After a very long period of depression and consolidation in low ground, oil prices began rising as we approached the OPEC deal in late November. And when that indeed happened, the black staff showed resilience and cautiously continued higher.

The deal between OPEC members and the inclusion of non-OPEC members in the commitment to cut production was a big change from the disagreements and the excess production seen in previous years.

The agreement implementation was scheduled for the start of the new year. OPEC members seem to be complying, at a level of around 90%. While Saudi Arabia bears the brunt of these cuts, a 90% compliance is nothing to frown upon. However, there are other cracks in the barrels of hope for oil bulls.

- Non-Opec non-compliance: While OPEC stands at 90% compliance, non-OPEC compliance is closer to 60%. Here, the main protagonist is Russia. The gradual nature of their production cuts is more gradual than the pace of Fed hikes in 2016. The lack of rush means an excess of production and oversupply.

- No deal extension: The deal signed in Vienna is for only 6 months, ending in June. Is it too early to talk about an extension? Perhaps. On the other hand, without a clear commitment, some will already look into re-expanding production. A recent comment from OPEC Secretary General, Mohammad Sanusi Barkindo is not encouraging.

- Rising US production: US shale production was behind the big fall in oil prices in 2014 and was always going to be an issue. If OPEC and non-OPEC members cut output and prices rise, it incentivizes the US shale industry to raise their own production. Some relatively expensive wells that were losing money break even when prices are higher. Or if you wish: the US shale industry fills the gap created by the deal. US output passed the 9 million barrels per day threshold.

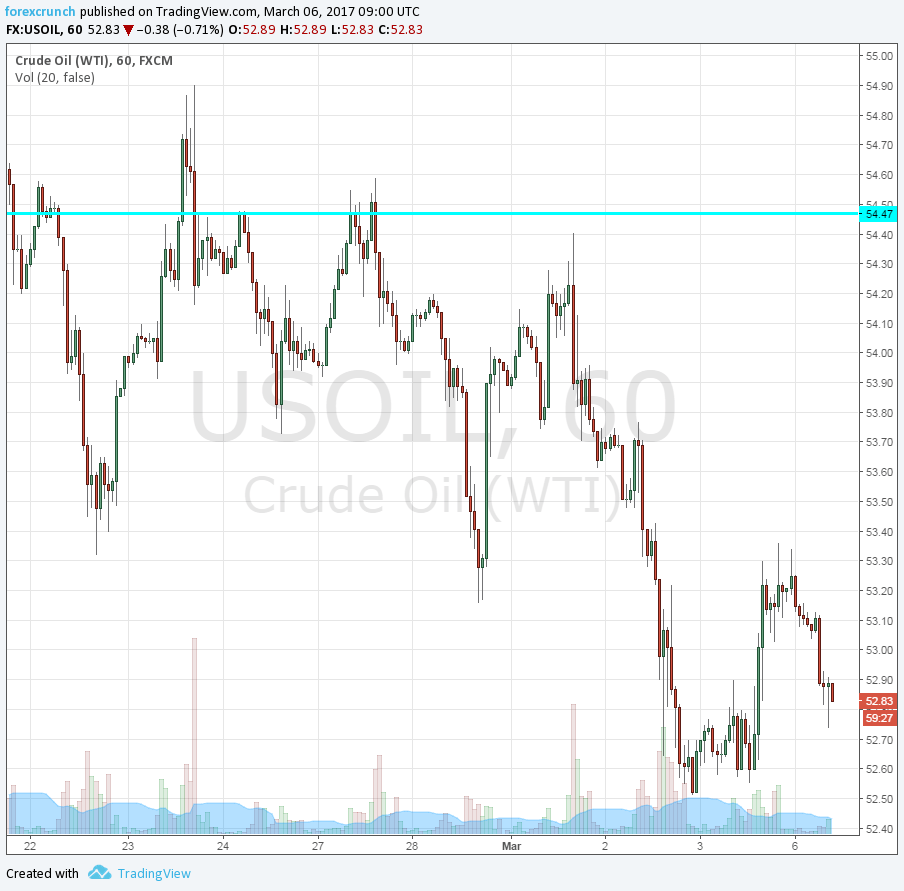

WTI Crude Oil made an attempt to break above the $55.20 level that was reached towards the end of 2016. The move failed and prices fell back down. While the commodity continues trading above $50, it has certainly lost momentum.

More: Elliott Wave Analysis: Crude OIL and GOLD

Oil and CAD

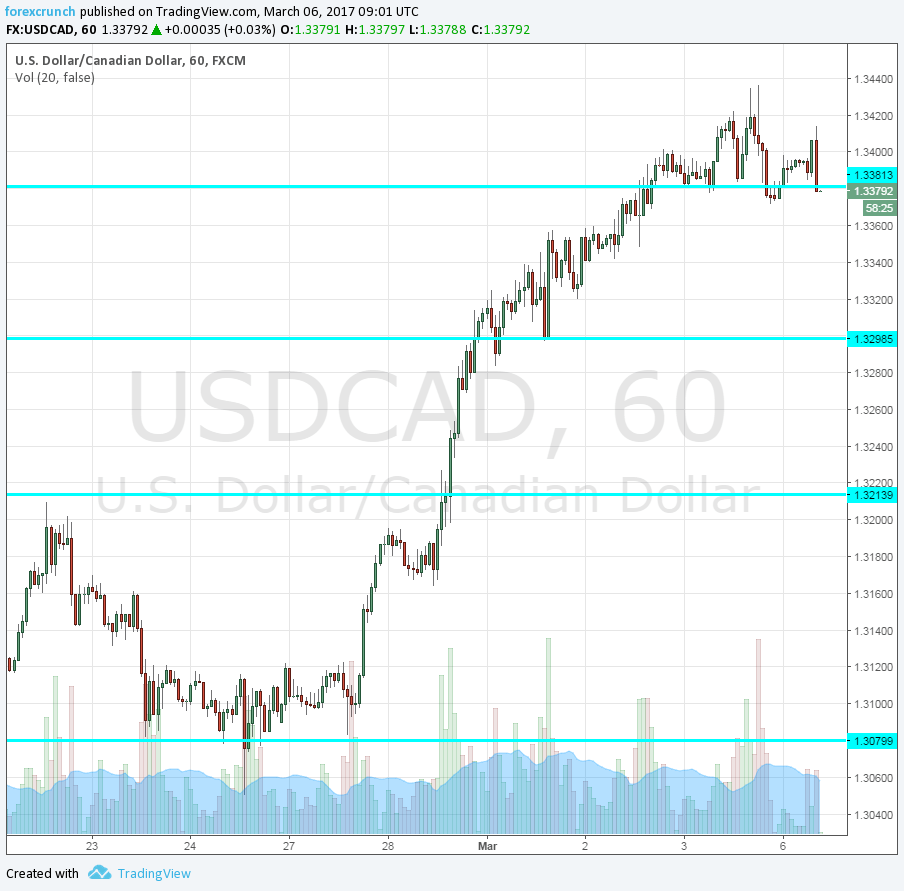

The Canadian dollar has already been suffering from a relatively dovish central bank and uncertainty about US policy and US demand.

The drop in oil prices adds another pain point. USD/CAD is trading around 1.3380, far above 1.30 that was seen not that long ago.

The next line of resistance awaits at 1.3460, followed by 1.36.