The main event is NZ Q4 CPI data at 10:45am – Market is sitting at 0.4% q/q. “More broadly, the starting point inflation picture has improved and the outlook is looking more assured.

Let’s take a look at possible outcomes for the price action just ahead of the event for both NZD/USD.

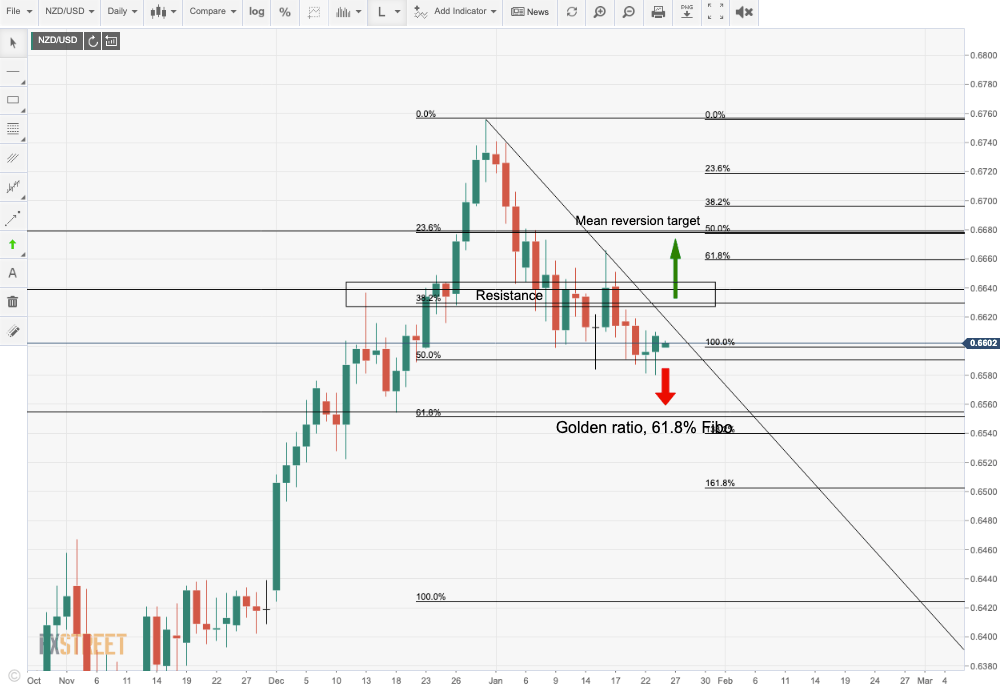

NZD/USD daily chart

The upside holds a tough confluence of 23.6% and 50% Fibo at 0.6680. “A print within the range of market expectations is consistent with a patient RBNZ and out updated call for a flat OCR for some time from here,” analysts at ANZ Bank explained, which would bring this level into focus, so long as bulls can ‘blow the doors off’ through 0.6640. A miss in expectations or a disappointment within the report will open prospects for a test to the 61,8% Fibo at 0.6550 – A surprise will open up the 200-day moving average and 78.6% confluence around the 0.6500 round number guarding a full retracement back to the 0.6420s.