NZD/USD reached news highs above 0.80, but it couldn’t hold on and eventually retreated. NBNZ Business Confidence and the Trade Balance are the main events this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

Last week the economy in New Zealand grew by 1.1% in the first quarter of 2012 beating expectations for 0.5% growth rate. However worsening global conditions, the slowdown in China and the strong kiwi are about to have a negative effect on the second quarter growth prospects. Will NZ economy overcome these obstacles?

Updates: There were two releases late last week. Visitor Arrivals declined by 1.0%, a three-month low. Credit Card Spending jumped 3.9%, indicating stronger consumer spending and confidence in the economy. The kiwi is down slightly, as NZD/USD was trading at 78.57. Trade Balance will be released later Tuesday. NZD/USD climbed above the 79 line, and was trading at 79.14. Trade Balance dropped sharply to monthly surplus of 301 million, slightly below the market forecast of 305M. Business Confidence, a key indicator,will be released on Thursday. NZD/USD was steady, trading just above the 0.79 line, at 0.7901. Business Confidence dropped sharply, posting a reading of 12.6 points. It was the indicator’s lowest reading since last March. Building Consents will be released later on Thursday. NZD/USD was steady, as the pair was trading at 79.11.

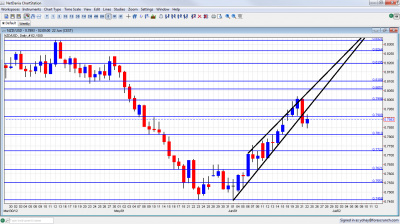

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Trade Balance: Tuesday, 22:45. April merchandise trade surplus improved to NZ$355 million from NZ$186 million in March however the rise in surplus was less than the NZ$400 million predicted by analysts. Exports dropped 7.6% but imports declined 12.2%.Trade surplus is expected to narrow to NZ$310 million.

- NBNZ Business Confidence: Thursday 1:00.New Zealand business confidence dropped for the first time in seven months in light of renewed concerns over about the global economy as Europe’s debt crisis worsens. Only 27.1% forecast improved economical conditions compared to34.9 in the previous month. All sectors excluding construction were negative.

- Building Consents: Thursday, 22:45.New Zealand residential building permits slowed down in April dropping 7.2% after gaining 19.2% in March. However there is a growth trend in construction and the month to month figures tend to be volatile.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/$ started the week on a high note. After settling above the 0.79 line (mentioned last week), the pair managed to push above 0.80, but this was short lived, and it eventually closed under 0.79.

Technical lines, from top to bottom:

0.84 was resistance back in February 2012. 0.8320 was a wing high in April, just before the big dive.

0.8260 capped the pair during March, and is stubborn resistance. 0.8185 was resistance in the past and is now weaker.

The 0.8080-0.81 region supported the pair during March and April and will be a tough barrier if 0.80 is broken. 0.8060 was resistance in October and support beforehand. It was also tested in January and in March, is much weaker now after only temporarily stopping the fall.

The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance. Another round number, 0.79, is key resistance, after being a very distinct line separating ranges. It proved its strength also in June 2012.

0.7810 was a double bottom in May 2012 and also served as resistance at the end of 2011, and now returns to this role after the crash.

0.7723 supported the pair back at the beginning of 2012 and also worked in the other direction in June 2012. 0.77 provided support in December and now switches to support.

0.7620 provided support in May 2012 and is resistance once again, although weaker than in previous weeks. 0.7550 is resistance once again, even after the breakdown. It was a very distinct line separating ranges and had a similar role back in January.

Below, 0.7460 is significant support after working as support at the end of 2011 and also in May and June 2012. This is key support. 0.7370, which was the trough in December is low support. This is a significant line if 0.7460 breaks.

0.7308 is minor support after working as such at the beginning of 2011. 0.72 worked in both directions during the past few years.

0.71 is the last line, after being a distinct trough in March 2011.

Steep Upward Channel Broken

As you can see in the graph, the pair is rising in a steep channel. Uptrend support was broken towards the end of the week, and this could be a bearish sign.

I remain bearish NZD/USD

The European crisis and the absence of QE3 in the US outweigh the relative strength of the New Zealand economy. The kiwi has better chances against other currencies, but the dollar seems strong at the moment.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss Franc, see the USD/CHF forecast.