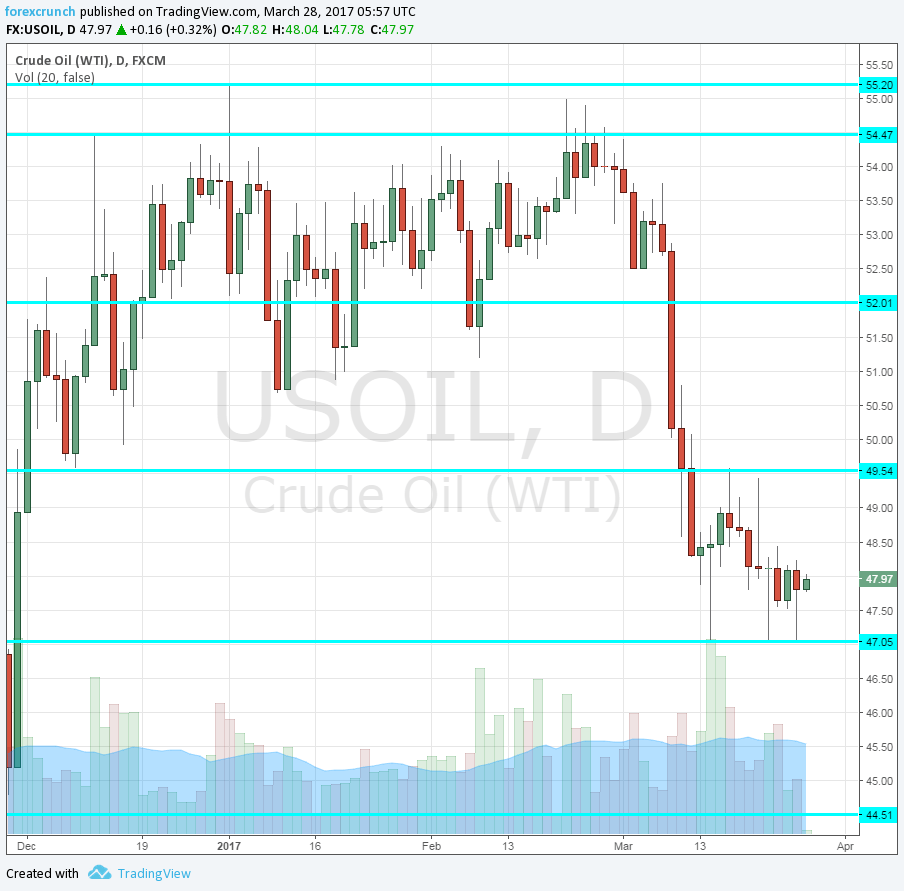

Oil prices have tumbled down and remained on the low ground. The recent negotiations between OPEC and non-OPEC members about an extension do little to alleviate the pressure. And what do technical levels tell us? The team at Barclays analyzes the dynamics:

Here is their view, courtesy of eFXnews:

CitiFX Technical FX Strategy Research notes that Oil charts suggest that there is a confirmed double top which targets a move to $46.50.

As such, Citi points to support at the 55 week moving average ($47.38) which is currently holding but a weekly close below would suggest that a move down towards the $41.90-$42.58 area is possible.

However, Citi views these short-term bearish dynamics, to be corrective in nature and maintains a positive bias on Oil over the next 18 months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.