- Goldman Sachs predicts that the third-quarter GDP will contract by 3.5-4 percentage points due to the current lockdown.

- The economic growth forecast for New Zealand in the second quarter is predicted to reach 16.4% pa.

- US dollar temporarily rose last week as some Fed officials reiterated the need for early tapering.

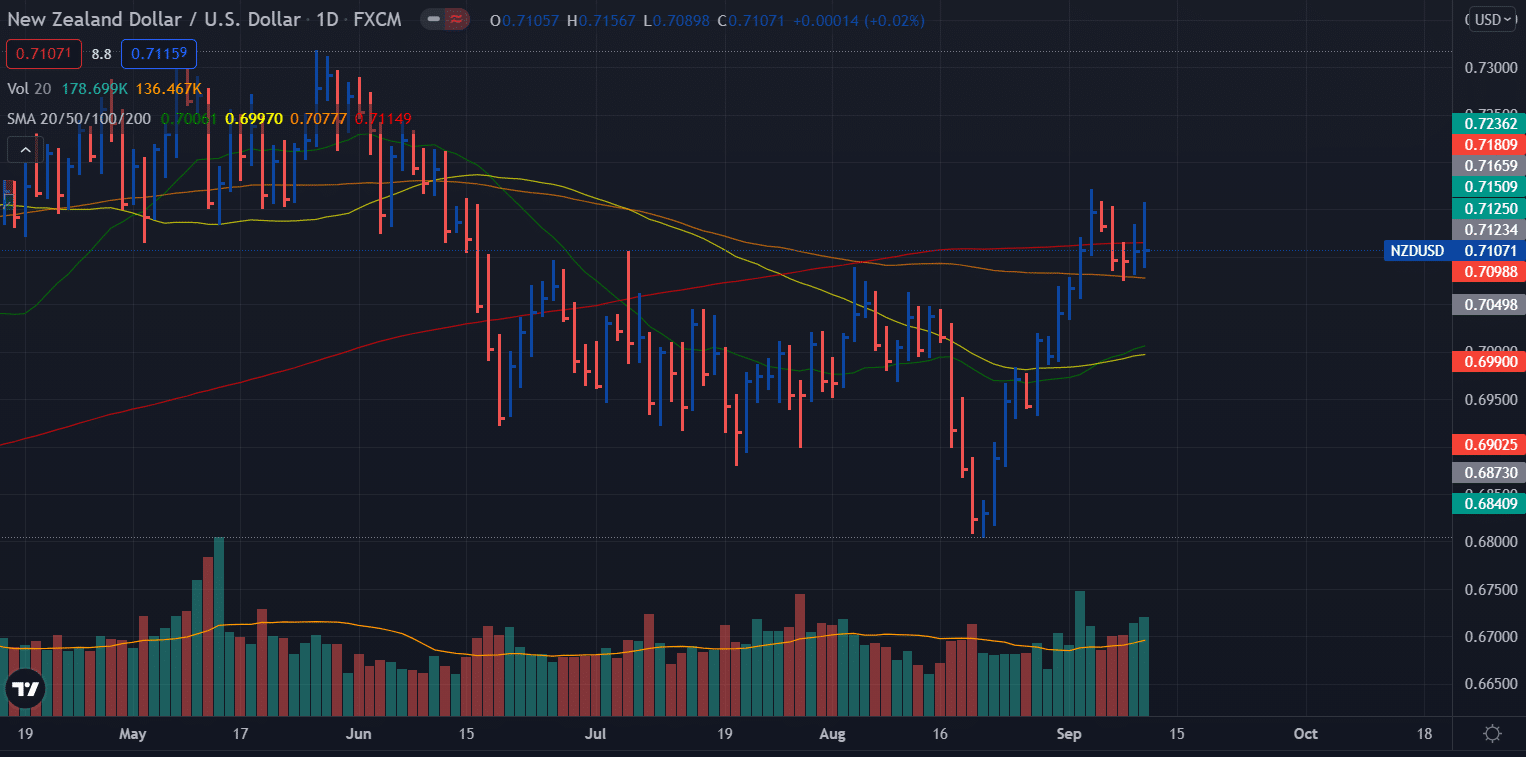

The NZD/USD weekly forecast is neutral as the price managed to stay above the key level of 0.7100 level amid strong NZ fundamentals, but the USD is gaining ground.

-Are you looking for automated trading? Check our detailed guide-

The NZD/USD pair started the week from mid-0.7100 level and found fresh selling on Monday, leading to 0.7075 weekly lows on Wednesday. However, the pair found some traction on the same day, led the rally to 0.7158 on Friday. However, the week closed off the highs near 0.7100 area, showing a slight weakness.

Auckland is expected to remain isolated until the end of September, even though the Covid outbreak in New Zealand appears to be under control.

Goldman Sachs predicts that the third-quarter GDP will contract by 3.5-4 percentage points due to the current lockdown. The RBNZ is unlikely to be prevented from raising rates in October or November this year, but it does increase the risk of a pullback in the NZDUSD.

The economic growth forecast for New Zealand in the second quarter is predicted to reach 16.4% pa for the fastest rate since 1987, which would be a positive development for the NZD / USD pair. Eventually, the Reserve Bank of New Zealand (RBNZ) could increase the Official Cash Rate (OCR) from an all-time low due to confidence in meeting inflation and employment objectives based on monetary incentives.

The NZD is likely to appreciate against its US counterpart, as RBNZ Deputy Governor Christian Hoxby “definitely mentioned it” at their August meeting, but further appreciation may contribute to retail sentiment shifting, such as it did earlier this year.

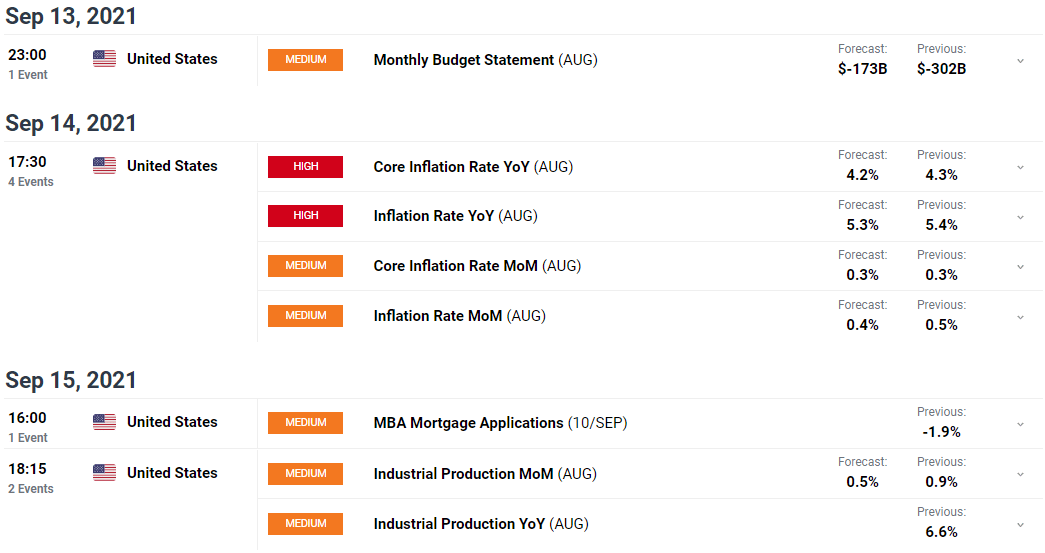

August is a critical month for retail sales and consumer prices in the US. After an unexpected drop in sales in July, inflation is closely scrutinized for its impact on consumer sentiment.

US dollar temporarily rose last week as some Fed officials reiterated the need for early tapering. However, it will be hard for the dollar to develop a significant trend until the markets have a more detailed understanding of the Fed’s bond program.

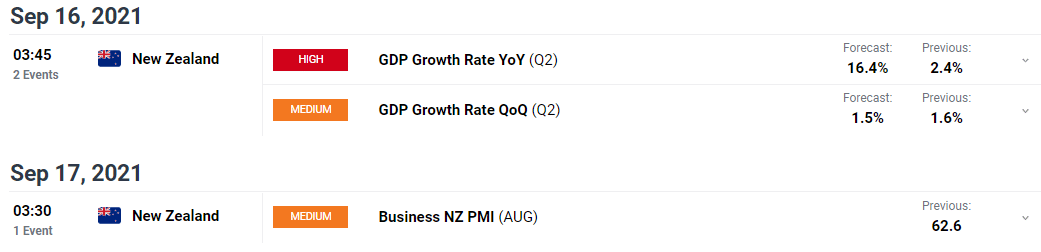

Key events in New Zealand during Sep 13 – 17

The economic calendar is light for NZ next week. The only event that matters is the GDP growth rate which is expected to show a significant rise to 16.4%. If the expectations are met, the NZD/USD pair will likely see a rally.

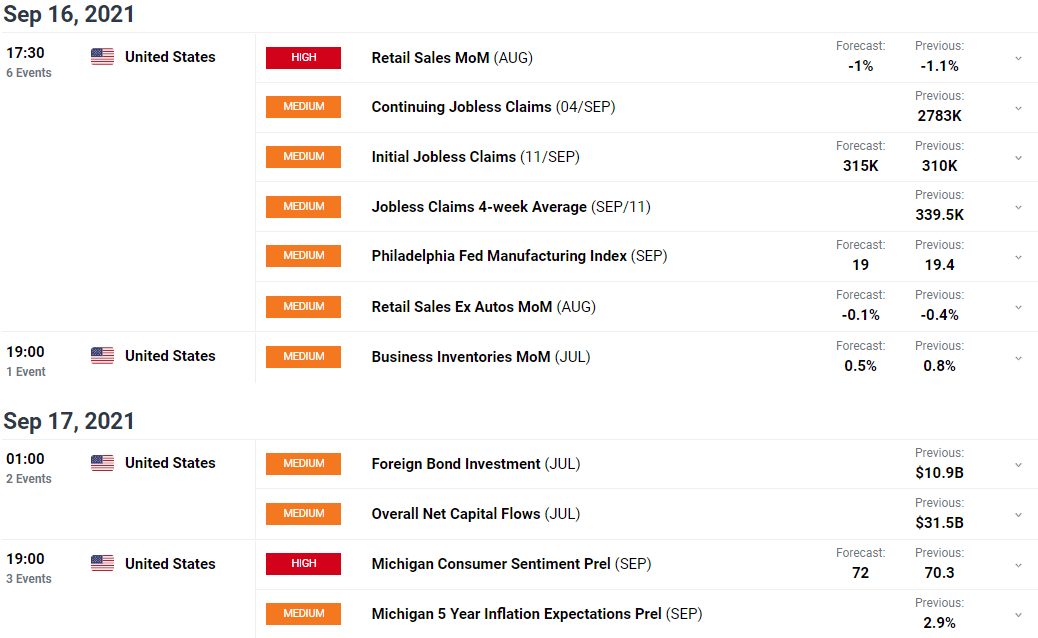

Key events in the US during Sep 13 – 17

The next week comes up with yearly core inflation data, which is expected to slightly decline. However, a major surprise in numbers can trigger a big movement in the market. Furthermore, retail sales data will be released on Tuesday, which is expected to slightly improve. Retail sales data is important as it is considered an indicator to gauge market activity. Finally, on Friday, Michigan Consumer Sentiment data is expected to release, which may support the US dollar.

-If you are interested in forex day trading then have a read of our guide to getting started-

NZD/USD weekly technical forecast: Upthrust to exert pressure

The NZD/USD pair marked an upthrust on the daily chart. The volume was high, and the price closed below the 200-day moving average. It is a clear sign of reversal. The bears may lead the price towards 0.6990 ahead of 0.6800. As long as the price remains under 0.7160, bearish pressure will likely exacerbate.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.