Negative interest rates are in abundance now, with new central banks adding them. What is the exception? Here is the answer from Deutsche Bank:

Here is their view, courtesy of eFXnews:

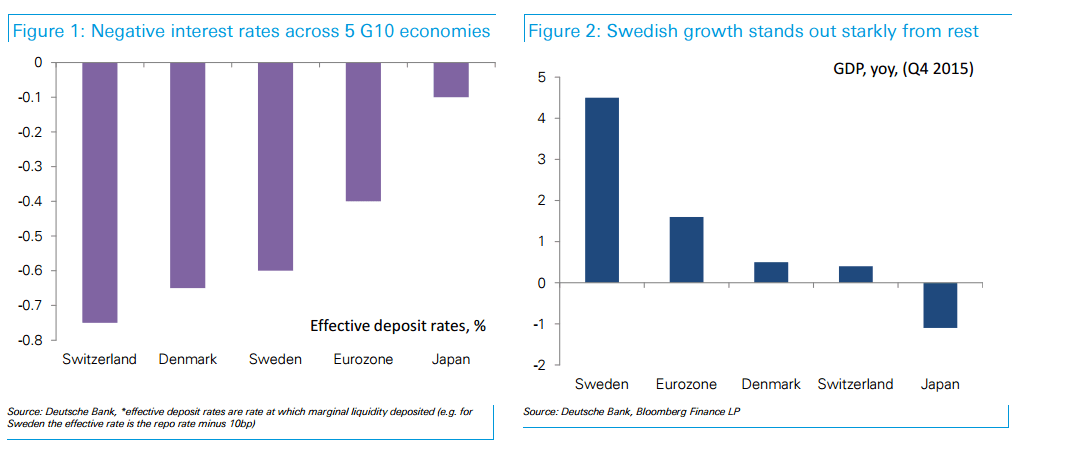

Central banks’ experiment with negative interest rates continues apace this year, with the BoJ the latest to have dipped a toe in the water and the ECB edging further towards the deep end last month. As the charts below show, the challenge for most policymakers is getting unconventional monetary policy to help economies escape from a liquidity trap, with record low interest rates failing to generate much in the way of inflation or growth.

There is one exception, however. Can you guess which it is? (hint: Sweden)

The problem for the Riksbank is surely that if inflation maintains its current steady upward trajectory they may be faced with a major communication challenge in having to re-price the market later this year. The latter is currently pricing negative rates until 2018, yet the output gap may have completely closed and a sharp rally in oil could quickly see CPIF, the inflation measure the Board increasingly talk about, above target. Inflation numbers, like tomorrow’s, should continue to be watched closely.

Stay long SEK.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.