The Australia and New Zealand Banking Group (ANZ) analysts expect oil prices to edge higher in the second half of this year on a potential supply disruption.

Key Quotes:

“OPEC+ is sticking with its production cuts deal.

Production is falling in Iran and Venezuela and risk of supply disruptions is rising in the Middle East.

Together these should see the oil market balance tightening in H2 2019.

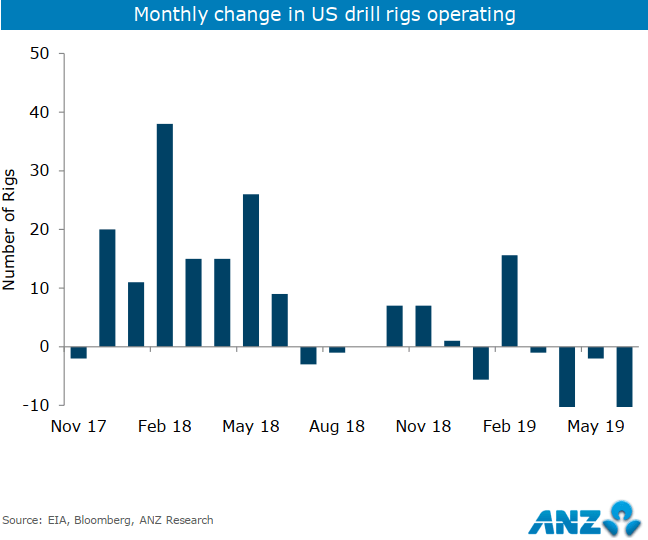

US shale companies have been pulling back on drilling, could limit growth in output from shale in near term.

Slowing global economic growth will still see demand growing more than 1mb/d.

We believe the market’s focus will soon shift from a focus on softer demand to looking at supply disruption risks. This should see prices back above USD70/bbl in H2 2019.”