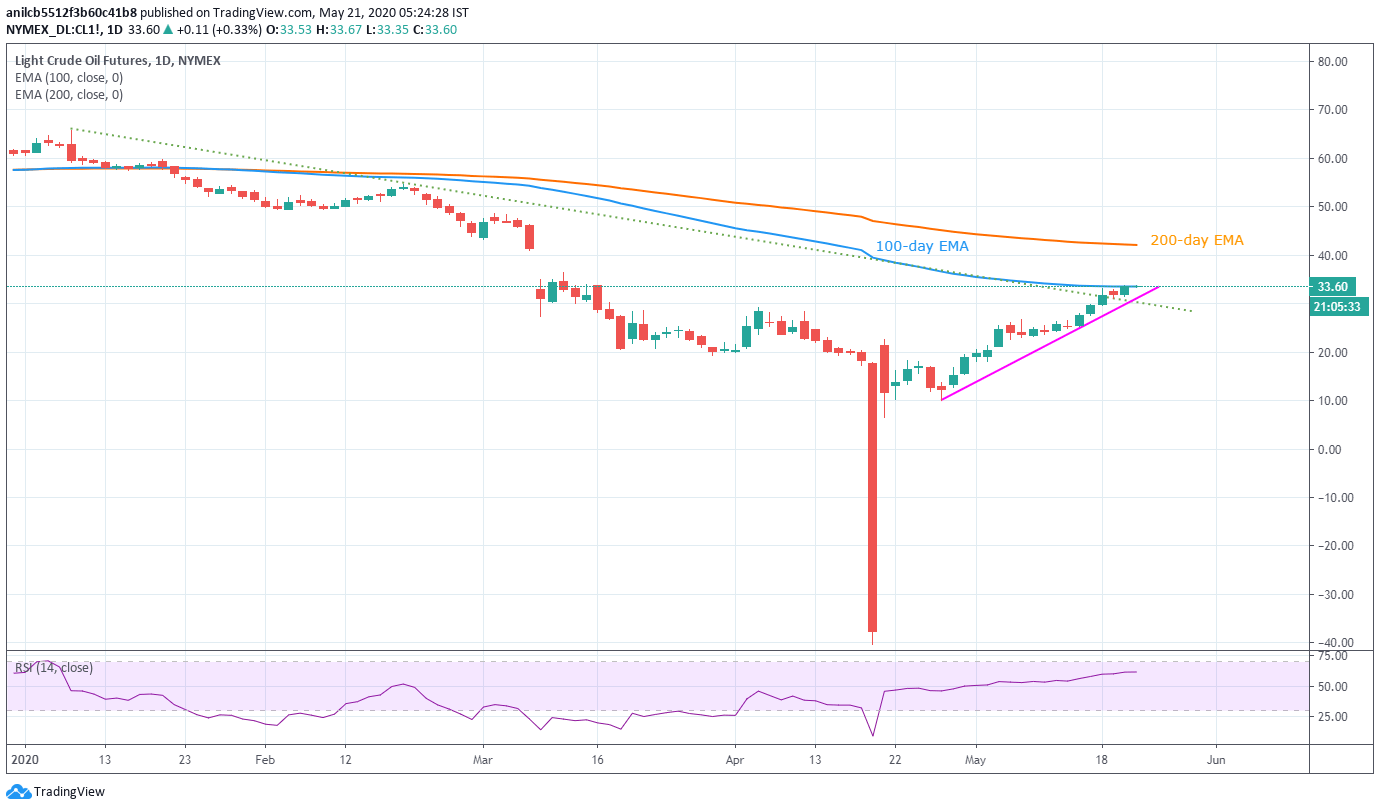

- WTI Futures on NYMEX print mild gains of around 0.45% while nearing the highest since March 13, 2020.

- Sustained break of four-month-old resistance line keeps buyers hopeful.

- 200-day EMA adds to the upside barriers, a three-week-old ascending trend line offers strong immediate support.

WTI takes the bids near $33.64, up 0.45% on a day, during the initial Asian session on Thursday. While a sustained break of a downward sloping trend line from January 09 keeps the bulls in command, 100-day EMA seems to restrict the black gold’s immediate upside.

As a result, the energy benchmark’s further upside remains dependent on how well it can cross the $33.54 resistance, which in turn could escalate the run-up towards March 11 top of $36.35.

Though, the quote’s further upside past-$36.35 enables the buyers to challenge $40.00 mark ahead of confronting 200-EMA figures surrounding $42.10.

On the contrary, the resistance-turned-support line joins an ascending trend line from April 28, near $30.00, to offer strong downside support to the oil prices.

WTI daily chart

Trend: Pullback expected