No change in the interest rate. They specifically mention the currency and say that more depreciation will be appropriate. In addition, they say that some easing may be needed during the year. This is very different from the talk about stability in rates seen in the previous rate decision.

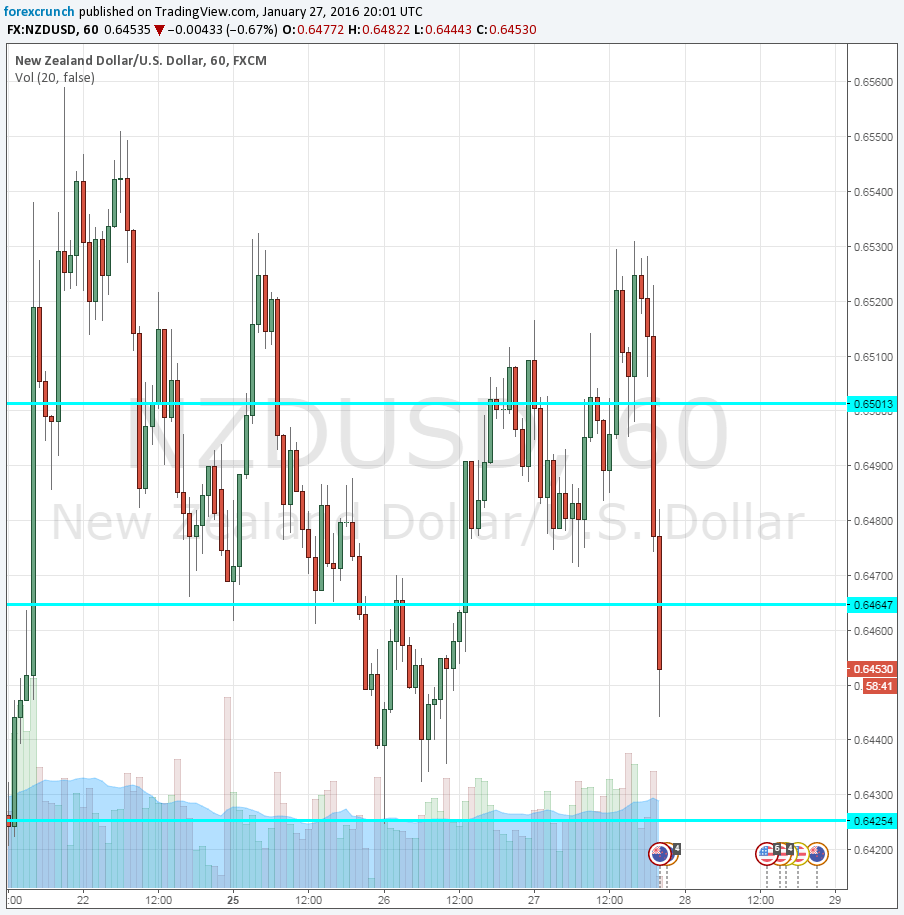

This is felt in NZD/USD which is sliding, currently within the range,

More dovish words are offered regarding inflation. It will take longer to reach the target that previously anticipated. They also mention house prices in Auckland as being a risk to stability. On the upside, they do see growth picking up.

Earlier, the Federal Reserve left the interest rate unchanged in the US and sounded a cautious words regarding the global economy, a slowdown in the US and more. This led to a risk off reaction, hurting the kiwi. Now this is extended.

From the statement:

Some further policy easing may be required over the coming year to ensure that future average inflation settles near the middle of the target range. We will continue to watch closely the emerging flow of economic data

The New Zealand rate decision is more exciting than the Fed one.

Here is the chart of NZD/USD, with an extension in the falls seen.The low so far is 0.6424, which is also support, and the pair doesn’t really bounce from there.