- XPD/USD corrects after reaching fresh all-time-highs just shy of $2,900.

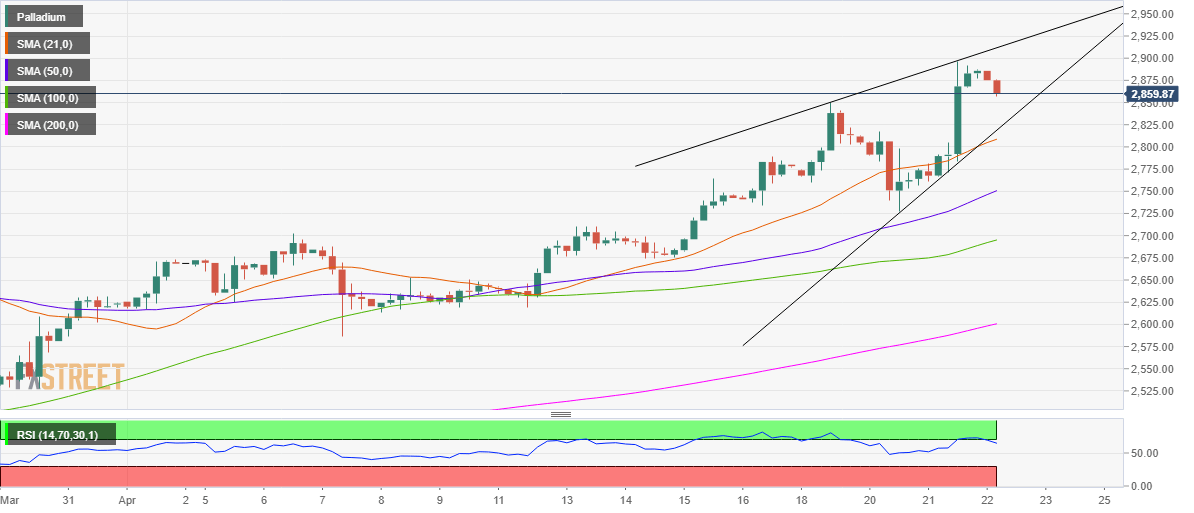

- Palladium trades in a rising wedge on the 4H chart, with a bullish RSI.

- The supply deficit continues to boost the price of Palladium amid rising demand.

Palladium (XPD/USD) is correcting towards $2,850 after hitting a fresh record high at $2,897 on Wednesday.

The white metal rallied as much as 5%, taking out the previous lifetime highs of $2,882 set earlier this year, as investors fretted that the supply deficit issue would likely worsen amid a rebound in demand from the automakers.

Further, the rally in gold prices also bolstered the upsurge in the XPD/USD. Palladium is used heavily in industrial applications apart from it being a precious metal.

Price of Palladium

As observed on the four-hour sticks, the price of palladium continues to waver in a rising wedge formation after facing rejection at the pattern hurdle.

The immediate support awaits at $2,850 the psychological level.

If the correction extends, a test of the wedge support at $2,810 could be in play. That level also coincides with the 21-simple moving average (SMA) cap.

Palladium price chart: Four-hour

Despite the pullback, the XPD bulls remain poised to clinch a fresh record high, as the Relative Strength Index (RSI) has eased from the overbought conditions while still holding firmer above 50.00.

Therefore, any bullish attempts could call for a test of the previous record high, above which the new swing highs could be challenged just under $2,900.

The next stop for the bulls is seen at the rising wedge support, now at $2,912.