300 and Tuesday’s low near 0.6270 will flash on bears’ radar.

NZD/USD 4-hour chart

Trend: bullish