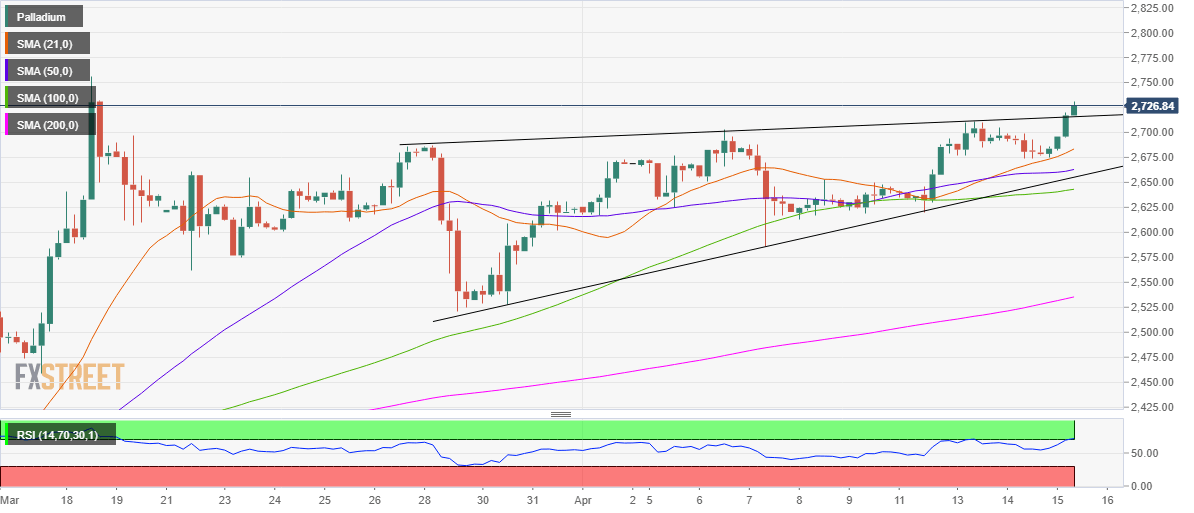

- XPD/USD dived out of the rising wedge on the 4H chart.

- Palladium remains on track to recapture the $2800 mark.

- However, overbought RSI conditions remain a cause for concern.

Palladium (XPD/USD) is seeing sizeable gains above $2700 on Thursday, as the bulls reverse Wednesday’s drop below the latter.

The white metal tracks the bullish momentum seen across the precious metals space, thanks to the relentless sell-off in the US dollar across the board.

Price of Palladium

As observed on the four-hour sticks, the price of palladium has charted a rising wedge breakout after closing the candlestick above the trendline resistance at $2715.

At the press time, XPD/USD trades at $2728, flirting with four-week highs of $2730 reached in the last hour.

The price is poised for additional upside, with a test of the March highs at $2756 inevitable. Further up, the XPD bulls target the $2800 threshold.

Palladium price chart: Four-hour

However, the Relative Strength Index (RSI) has entered into the overbought region on the said time frame, warranting caution for the XPD bulls.

A pullback towards the pattern resistance now support at $2715 could be in the offing.

If the sellers take over complete control, the bullish 21-simple moving average (SMA) at $2684 could be put at risk.

The next line of defense for the buyers is seen at $2663, where the 50-SMA is located.