The Chinese yuan was devalued by authorities and then again by market forces. So far, the AUD has suffered.

What are the implications in the longer run? The team at NAB analyze:

Here is their view, courtesy of eFXnews:

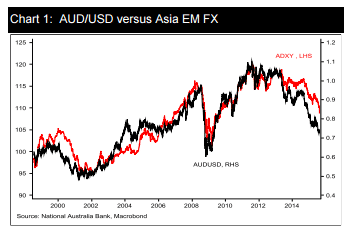

Today’s sharp move lower in the onshore Renminbi – engineered via the PBoC fixing the USD/CNY rate almost 2% higher – saw the AUD weakening in classic knee-jerk fashion, it being the most liquid proxy trade for USD/CNY in particular and USD/Asia in general, notes Australia National Bank (NAB).

“If a still weaker CNY does transpires, then in all likelihood we will see USD/Asia move higher in the slipstream of USD/CNY and AUD/USD move lower in sympathy. This in turn threatens our current AUD/USD forecast that currently has 0.74 for end September, 0.72 for year end and a low of around 0.71 in H1 2015,” NAB argues.

“For the forecasts to hold true, chances are we will need to see evidence that the PBoC is retaining a heavy hand in the formation of USD/CNY such that it now trades sideways once more not higher (possible). Or, that USD/CNY does move higher but USD/Asia (ex-CNY) does not (improbable),” NAB adds.

“At the same time, our AUD/USD forecasts for the remainder of this year are heavily conditioned on whether the Fed makes its first move on rate following the September 16/17 FOMC meeting, and if so whether the US dollar necessarily appreciates on the back of that. We think there is still some USD dollar upside on a September move (the NAB call) and so risk to our current AUD/USD forecasts lie to the downside,” NAB projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.