For the first time in 9 years or so, the members of the Organization of the Petroleum Exporting Countries reached a deal on curbing production. Arch-enemies Iran and Saudi Arabia managed to agree. While holes can be poked in the agreement, markets have reacted to this surprise. This was not expected. A range of 32.5 to 33.5 million barrels per day was agreed upon.

Some details await confirmation at the official, scheduled OPEC meeting scheduled for late November. It will also be interesting to see if OPEC manages to draw Russia into the agreement. The significant non-OPEC producer has left the Algiers summit but may be convinced to join in.

Analysis: OPEC Agreement To Prove Difficult To Carry Out; Oil Could Quickly Reverse Gains – Danske

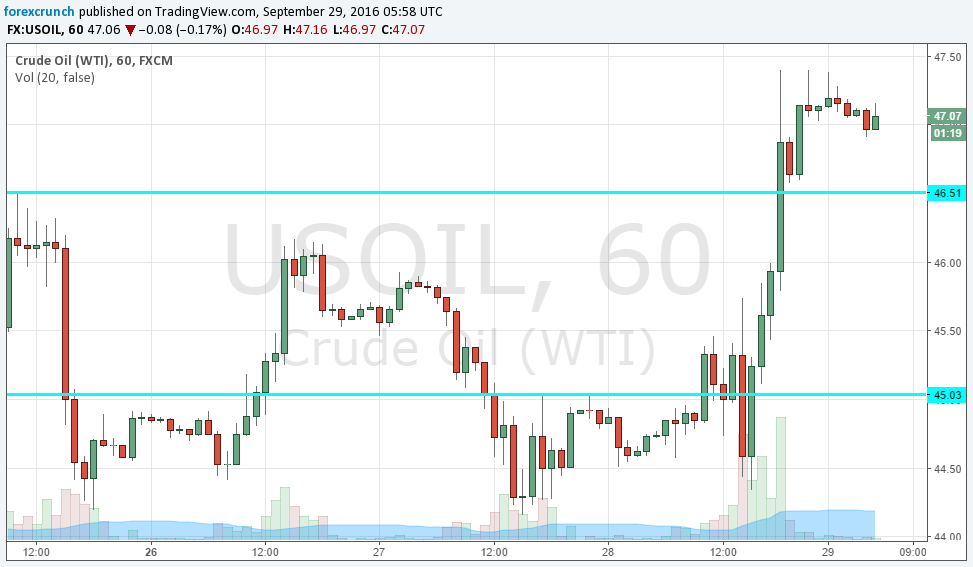

WTI Crude Oil, that was flirting with $45, broke above resistance at $46.50 and reached a high of $47.40. This is still below the August highs of $49, or the post-crash peak of $52, but a worthy leap nevertheless.

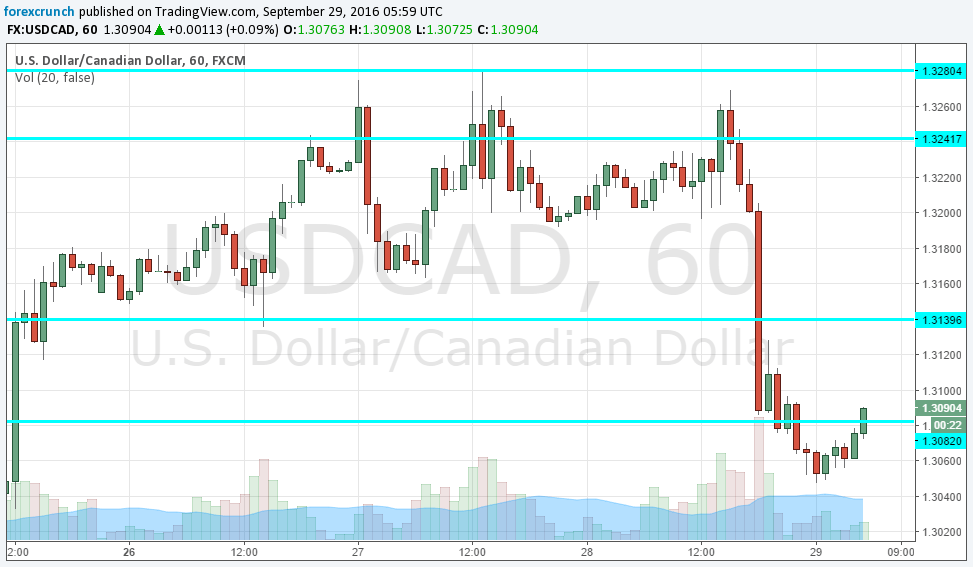

The Canadian dollar, which lost some of its direct correlation with the black gold, did not stay unmoved. USD/CAD dropped as low as 1.3048. Support awaits at 1.30, followed by 1.2910. Resistance is at 1.3140.